US Indices Hit a Roadblock After Solid Services Print: S&P 500, Nasdaq

[ad_1] S&P 500, SPX, NASDAQ 100, NDX – OUTLOOK: The S&P 500 index and the Nasdaq 100 index retreated from key resistance zones. Lofty real yields, above-average valuations continue to pose a high bar for material index gains. What are the outlook and the key levels to watch in the S&P 500 and the Nasdaq

[ad_1]

S&P 500, SPX, NASDAQ 100, NDX – OUTLOOK:

- The S&P 500 index and the Nasdaq 100 index retreated from key resistance zones.

- Lofty real yields, above-average valuations continue to pose a high bar for material index gains.

- What are the outlook and the key levels to watch in the S&P 500 and the Nasdaq 100 index?

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

US indices turned lower on Wednesday after stronger-than-expected services sector data pushed up the odds of a November rate hike, reigniting concerns of higher for longer rates.

Markets are now pricing in about a 44% chance of a November rate hike, up from around 30% at the start of the week, pushing up yields / real yields. The softer data in the second half of August gave the impression that the US economy isn’t resurging. However, this month’s data underscores the outperformance of the world’s largest economy, keeping the upward pressure intact on yields.

As highlighted in a recent update, with real yields rising, valuations well above historical averages, and full-year EPS projections yet to turn materially higher, the bar for equities to outperform some of the other asset classes is now higher. See “US Indices’ Upside Could be Capped: S&P 500, Nasdaq Price Setups,” published August 24, and “US Indices Rally Beginning to Crack? S&P 500, Nasdaq Price Setups,” published August 3.

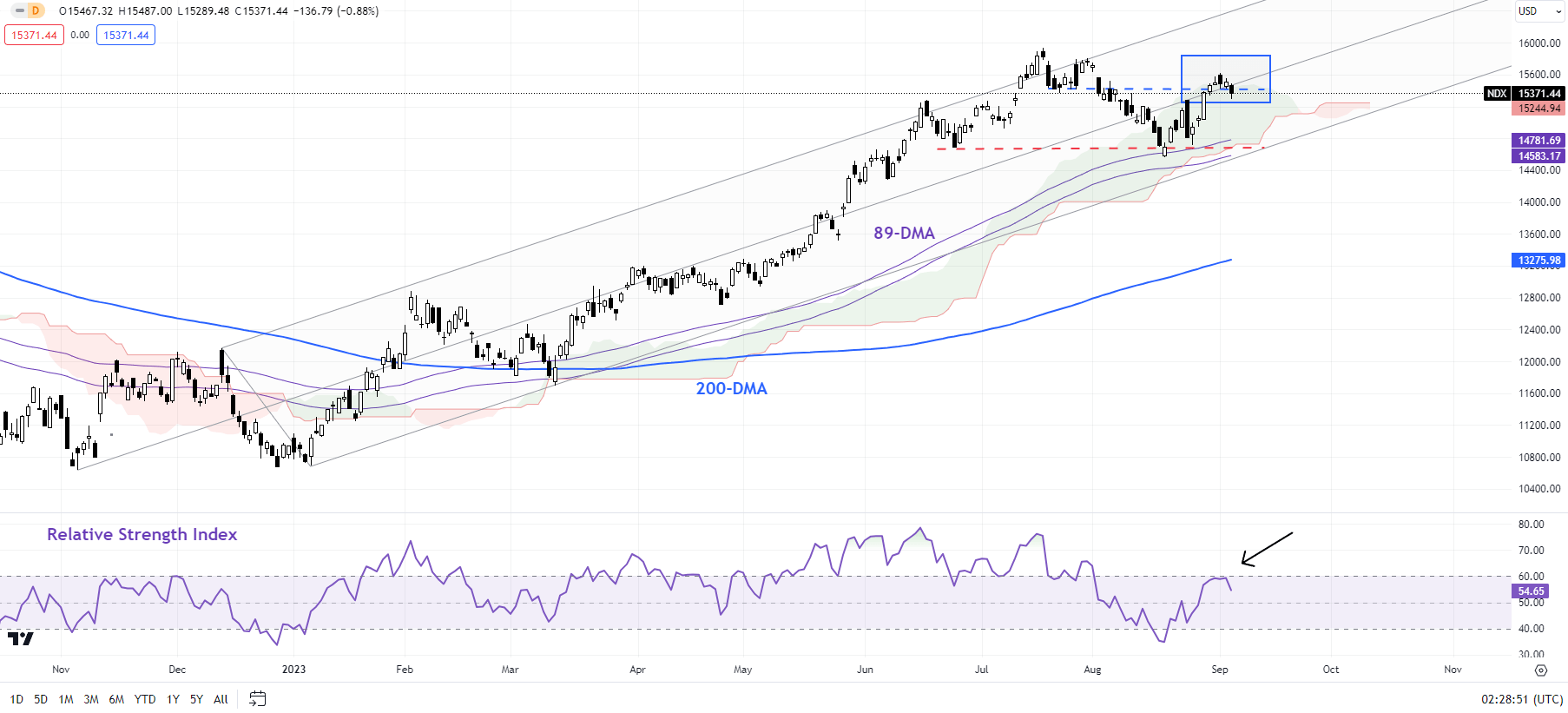

Nasdaq 100 Daily Chart

Chart Created by Manish Jaradi Using TradingView

Nasdaq 100: Rally appearing to be running out of fuel

On technical charts, the Nasdaq 100 index has run into stiff resistance: the median line of a pitchfork channel since late 2022, the July 24 low of 15375, and the upper edge of the Ichimoku cloud on the daily charts – a risk highlighted in theprevious update.

The rollover of the 14-day Relative Strength Index rolling from near the 60-level raises the odds that the bounce from late August is corrective. Nasdaq mid-August rebounded from vital cushion area, including the 89-day moving average, the lower edge of the Ichimoku cloud on the daily chart, and the June low of 14700. Any break below immediate support at the late-August high of 15280 would confirm that the upward pressure from August had faded, potentially opening the way toward the August low of 14550.

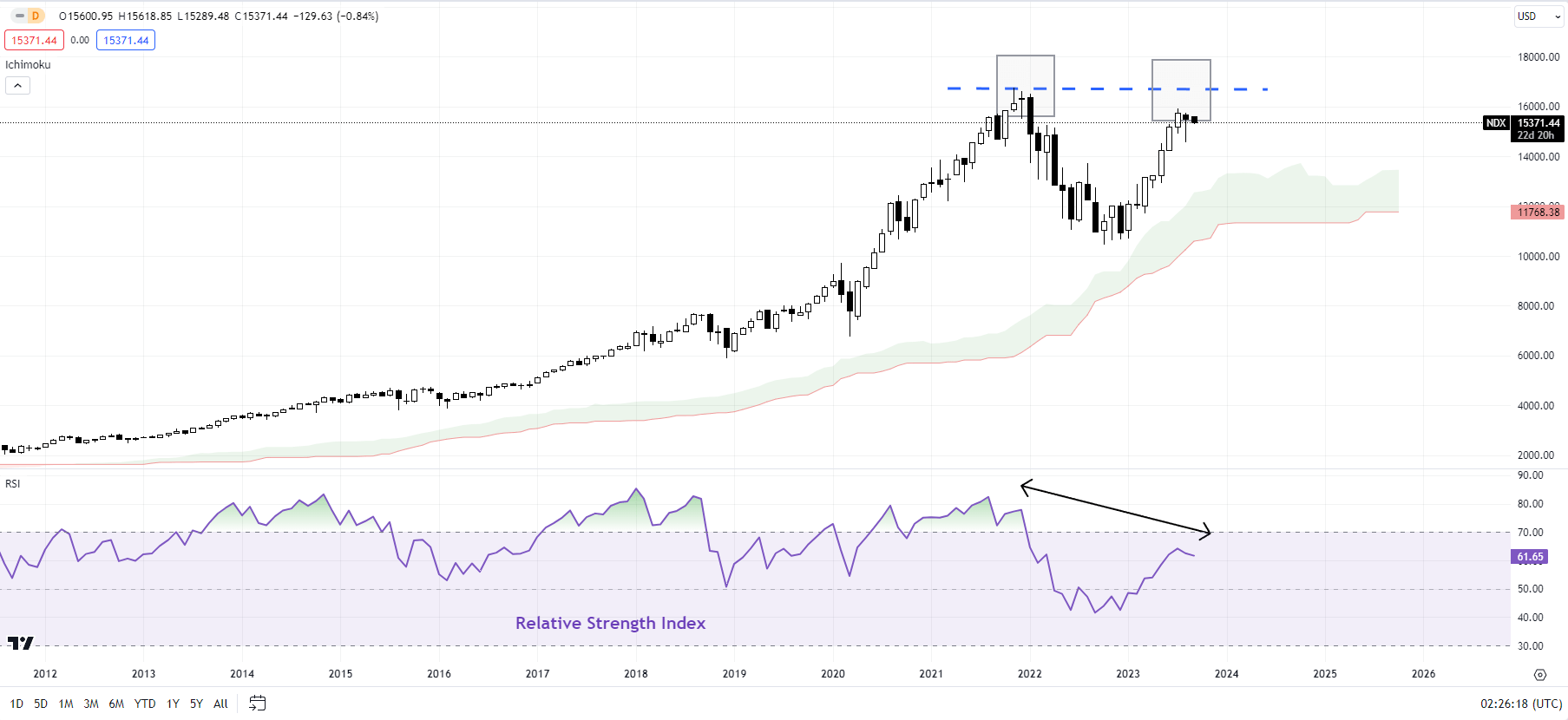

Nasdaq 100 Monthly Chart

Chart Created by Manish Jaradi Using TradingView

More broadly, as noted in “S&P 500, Nasdaq 100 Forecast: Overly Optimistic Sentiment Poses a Minor Setback Risk,” published July 23, monthly charts have been feeble compared with the 50% rally since October (see the monthly chart), raising the risk of a gradual weakening pattern in gold in recent months. For more discussion, see “Is Nasdaq Following Gold’s Footsteps? NDX, XAU/USD Price Setups,” published August 14.

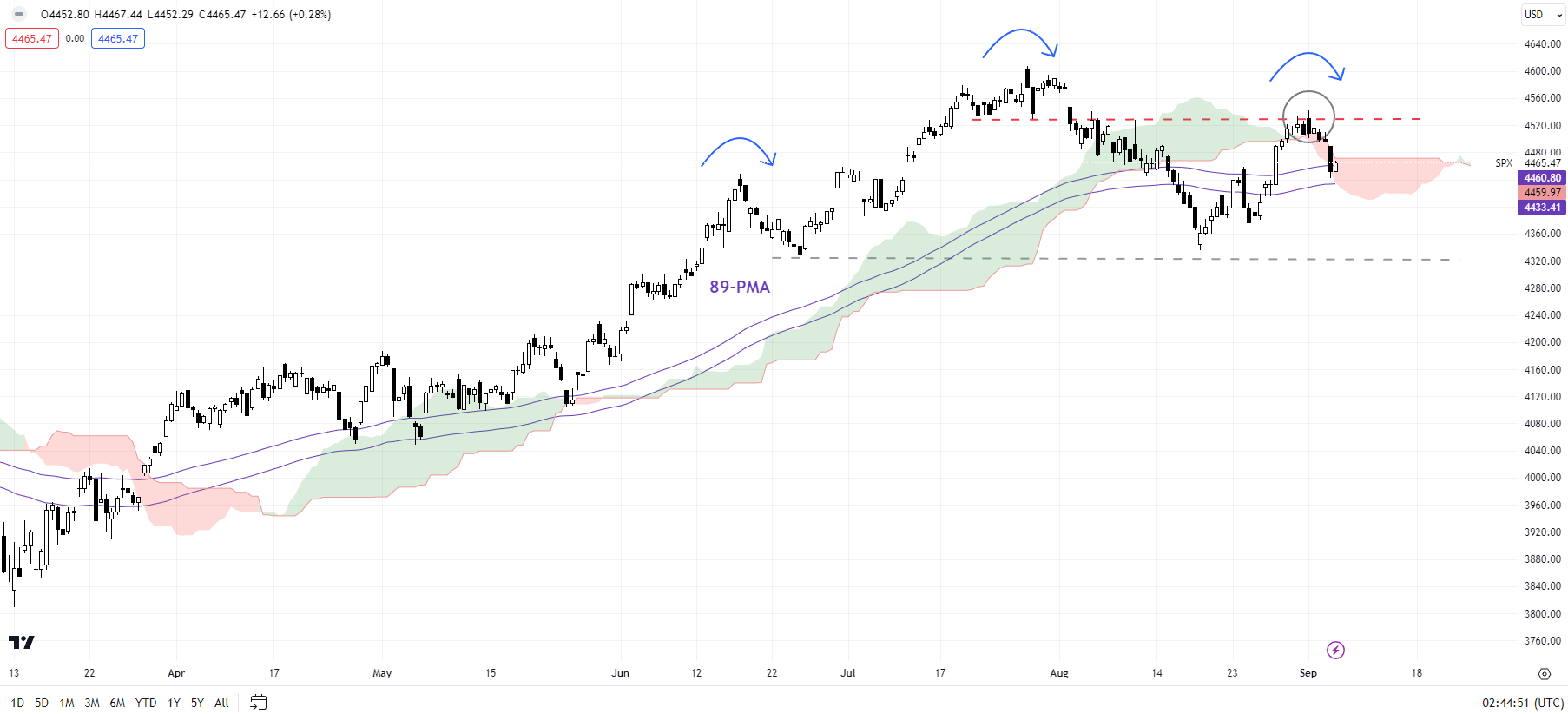

S&P 500 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView.

S&P 500: Rally stalls for now

The S&P 500 index has surrendered some of its late-August gains as it ran into a tough ceiling on the upper edge of the Ichimoku cloud on the 240-minute charts, coinciding with the end-July low of 4600. Ashighlighted in the previous update, the index could need to clear past the support-turned-resistance at 4550 for the downside risks to dissipate.

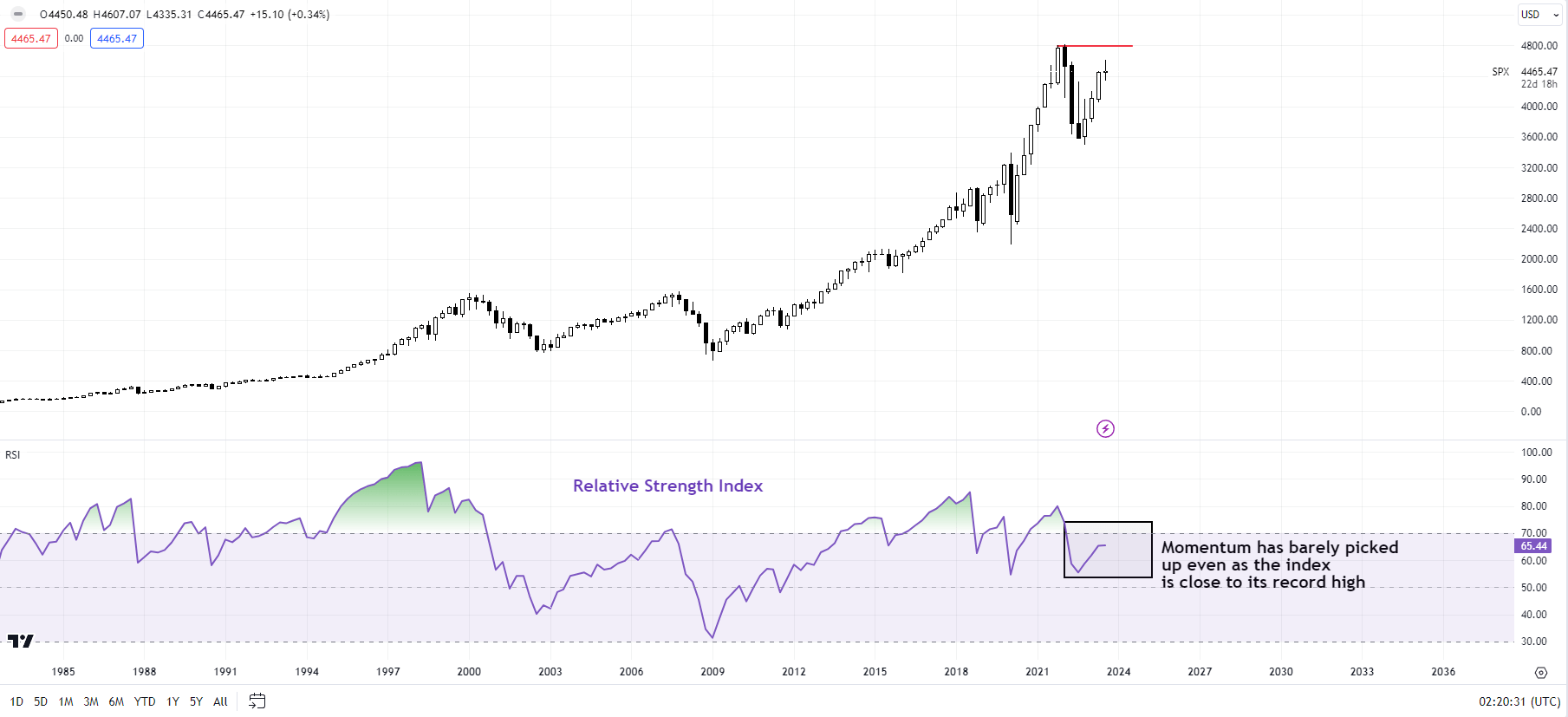

S&P 500 Quarterly Chart

Chart Created by Manish Jaradi Using TradingView

The recent retreat raises the risk of a potential lower high – for the first time since the rally began late last year. Any break below the August low of 4335 would disrupt the higher-top-higher-bottom sequence since late 2022, raising the odds that the ten-month-long rally was corrective, and not the start of a new uptrend. The feeble upward momentum on higher timeframe charts reinforces the corrective nature of the rebound. (See the quarterly chart.)

Recommended by Manish Jaradi

Traits of Successful Traders

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰