Wait-and-See in Lead-Up to Fed’s Decision, RBA Minutes in Focus

[ad_1] Market Recap Recommended by Jun Rong Yeap How to Trade FX with Your Stock Trading Strategy Market sentiments remained in its usual wait-and-see ahead of the Federal Open Market Committee (FOMC) meeting this week, as the VIX headed higher for the second straight day to reflect increased hedging activities while major US indices ended

[ad_1]

Market Recap

Recommended by Jun Rong Yeap

How to Trade FX with Your Stock Trading Strategy

Market sentiments remained in its usual wait-and-see ahead of the Federal Open Market Committee (FOMC) meeting this week, as the VIX headed higher for the second straight day to reflect increased hedging activities while major US indices ended the day flat.

On the other hand, US Treasury yields continued to hover around their multi-year highs, with expectations seemingly leaning towards a potential ‘hawkish pause’ scenario from the Federal Reserve (Fed). This is where the central bank keeps rates on hold at the upcoming meeting, but leaves the door open for one more rate hike by the end of this year as per its previous dot plot. Some pushback against recession risks by policymakers lately may support an upward revision in growth forecasts, but with soft landing hopes having to face off against a potential hawkish recalibration in rate expectations.

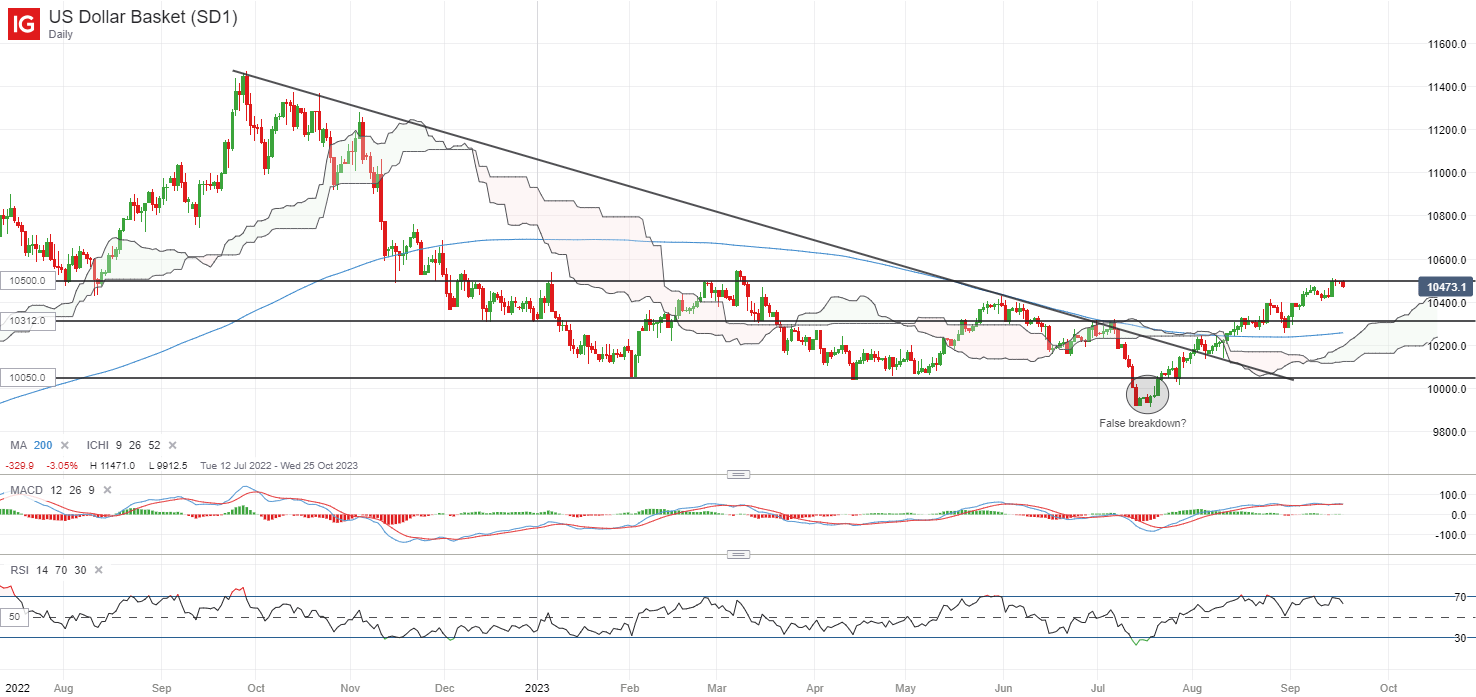

The US dollar continues to trade above its 200-day MA, with the formation of higher highs and higher lows since July this year, as market participants get more accustomed to a high-for-longer rate outlook. That said, the US dollar index is now back to retest a key resistance at the 105.00-105.60 range, which marks its year-to-date high.

Any successful move above this range may support a breakout of its months-long ranging pattern since December 2022, but a potential bearish divergence on Relative Strength Index (RSI) points to some near-term exhaustion for now. CFTC data revealed that the aggregate net-short positioning for US dollar against other G10 currencies is at its lowest in three months, with any reversal into net-long positioning likely to support further upward bias based on historical instances.

Recommended by Jun Rong Yeap

The Fundamentals of Breakout Trading

Source: IG charts

Asia Open

Asian stocks look set for a downbeat open, with Nikkei -0.76%, ASX -0.32% and KOSPI +0.16% at the time of writing, as Japan markets return from its holiday break. Chinese equities remain in a mixed state yesterday, attempting to weigh between recent improvement in economic data and lingering default risks from Country Garden, which suggests that the property sector risks will likely drag for longer.

The Reserve Bank of Australia (RBA) meeting minutes will be in focus today. With the central bank keeping rates on hold for the third straight month at its September meeting, expectations are largely priced for the trend to continue through the rest of the year, with any confirmation to be sought from the upcoming minutes. At its previous meeting, the central bank retained its tightening bias, but also acknowledged growing economic risks from China and recent slowdown in inflation data, which seem to leave room for more wait-and-see for now.

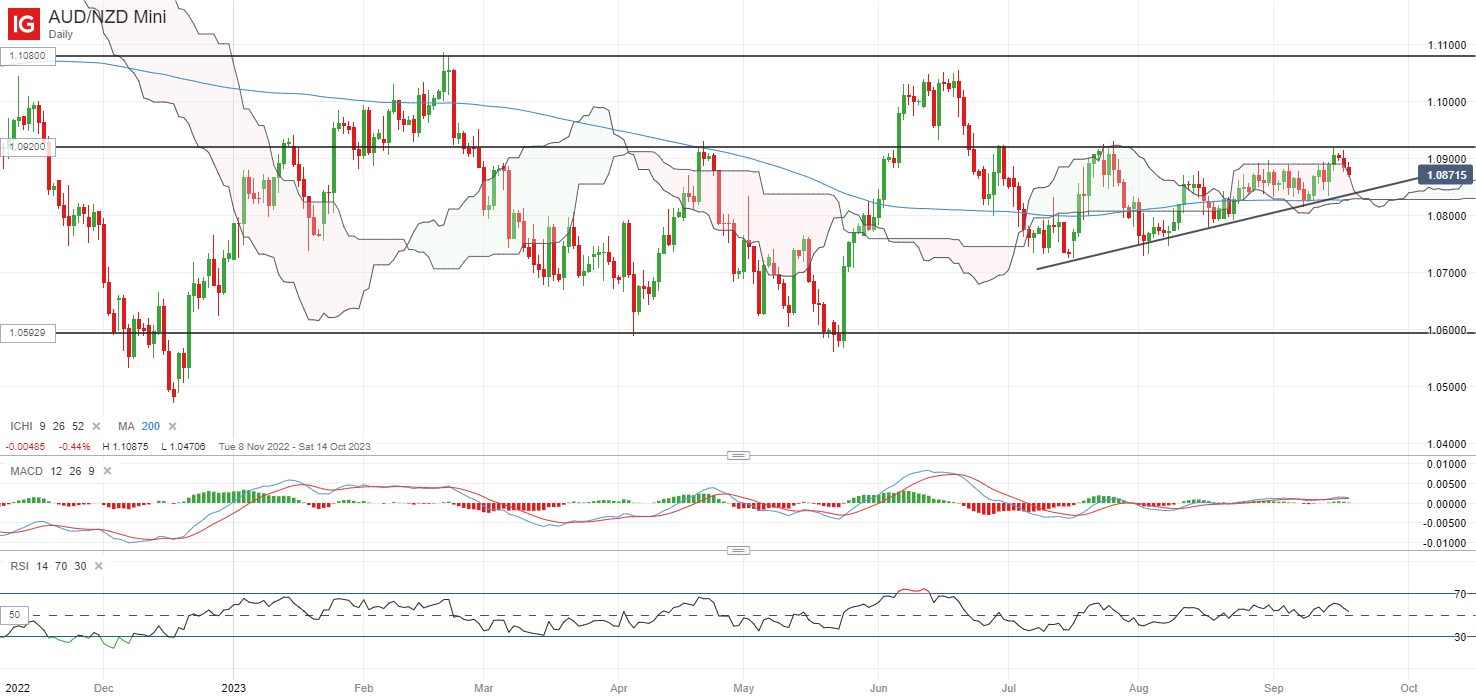

The AUD/NZD may be on watch, having been trading within an ascending triangle pattern since July this year, with the 1.092 level serving as an immediate resistance to overcome for buyers. Its daily RSI has been attempting to defend the key 50 level since August this year as well, which leaves buyers in some control for now. On the downside, the upward trendline support may be crucial to hold, failing which could pave the way to retest its July/August 2023 lows at the 1.073 level next.

Source: IG charts

On the watchlist: Silver prices attempting a bounce-off support confluence

Silver prices have been attempting to hold up lately amid higher Treasury yields and US dollar strength, as buyers managed to defend the US$22.30 level, where an upward trendline support is in place since September 2022. Higher lows on Moving Average Convergence/Divergence (MACD) on the daily chart may point to some upward momentum in the near term, as prices may potentially eye for a retest of the US$24.50 level, where the upper edge of its ranging pattern resides.

On the weekly chart, a bullish pin bar formation was formed last week, with any positive follow-through on watch this week. Further upside may also validate a bullish crossover on daily MACD, which may potentially draw some technical buyers.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Source: IG charts

Monday: DJIA +0.02%; S&P 500 +0.07%; Nasdaq +0.01%, DAX -1.05%, FTSE -0.76%

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰