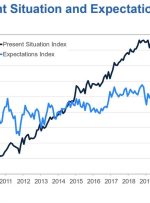

[ad_1] UPCOMING EVENTS: Tuesday: Australian Retail Sales, US Consumer Confidence. Wednesday: Australian Monthly CPI, RBNZ Policy Decision, US GPD Q3 2nd Estimate. Thursday: Japan Industrial Production and Retail Sales, China PMIs, Switzerland Retail Sales, Eurozone CPI and Unemployment Rate, Canada GDP, US Core PCE, US Jobless Claims. Friday: Japan Jobs data, China Caixin Manufacturing PMI,