US Dollar Outlook Shaky as Yields Tank, Setups on EUR/USD, GBP/USD, AUD/USD

[ad_1] US DOLLAR FORECAST – EUR/USD, GBP/USD, AUD/USD The U.S. dollar could head lower in the near term The pullback in U.S. Treasury yields will act as a headwind for the greenback This article explores the technical outlook for EUR/USD, GBP/USD and AUD/USD, focusing on price action dynamics and key levels in play Most Read:

[ad_1]

US DOLLAR FORECAST – EUR/USD, GBP/USD, AUD/USD

- The U.S. dollar could head lower in the near term

- The pullback in U.S. Treasury yields will act as a headwind for the greenback

- This article explores the technical outlook for EUR/USD, GBP/USD and AUD/USD, focusing on price action dynamics and key levels in play

Most Read: Gold Price Forecast – XAU/USD Breaks Out as Yields Sink, Fed Pivot Hopes Build

The U.S. dollar, as measured by the DXY index, has fallen more than 2.15% this month. Over the last couple of days, however, the selling pressure has eased, allowing the broader greenback to perk up modestly. Despite the stabilization, it is likely that the downward correction that began a few weeks ago has not yet run its course.

One variable that could weigh on the U.S. currency is the recent move in Treasuries as traders try to front-run the “Fed pivot.” For context, yields have pulled back sharply this month, with the downturn accelerating following subdued October U.S. CPI and PPI data. Both of these reports surprised to the downside, sparking a dovish repricing of interest rate expectations.

Yields could continue to retrench if economic weakness, clearly displayed in the latest jobless claims numbers, intensifies heading into 2024. This scenario is anticipated as the impact of past tightening measures feeds through the real economy.

Another factor that could further depress yields and the U.S. dollar is the massive sell-off in oil, which has plunged nearly 20% this quarter. If the trajectory of declining energy costs persists, inflation will decelerate faster than forecast, reducing the need for an overly restrictive stance by the U.S. central bank.

For an extensive analysis of the euro’s medium-term outlook, make sure to download our Q4 technical and fundamental forecast

Recommended by Diego Colman

Get Your Free EUR Forecast

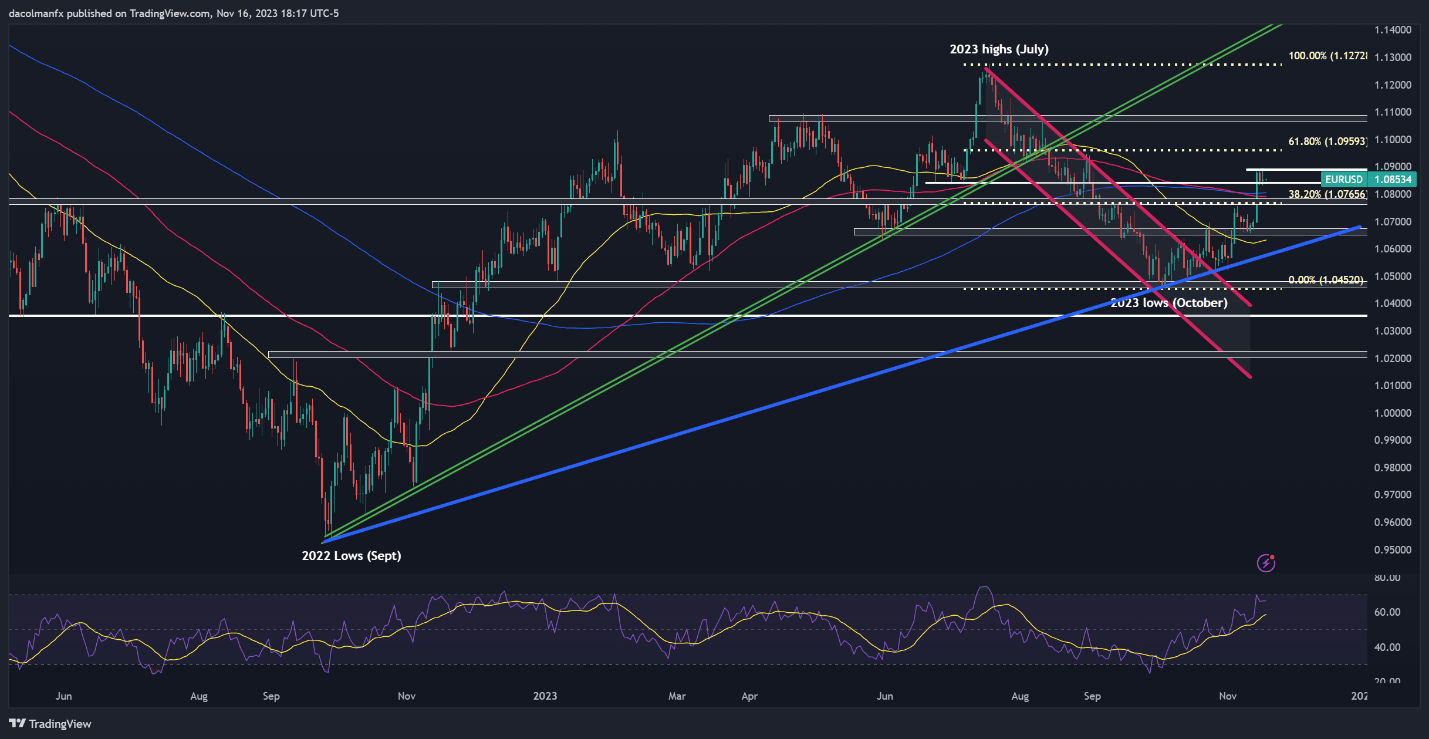

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD was muted on Thursday following a moderate pullback in the previous session. Despite market indecision, the euro retains a constructive bias against the U.S. dollar, with prices making higher highs and higher lows recently and trading above key moving averages.

To reaffirm the bullish perspective, the pair needs to hold above the 200 and 100-day SMA near 1.0765. Successfully defending this support zone could pave the way for the exchange rate to break above the psychological 1.0900 level and advance towards Fibonacci resistance at 1.0960, followed by 1.1075.

In case sellers regain strength and push EUR/USD below 1.0765, the short-term bias might shift to a bearish outlook for the common currency. This potential development might lead to a downward move towards 1.0650, with continued weakness heightening the risk of retesting trendline support at 1.0570.

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

Uncover expert strategies and useful tips. Download the “How to trade GBP/USD” guide to empower your trading!

Recommended by Diego Colman

How to Trade GBP/USD

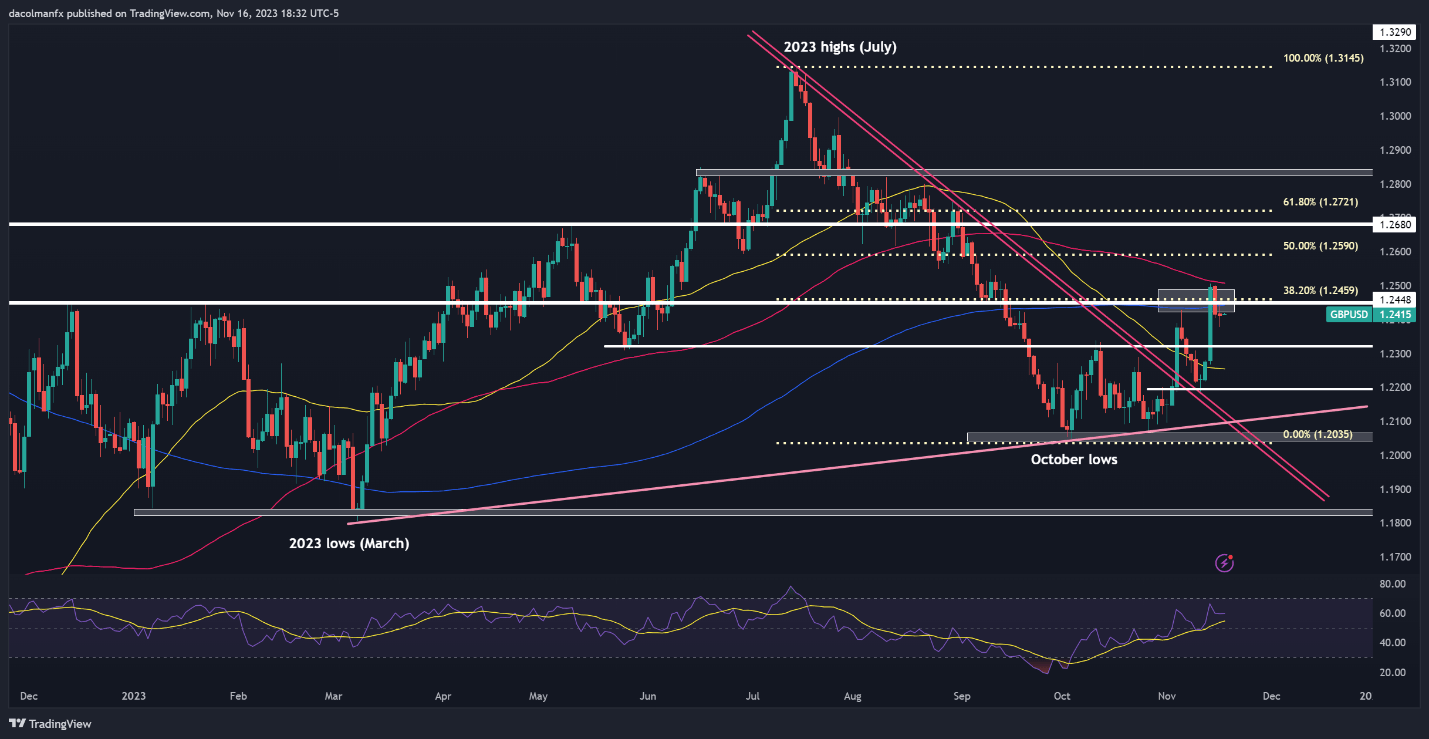

GBP/USD FORECAST – TECHNICAL ANALYSIS

Thursday saw GBP/USD maintaining a subdued stance, struggling to gather positive impetus, with slight consolidation below the 200-day simple moving average. In the event of escalating losses, primary support rests at 1.2320. Preserving this crucial floor is essential to revive hopes of a sustained uptrend; any failure to do so might lead to a descent toward the 1.2200 threshold.

Should the bulls reclaim control, initial resistance is expected at 1.2450/1.2460. Upside clearance of this barrier could invite fresh buying interest, laying the groundwork for a potential rally towards the 100-day simple moving average. On further strength, we could see a move towards 1.2590, which represents the 50% Fibonacci retracement of the July/October decline.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Using TradingView

Interested in learning how retail positioning can shape the short-term trajectory of AUD/USD? Our sentiment guide discusses the role of crowd mentality in the market. Get the guide now!

| Change in | Longs | Shorts | OI |

| Daily | 10% | -18% | -1% |

| Weekly | -24% | 42% | -10% |

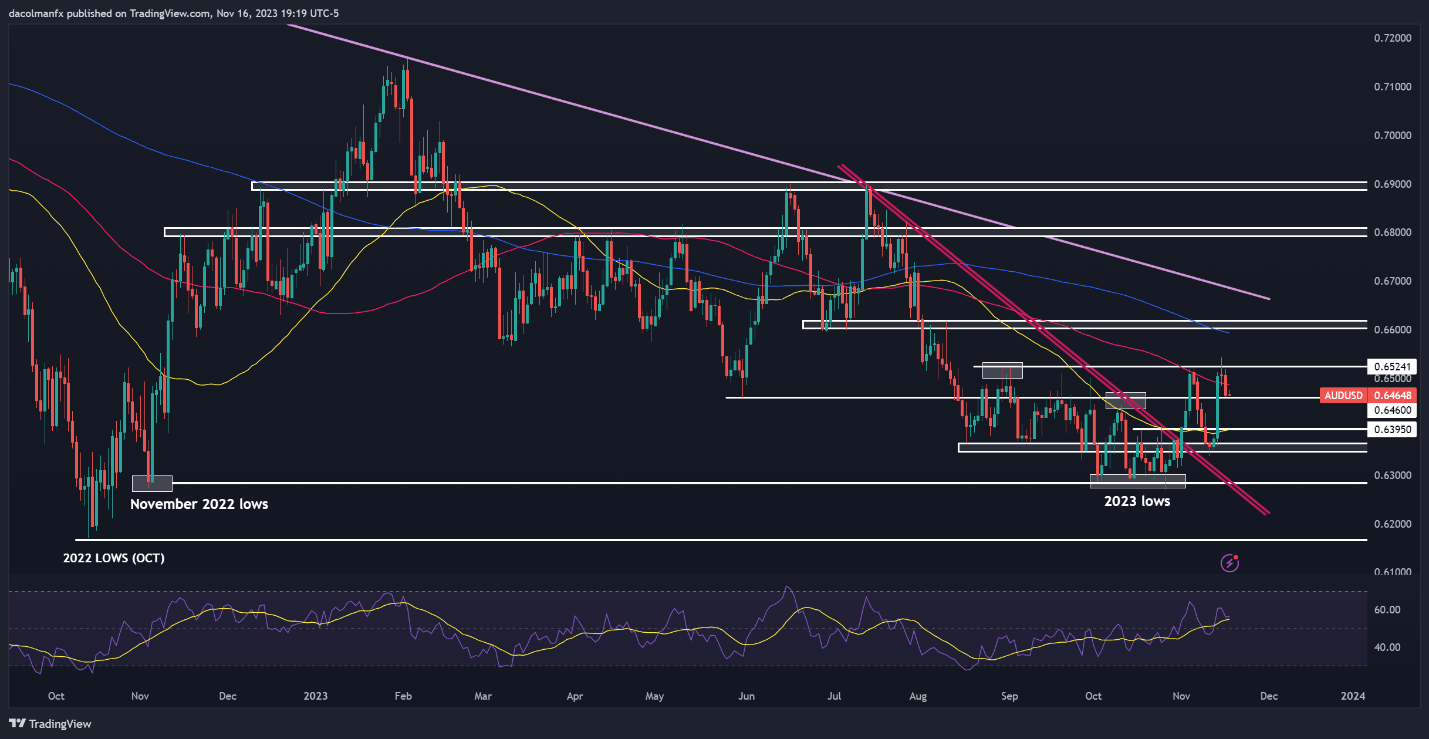

AUD/USD FORECAST – TECHNICAL ANALYSIS

Following robust gains earlier in the week, AUD/USD fell on Thursday, with prices slipping beneath the 100-day SMA after being rejected at the 0.6500 handle. Should the retracement continue, support rests at 0.6460 and 0.6395 thereafter. On further weakness, a drop towards 0.6350 is plausible.

On the other hand, if the pair resumes its advance, technical resistance is located around the 0.6500 mark. Overcoming this hurdle might present a challenge for the bullish camp, yet a clean and clear breakout could catalyze a rally towards the 200-day simple moving average, a tad below the 0.6600 level/

AUD/USD TECHNICAL CHART

AUD/USD Chart Created Using TradingView

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰