USD/JPY, GBP/USD, AUD/USD, Volatility Up Ahead

[ad_1] USD/JPY, GBP/USD, AUD/USD FORECAST: The October U.S. inflation report will steal the limelight on Tuesday If actual CPI results deviate from consensus expectations by a wide margin, FX volatility can rise significantly This article explores pivotal technical levels for USD/JPY, GBP/USD and AUD/USD that may act as support or resistance in the coming trading

[ad_1]

USD/JPY, GBP/USD, AUD/USD FORECAST:

- The October U.S. inflation report will steal the limelight on Tuesday

- If actual CPI results deviate from consensus expectations by a wide margin, FX volatility can rise significantly

- This article explores pivotal technical levels for USD/JPY, GBP/USD and AUD/USD that may act as support or resistance in the coming trading sessions

Most Read: US Inflation Preview – How Will Gold Prices, EUR/USD and the Nasdaq 100 React to Data?

Traders should be on high alert on Tuesday, as the U.S. Bureau of Labor Statistics is expected to release October inflation figures in the morning. Against this backdrop, volatility is likely to pick up later this week, with market direction and underlying FX moves dependent on the strength or weakness of upcoming consumer price index data.

In terms of consensus estimates, headline CPI is forecast to have risen 0.1% m/m and 3.3 % y/y. For its part, the core gauge is seen increasing 0.3% m/m and 4.1% y/y. Overall, inflation results that surprise to the upside by a wide margin should be bullish for the broader U.S. dollar. The reverse is also true: a weak CPI report that comes in below expectations will likely act as a headwind for the greenback.

This article explores pivotal technical levels for USD/JPY, GBP/USD and AUD/USD that may act as support or resistance in the event of large price swings in the coming trading sessions.

For a comprehensive assessment of the Japanese yen’s medium-term prospects, make sure to download our Q4 outlook!

Recommended by Diego Colman

Get Your Free JPY Forecast

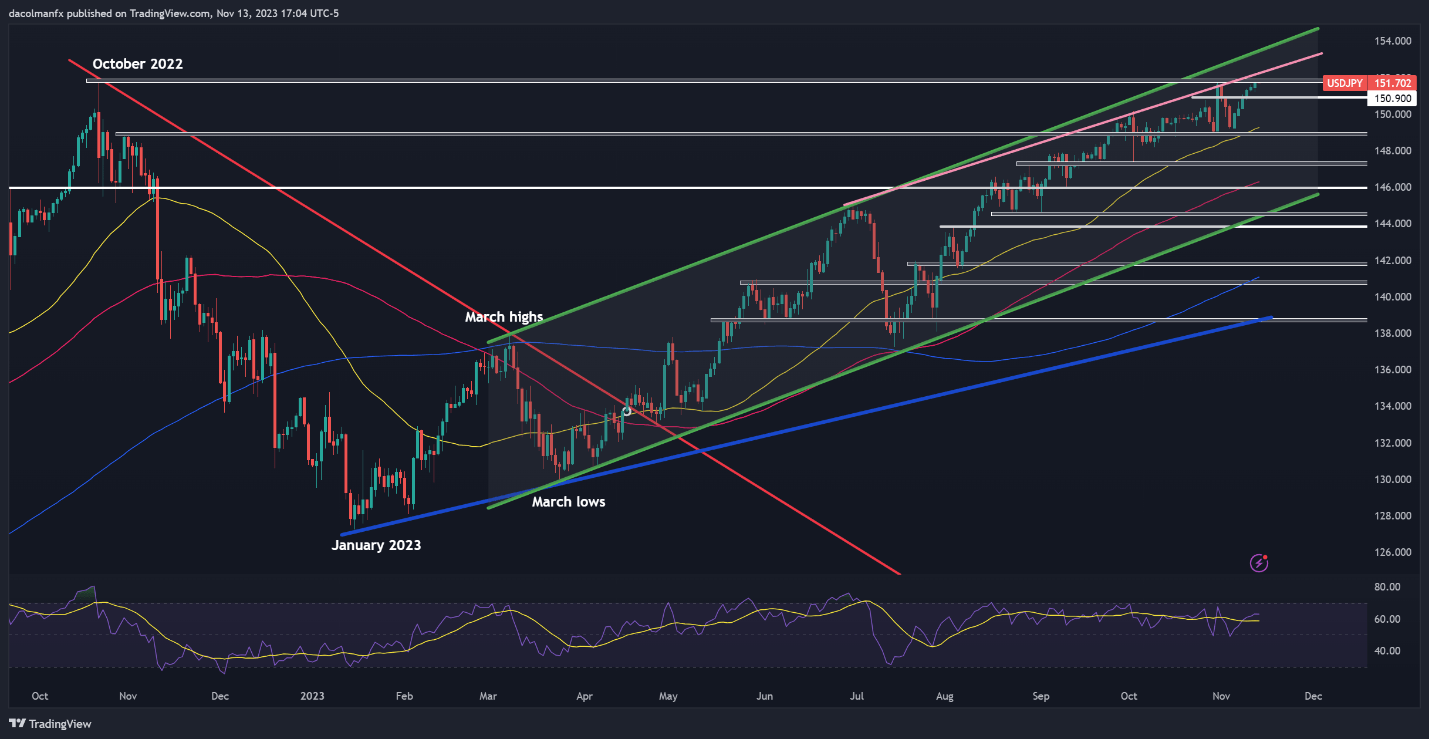

USD/JPY TECHNICAL ANALYSIS

After a minor pullback earlier this month, USD/JPY has regained its poise, clearing a significant hurdle at 150.90 and ascending toward its 2022/2023 high, just shy of the psychological 152.00 mark. With the pair on an upward trajectory and flirting with a key level, traders should exercise caution as Tokyo may step in unexpectedly to prevent further yen weakness and suppress speculative activity.

In the event of Japanese authorities intervening in the FX market, there is a risk of USD/JPY quickly breaking below 150.90 and sinking towards 149.00. Additional losses from here on out could shift the focus to 147.25. On the flip side, if Tokyo refrains from intervention and allows USD/JPY to push above 152.00, we could see a move towards the upper limit of a medium-term rising channel at 153.50.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

For a complete overview of the British pound’s technical and fundamental outlook, download the free Q4 trading forecast now!

Recommended by Diego Colman

Get Your Free GBP Forecast

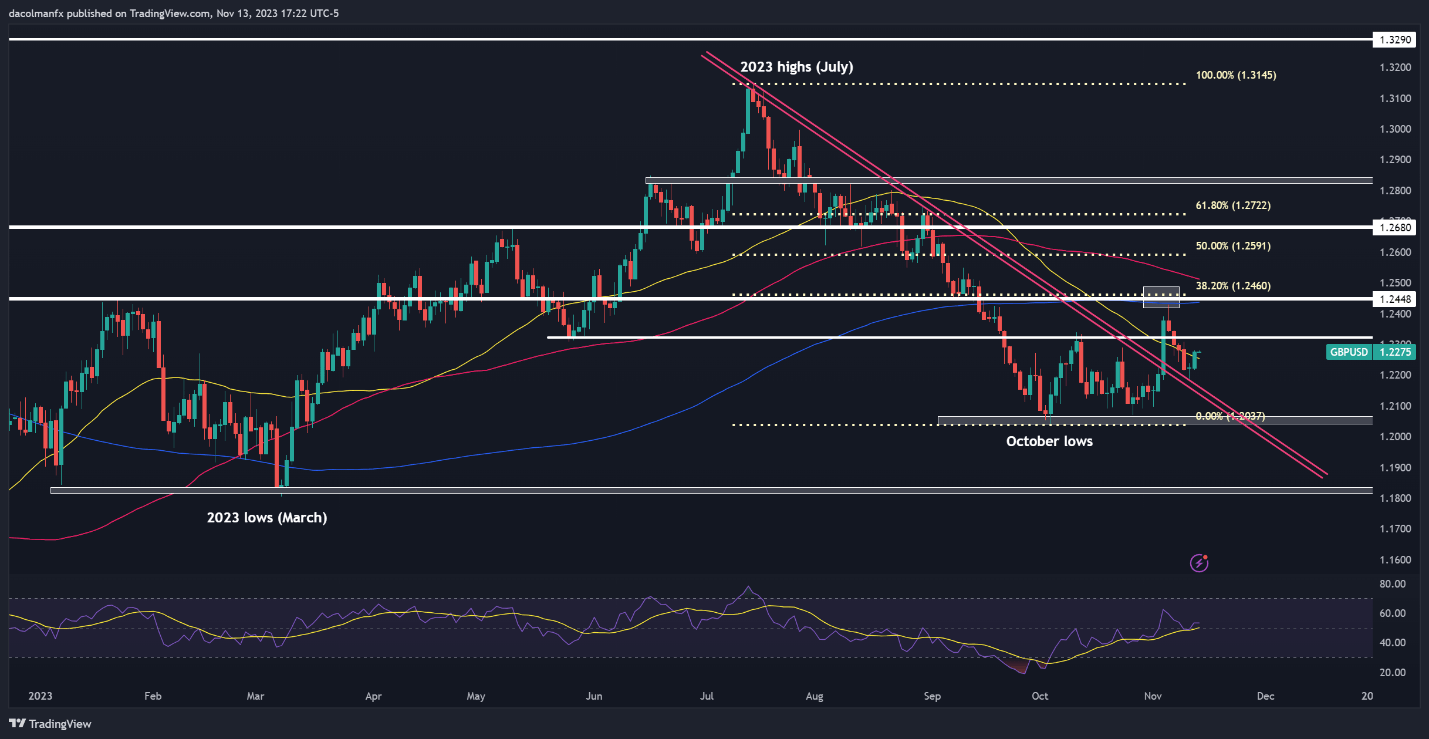

GBP/USD TECHNICAL ANALYSIS

After encountering resistance at a Fibonacci level near 1.2460, GBP/USD has yielded ground, with prices now hovering above the 50-day simple moving average. Should the pair maintain its position above this technical indicator and initiate upward consolidation, there’s potential for sentiment to recover, which could pave the way for a move towards 1.2325. On further strength, the focus shifts to 1.2460.

Conversely, if sellers return with determination and spark a pullback, the first line of defense against a bearish assault emerges at 1.2250, followed by trendline support at 1.2140. A successful breach of this pivotal level holds the potential to reinforce downward momentum, ushering in a descent toward the 2023 lows around 1.2040.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Using TradingView

Interested in learning how retail positioning can shape the short-term trajectory of AUD/USD? Our sentiment guide explains the role of crowd mentality in FX markets. Grab a copy now!

| Change in | Longs | Shorts | OI |

| Daily | 3% | 15% | 5% |

| Weekly | 43% | -49% | 7% |

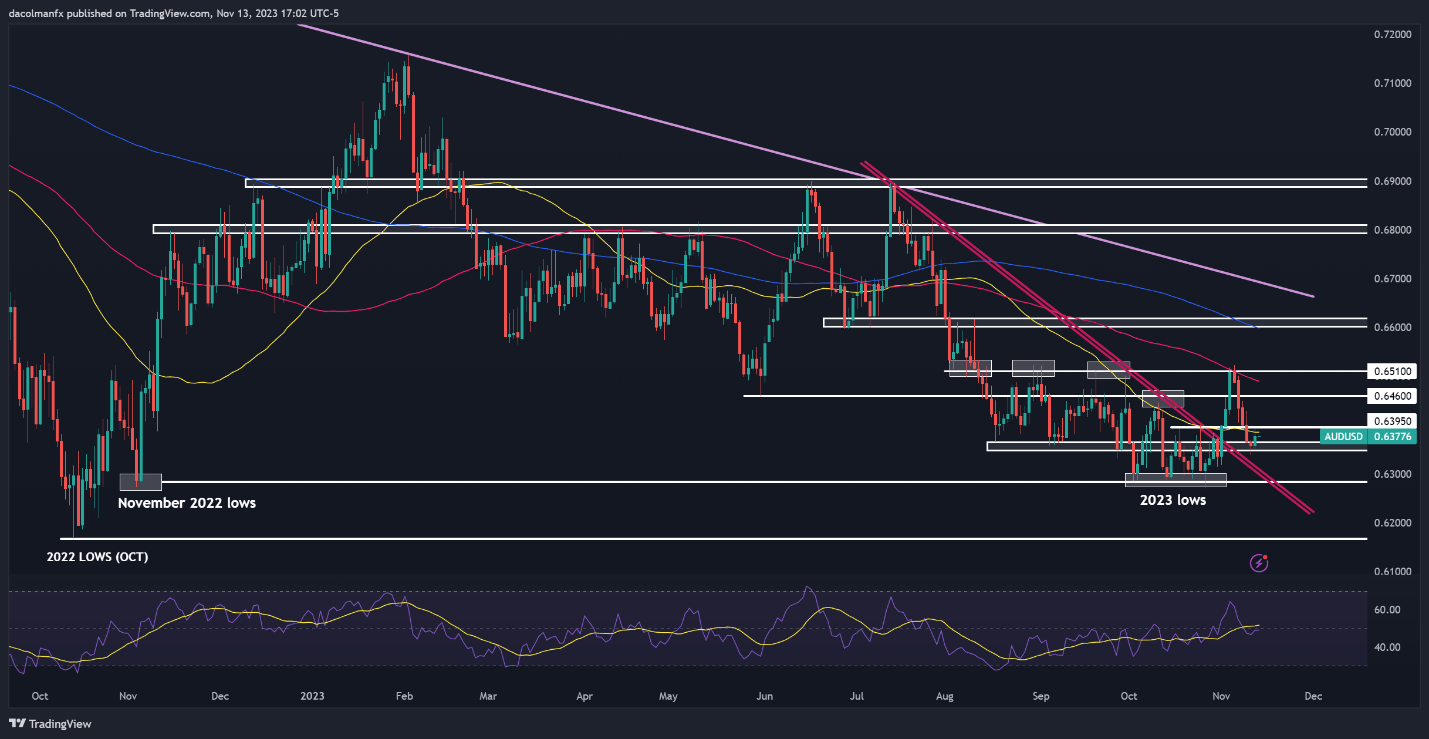

AUD/USD TECHNICAL ANALYSIS

AUD/USD bounced on Monday off technical support in the 0.6350 zone following last week’s selloff, with the exchange rate making a move on the 50-day simple moving average located slightly below the 0.6400 handle. If the bulls manage to propel prices above this technical barrier, the possibility of a rally towards 0.6460 comes into view. On further strength, attention turns to 0.6500.

Conversely, if sellers mount a comeback and trigger a bearish reversal, the primary support area to watch is at 0.6350. It is of paramount importance for the bulls to vigorously defend this floor – any failure to do so may rejuvenate downside pressure, setting the stage for a retracement towards 0.6310. Should weakness persist, retesting this year’s lows becomes a potential scenario.

AUD/USD TECHNICAL CHART

AUD/USD Chart Created Using TradingView

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :ahead ، AUDUSD ، GBPUSD ، USDJPY ، Volatility

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰