WTI and Brent Eye a Retracement with Saudi Aramco Reporting Q2 Profits Drop

[ad_1] OIL PRICE FORECAST: Trade Smarter – Sign up for the DailyFX Newsletter Receive timely and compelling market commentary from the DailyFX team Subscribe to Newsletter Most Read: What is OPEC and What is Their Role in Global Markets? Oil prices finished last week strong as a weaker US Dollar on Friday helped keep prices

[ad_1]

OIL PRICE FORECAST:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: What is OPEC and What is Their Role in Global Markets?

Oil prices finished last week strong as a weaker US Dollar on Friday helped keep prices supported. Oil seemed to be destined for a retracement last week before comments of a Saudi extension on its production cuts kept market participants on edge.

SAUDI ARAMCO PRODUCTION CUTS, US EXPORTS SURGE

This morning we heard comments CEO Amin Nasser who stated that they still have significant supply for customers while adding that the voluntary cuts could be extended or deepened. Mr Nasser went further and said that Chinese flights are only at 85% of pre-pandemic levels, which would point to further growth ahead. The Kingdom and the OPEC+ alliance have been quick to arrest any meaningful slide in Oil prices (so far, they have intervened between the $66-$70 a barrel range) and this looks set to continue.

The profits of Saudi Aramco did drop some 38% with notable positives being the manner in which they have navigated the uncertain geopolitical and market climates. Capital spending is set to to continue as the Kingdom looks to expand capacity and use of emerging and ever-changing developments in the technology sphere.

US Crude oil exports have surged in 2023 pushing prices down in Europe and Asia and is likely a key reason behind continuous production cuts by OPEC + as the towns major players seem to engaged in a tug of war over prices. There appears to be fear of an oversupply and could explain the announcement of the Saudi Kingdom to extend production cuts. However, despite this Oil prices still appear more sensitive to decisions taken by OPEC + member countries. In a positive the OPEC+ Ministerial Panel met on Friday keeping policy unchanged thanks to the Saudi cuts and the recent rally in Oil prices which saw WTI rise +-16% during the month of July.

US DATA WEIGHS ON SENTIMENT AT THE START OF THE WEEK

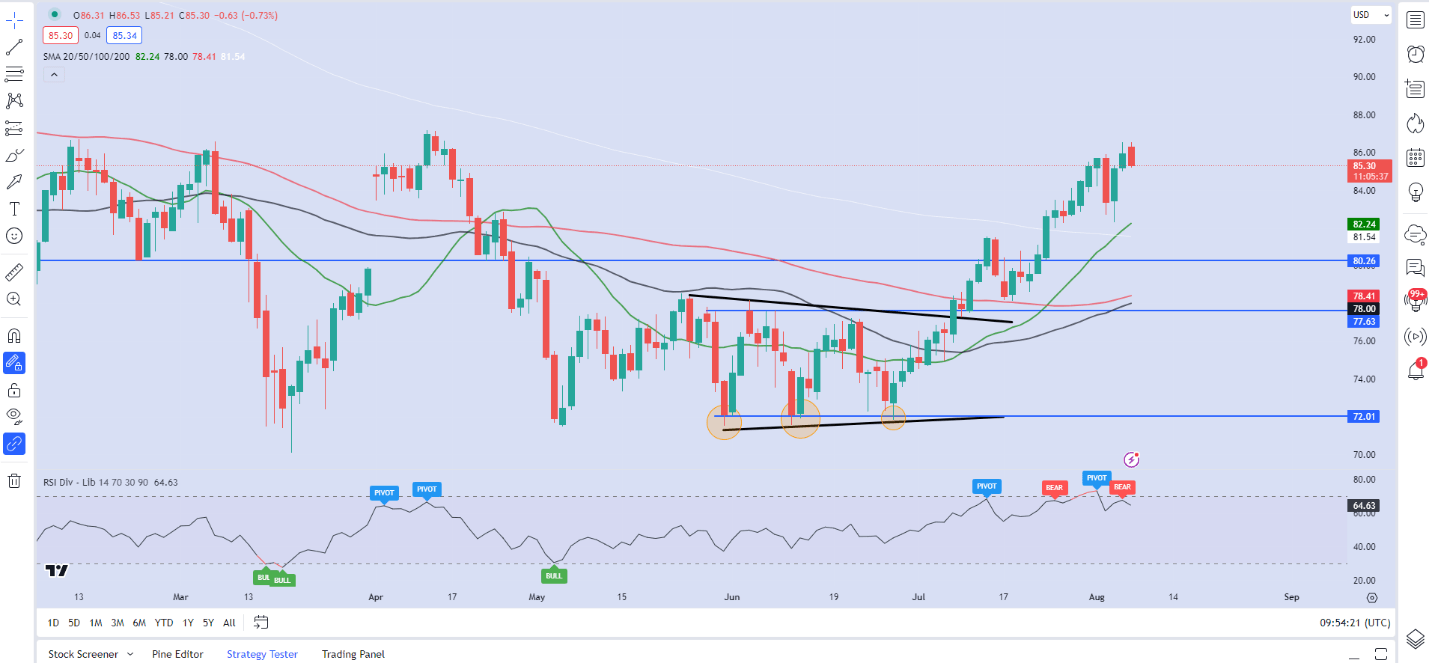

Last Fridays NFP just added a wee bit of uncertainty to markets as the jobs data released on Friday came in rather mixed. While the Non-Farm print came in below estimates, the unemployment rate dropped back to 3.5% with average hourly earnings rising once more. The robustness of the labor market saw a slight uptick in rate hike expectations heading into this week’s US CPI numbers which should provide a clearer picture.

Looking ahead to the rest of the week and US CPI is the biggest risk event which could have broader implications on overall market sentiment depending on the print. A further drop in inflation could help risk assets and oil prices move higher with market participants likely to pay close attention to the stubborn Core CPI number as well.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

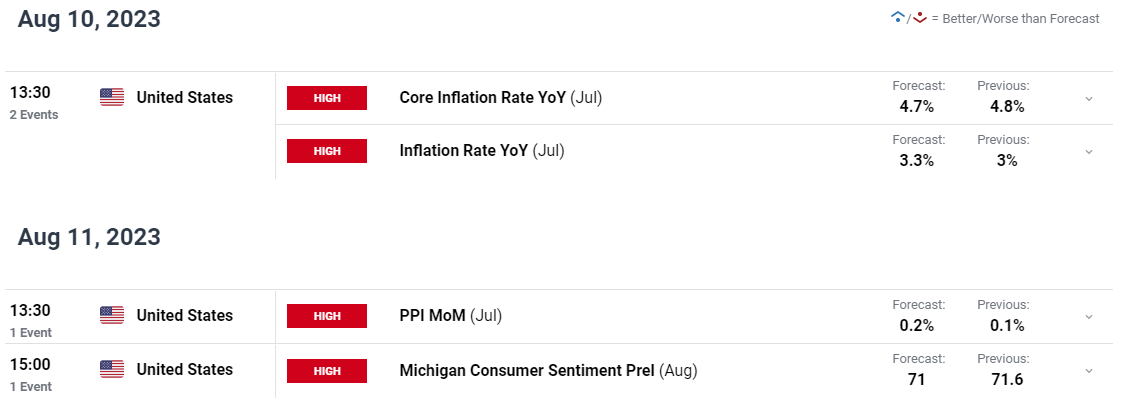

From a technical perspective both WTI and Brent finished last week strong before a slight gap higher over the weekend which has already been filled. WTI for its part remains inside the rising wedge pattern tapping the top on Friday before a move lower which has continued into the new week. There is also a potential golden cross pattern developing on the Daily Chart as we have the 50-MA eyeing a break above the 100-day MA which could see WTI rise higher following a brief retracement.

WTI is currently resting at support around the $82 a barrel mark with a break lower bringing the $80 psychological level into play before the 50 and 100-Day MAs are reached resting at $73.65 and $74.11 respectively.

To learn more about trading ranges and patterns download the Guide below

Recommended by Zain Vawda

The Fundamentals of Breakout Trading

WTI Crude Oil Daily Chart – August 7, 2023

Source: TradingView

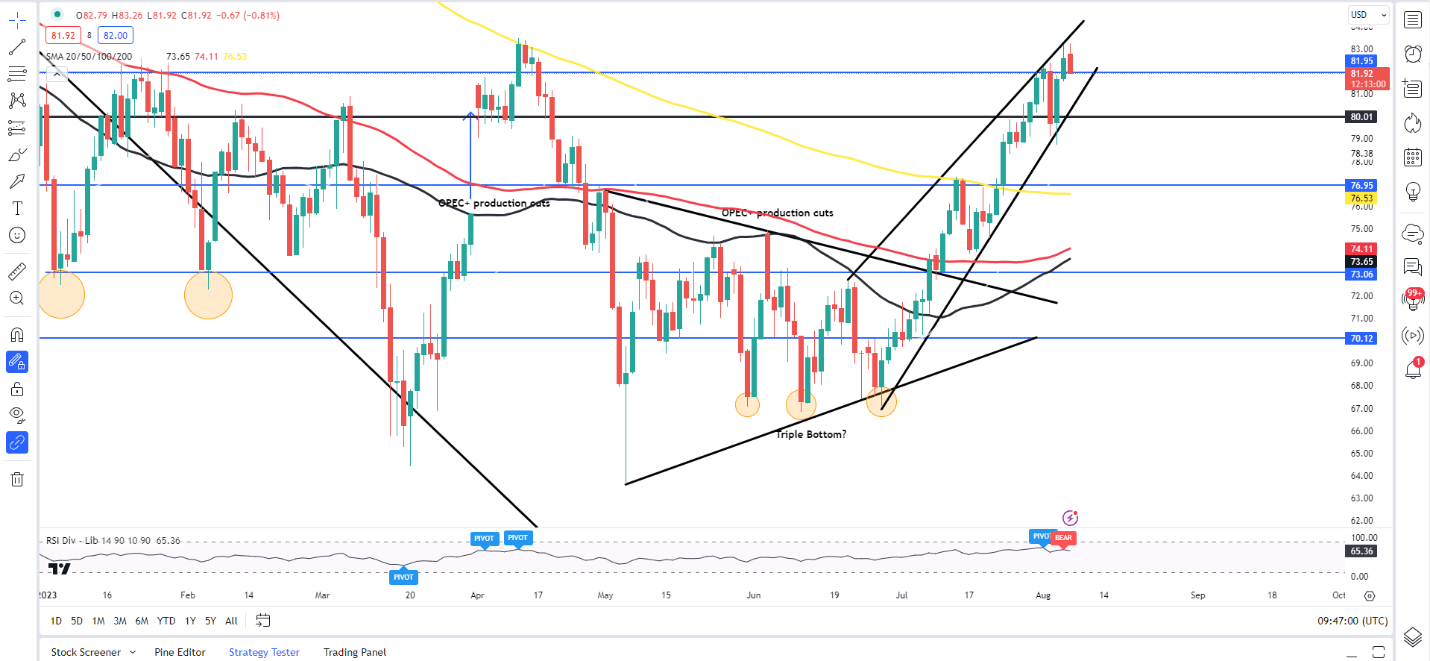

Brent Crude is beginning to look like a mirror image of WTI with a golden cross taking place last week as the 20-day MA has crossed above the 200 day MA In a sign of the upside momentum that remains.

A pullback in price from here may run into an issue around the $82.20 a mark as we have a host of confluences resting there with the swing high and the 20-da MA. Looking lower and the $80 a barrel psychological level may be tested once more.

Brent Oil Daily Chart – August 7, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA- OIL US CRUDE

IGCS shows retail traders are currently SHORT on WTI Oil, with 62% of traders currently holding SHORT positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are SHORT highlights means Oil prices could continue to rise following a brief pullback.

| Change in | Longs | Shorts | OI |

| Daily | 0% | 2% | 1% |

| Weekly | -13% | 28% | 9% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰