Trend Guardian Pro EA Manual, Strategies and Setfiles – My Trading – 20 November 2023

[ad_1] Before you start (Must Read!) It’s imperative to understand that Trend Guardian Pro EA (TGP) is not a set-and-forget system; but an advanced, dynamic ally in your trading endeavors. TGP stands out in the realm of expert advisors by offering unprecedented customization options catering to individual trading styles and strategies. Whether you’re a scalper,

[ad_1]

Before you start (Must Read!)

It’s imperative to understand that Trend Guardian Pro EA (TGP) is not a set-and-forget system; but an advanced, dynamic ally in your trading endeavors. TGP stands out in the realm of expert advisors by offering unprecedented customization options catering to individual trading styles and strategies. Whether you’re a scalper, a swing trader, or have a different approach, TGP can be tailored to meet your specific needs and goals, automating your trading operations with precision and reliability. Moreover, TGP is designed with proprietary trading firms (AKA Prop Firms) in mind, equipped with features that transcend basic automation. It allows for granular control over trading parameters, risk management settings, and operational toggles that can be instrumental in aligning it with strict trading mandates and risk protocols typical of prop trading entities. However, the power of TGP demands a good level of proficiency from its users. Familiarity with the fundamentals of forex trading, technical analysis, EAs and the Meta Trader (MT4 and MT5) platform is imperative. You should also be comfortable with basic risk management principles and have a clear understanding of your trading plan. Remember, TGP is a tool to implement your strategies automatically, not a magic wand or a holy grail that guarantees profits. It requires careful setup and informed decision-making about trading preferences and risk settings.

NOTE: Before trading your live accounts using TGP, ensure your trading account is adequately funded and that you’ve tested TGP in a demo environment for at least 1 to 3 months, depends on your expertise and trading skills, to familiarize yourself with its functionalities and settings.

NOTE: All distance values in TGP settings are in points and not pips

Configurations and Settings:

TGP settings are designed to provide you with extensive customization options to optimize your trading strategy. Settings are classified as below:

- Panel Settings

- Trend Starter Indicator Settings

- MAs Filter

- Cycles First and Top-ups Entries Settings

- Cycle Management Settings

- Account Management Settings

- General and Alerts Settings

Panel Settings:

You can customize whether to have a display on the chart or not, the text color and size, and the panel position by adjusting the X and Y values.

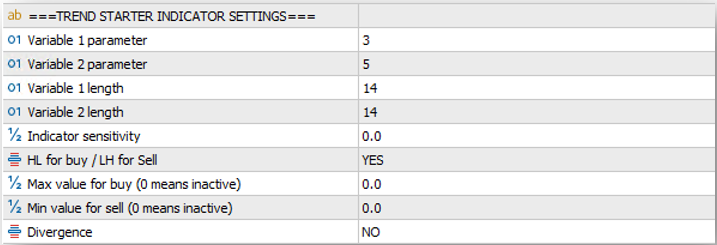

Trend Starter Indicator Settings:

TGP operates on a unique concept of trading cycles, initiated by the integral Trend Starter Indicator (TSI). The TSI, embedded within TGP, initiates these cycles when the TSI parameters are met to trigger a signal, guiding the system to execute trades based on your predefined settings. TSI is a non-repaint indicator once plotted at the candle close. Although the TSI is a core component of TGP, it functions behind the scenes, not displaying signals on your charts. This design ensures a streamlined user experience. However, for traders desiring visual cues, we recommend acquiring the standalone TSI from the MQL5 marketplace. While not mandatory for TGP’s operation, visualizing TSI signals can provide additional clarity and insight into the initiation of trading cycles, enhancing your situational awareness.

Variables and lengths: TSI consists of two main oscillators (Variable 1 and 2) that provide a trading signal when they cross at the close of the candle. Variable 1 (blue) is the fast oscillator, while Variable 2 (Red) is the slow one. You can define both variables’ values and length. It is recommended to set the variables between 3 and 10, and the lengths above 4 (the lower the variables, and lengths, the higher number of signals, hence more noise).

Sensitivity allows you to define the sensitivity of the cross overs. In so many instances, the variable values distance after the cross is extremely small, hence you would prefer to ignore it. It is recommended to set it between 0 and 2 (If you set it above that, you will get fewer signals).

HL for buy / LH for Sell filter: Is a unique filter that commands the TGP to consider a buy signal ONLY if the current cross signal was higher than the previous cross signal (Higher Low), and vice a versa (Lower High) for sell signal.

Max and min value for buy and sell: You might not want to buy in an overbought condition, and vice a versa, hence you can use this filter to set the max variable 1 value to buy (or min to sell)

Divergence: This filter allows you to only consider the signals with divergence occurs between the highs and lows of the indicator vs. price.

MAs Filter:

Trend Guardian Pro (TGP) incorporates Moving Averages filter that consists of three MAs with four different modes to enhance trade accuracy. These advanced settings will help pinpoint more precise entry points by highlighting broader market trends. In this section, we’ll unpack how TGP uses moving averages in tandem with its core features to optimize your trading outcomes. Dive in to understand this added layer of refinement.

MAs type: Select the desired MA type from a drop-down menu (EMA, SMA…. etc.)

MAs timeframe: Select the desired MA timeframe from a drop-down menu, (5min, 15min, 1hr, 1d…etc.)

MA1,2 and 3 period: Input the desired MA(s) period for the selected MA(s). Input 0, and the relevant MA will be ignored.

Current MAs filter mode: At the close of every candle, TGP will investigate the selected MA(s) and filter trades based on the selected filter mode. Let us take the below example, to explain the different MAs filter modes: Assume you selected Exponential MA, 1 hour time frame, MA1=10, MA2=50 and MA3=100.

Angle direction: If all three EMAs (10,50, and 100) are pointing up, then only BUY signals will be considered, and vice versa for a SELL.

MAs position: If all three EMAs (10,50, and 100) are positioned on top of each other, then only BUY signals will be considered, and vice versa for a SELL (obviously if you selected this mode, you shall select at least two MAs in this option). Note: If the position order is 50, 10 and 200, then no signals will be considered.

Price Position: If the current price is above all three EMAs (10,50, and 100), then only BUY signals will be considered, and vice versa for a SELL. Note: If the price is above the 50, and 200, but below the 10, then no signals will be considered.

All: If all three EMAs (10,50, and 100) are pointing up, and positioned on top of each other, and the current price is above all three of them, then only BUY signal will be considered, and vice versa for a SELL. Note: If you select this, you shall expect fewer trades.

Cycles First and Top-up Entries Settings

Cycles Filters

Cycles Direction: Determines the trading direction, either buying, selling, or both.

Allow Hedged Cycles: If set to “YES”, TGP allows buying and selling at the same time (Hedging). If “NO”, hedging is disabled.

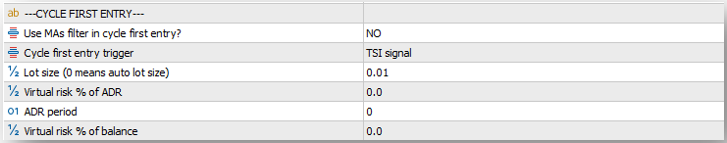

Cycle First Entry

A buy or sell cycle will be initiated by the cycle first entry. This section will help you define your cycles initiation parameters.

Use MAs filter in cycle first entry: Enables or disables the MAs filter previously explained for the initial entry of a cycle.

Cycle first entry trigger: Not a fan of full automation of entries? This parameter is for you, as it will allow you to decide whether the TGP shall use TSI to initiate the cycles, or you do it manually.

TSI signal: When selected, the cycle will be initiated based on the signal and filter parameters previously selected.

Manually: When selected, no automated cycle initiation will take please, and you will have to place the orders manually using the TGP panel

Lot size (0 means auto lot size): Specify the desired lot size for the cycle initial trade. Input 0, and TGP will calculate the lot size based on the next parameters.

Virtual risk % of ADR: This setting allows traders to define their virtual stop distance as a percentage of the Average Daily Range (ADR). This distance will be used to calculate the lot size. The higher the %, the wider the distance, hence lower lot size.

ADR period: Defines how many days to be considered in calculating the ADR (usually between 10 and 20 is a good recommendation).

Virtual risk % of balance: Specifies the risk level as a percentage of the account balance. The higher the %, hence higher lot size.

(NOTE: You don’t need to worry about the lot size calculation and how is it driven, as it is all calculations are imbedded within TGP code, hence provides you with peace on mind, and full adaptability on all currency pairs, and CFDs. Yet I have placed an example at the end of this manual in case you want to know how the lot sizing is calculated)

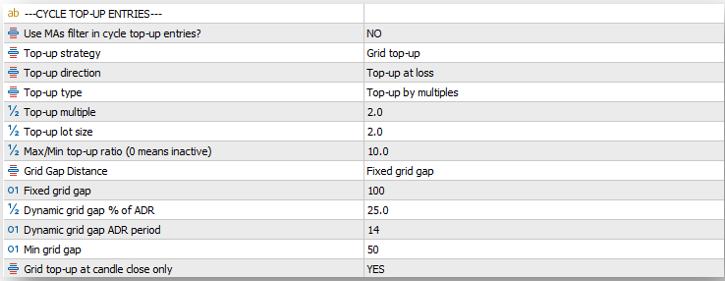

Cycle Top-up Entries

Once the cycle is initiates, TGP provides many options for top-up trades (i.e., grid trading, martingale, snowballing…. etc.)

Use MAs filter in cycle top-up entries: Enables or disables the MAs filter previously explained for top-up entries.

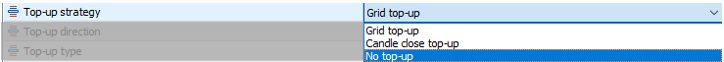

Top-up strategy: You have three choices from a drop-down list.

Grid top-up: Top-up trades will be placed on a grid with predefined distance parameters from the previously open trade.

Candle close top-up: Trades will be placed at the close of each candle on the selected chart timeframe.

No top-up: Top-up trades will be disabled.

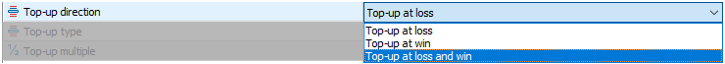

Top-up direction: You have three choices from a drop-down list.

Top-up at loss: Top-up trades will only be triggered when account is in floating loss.

Top-up at win: Top-up trades will only be triggered when account is in floating profit.

Top-up at loss and win: Top-up trades will be placed whether the account is floating loss or profit.

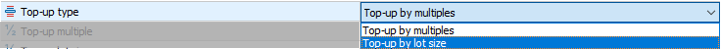

Top-up type: You have two choices from a drop-down list.

Top-up by multiple: Top-up trade will be multiplied by this factor from the previous trade.

Top-up by lot size: Top-up trade lot size will increase/decrease by this value from the previous trade. Note: -ve value means decrease, and +ve value means increase.

Top-up multiple: If the top-up by multiple option is selected, input the multiple value here. Note: 1 means, all top-up trades lot size will be equal to the previous trade, above 1 means top-up lot size increase, and below 1 means top-up lot size decrease.

Top-up lot size: If the top-up by lot size option is selected, input the lot size value here that you want to add on top of the previous trade. Note: 0 means, all top-up trades lot size will be equal to the previous trade, +ve value means top-up lot size increase, and -ve value means top-up lot size decrease.

Max/Min top-up ratio: Sets a cap or floor on the lot size for the top-up trades in respect to the cycle first entry. Example: If this value is set to 5, and the cycle first entry was 0.1 lots, then the maximum top-up lot size will be 0.5 lots.

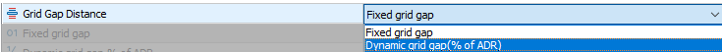

Grid gap distance: You have two choices from a drop-down list.

Fixed grid gap: Chose this option to set your grid gap size.

Dynamic grid gap: Chose this option to let TGP calculate the grid gap based on a percentage of the Average Daily Range.

Fixed grid gap: If you selected the fixed grid gap option, input the desired gap size in this field (In Points and not pips).

Dynamic grid gap % of ADR: If you selected the dynamic grid gap, input the desired % of the ADR to calculate the gap size. Example: If the ADR is currently at 880 points, and you input this field as 50, then the grid distance at that moment will be 440 points (44 pips).

Dynamic grid gap ADR period: Defines the period for the dynamic grid gap’s ADR calculation.

Min Grid Gap: Important to be set with the dynamic grid gap calculation, to set a min value for the grid distance.

Grid top-up at candle close only: If set to “YES”, top-ups in a grid strategy will only occur once a candle closes beyond a grid level. Example: If this selected as “YES”, and if grid distance is set to 200 points, yet price went beyond, to the candle closed at a distance of 350 points from the previous trade, TGP will add the top-up value at the close of the candle, and not at the 200 points mark.

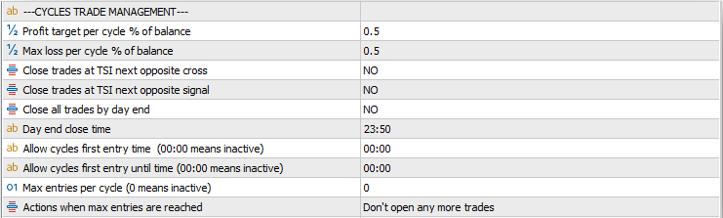

Cycles Management Settings

This section will empower you to adjust your cycles trade management parameters.

Profit target per cycle % of balance: This determines the desired profit (realised and floating) for each trading cycle as a percentage of the account balance.

Max loss per cycle % of balance: This setting caps the maximum allowable loss (realized and floating) for each cycle as a percentage of the account balance.

Close trades at TSI next opposite cross: If set to “YES,” TGP will close all trades within a cycle when the Trend Starter Indicator (TSI) produces an opposite cross to the current trades. This serves as a safety mechanism based on market direction.

Close trades at TSI next opposite signal: Like the above, but this setting is based on the TSI’s next opposite signal rather than a cross.

Close all trades by day end: When set to “YES,” the TGP will close all active trades by the end of the trading day, regardless of their profit or loss status.

Day end close time: Specifies the exact time at which all trades should be closed if the “Close All Trades by Day End” is set to “YES”.

Allow cycles first entry time: This determines when TGP is allowed to initiate the first trade in a cycle. A “00:00” setting, means that no time restriction is applied.

Allow cycles first entry until time: This setting specifies until what time TGP is allowed to initiate the first trade of a cycle. A “00:00” setting, means that no time restriction is applied.

Max entries per cycle: This cap the number of trades TGP can execute within a single cycle. A setting of “0” means this feature is inactive, and there’s no limit on the number of trades.

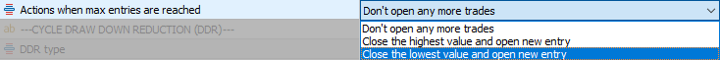

Actions when max entries are reached: When maximum number of trades per cycle is reached, and a new top-up trade is signaled, You have three choices from a drop-down list.

Don’t open any more trades: TGP will not open any more top-up trades for the cycle.

Close the highest value and open a new entry: TGP will close the highest value trade within the open trades and will open the new top-trade.

Close the lowest value and open a new entry: TGP will close the lowest value trade within the open trades and will open the new top-trade.

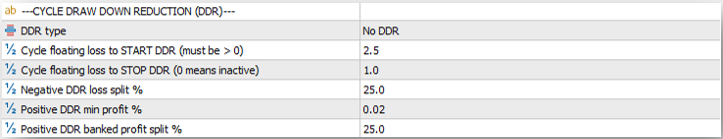

Cycle Draw Down Reduction (DDR)

TGP introduces a unique Drawdown Reduction (DDR) mechanism, allowing users to manage drawdowns positively or negatively. Depending on your DDR choice, the system either uses a portion of profits to offset losses or strategically closes trades to limit losses. Define specific thresholds to activate or deactivate this innovative feature.

DDR Type: TGP comes with two options for DDR, you can select from a drop-down list.

No DDR: Simply opt-out of any DDR strategy.

Negative DDR: When your cycle’s drawdown hits a defined percentage of the balance, TGP will start to limit this loss. It’ll do so by partially closing trades equivalent to a set percentage of the total drawdown.

Positive DDR: Here, TGP taps into the gains. It waits for trades to hit a positive percentage mark, and then uses a part of those profits to mitigate ongoing losses in the cycle.

Cycle floating loss to START DDR: If you opted in for DDR (whether negative or positive DDR), you need to define the draw down value (as a % of balance), of which the DDR algorithm will be activated.

Cycle floating loss to STOP DDR: This is the draw down value (as a % of balance) when reached, the DDR algorithm will be deactivated.

Negative DDR loss split %: Under the Negative DDR setting, when drawdown reaches the activation threshold, specify how much of the drawdown you’d like to tackle. For instance, if set at 25% for a $400 drawdown, TGP will adjust trades, effectively reducing the drawdown to $300, realizing a $100 loss.

Positive DDR min profit %: With Positive DDR active and once the cycle floating loss to start DDR is reached, TGP looks out for any trades that has a positive float to achieve this percentage profit to use it to close partial volume from the losing trades.

Positive DDR banked profit split %: Once the previous parameter is reached, TGP will close the positive float trade, against partial volume from the losing trades, and bank this % from the positive float.

Example: On an account of 10K, where positive DDR is active, and set to start when the draw down (floating loss) reached 5%, positive DDR min profit set to 1%, and positive DDR banked profit split % set to 25%. Assume a trade is placed, and market moved against you, this the TGP built some top-up trades, now the TGP will wait for any pull back of these top-up trades to create some positive floats. Once one of the positive floats reaches 1% (100 USD), TGP will close these positive float trades, bank 25 USD, and use the 75 USD to close as much as possible partial volume from the losing trades.

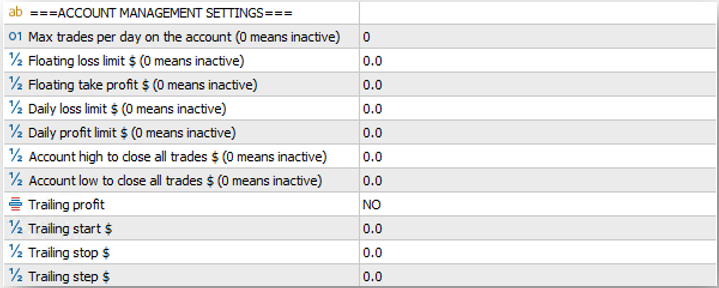

Account Management Settings

TGP has comprehensive Account Management features, designed primarily for robust account protection. This functionality positions TGP as an indispensable tool, especially for proprietary firms’ traders. The feature incorporates numerous mechanisms to meticulously manage risk, ensuring equity remains within designated daily loss limits. Moreover, to optimize profit retention, the TGP system integrates equity trailing options. Unlike cycle management settings, this section applies to the entire account, regardless of the magic number.

Maximum trades per day on the account: To protect you from over trading, TGP offers you the option to set maximum number of trades per day on the account level.

Floating loss limit $: Set a maximum floating loss limit in money value, when reached, all open trades on the account will be closed, and resume trades at the next available signal.

Floating profit limit $: Set a maximum profit limit in money value, when reached, all open trades on the account will be closed, and resume trades at the next available signal.

Daily loss limit $: Set a maximum daily loss (realised and unrealized) limit in money value, when reached, all open trades on the account will be closed, and resume trades the following day.

Daily profit limit $: Set a maximum daily profit (realised and unrealized) limit in money value, when reached, all open trades on the account will be closed, and resume trades the following day.

Account high to close all trades $: Set the highest equity value for the TGP to close all trades and disable trading on the account.

Account low to close all trades $: Set the lowest equity value for the TGP to close all trades and disable trading on the account.

Trailing profit: Select YES if you want to enable equity trailing on the account.

Trailing start, stop and step: If you opt-in for trailing, here you need to set the trailing start, stop, and step values.

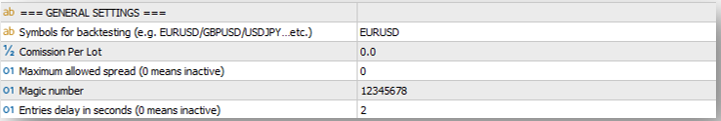

General Settings

Symbols for back testing: TGP allows you to back test multiple assets at the same time, simply add the pair/asset you want to back test in this field.

Commission per lot: Usually commission is calculated at the end of the buying/selling cycles. To accommodate the commission cost in the TGP P&L calculation, you need to define your broker commission value in this field.

Maximum allowed spread: Set your max allowed spread for your trades.

Magic number: Input the desired unique magic number. You can’t have the same magic number to different pairs, as it will confuse TGP while calculations related to trade management.

Entries delay in seconds: This is a special feature for prop firms’ traders who might trade the same identical sets, with the same entries. Setting few seconds delay before executing the trades, will help traders not to have their accounts marked for identical strategies violations.

Explanation of dynamic lot size calculation based on ADR

1st: Calculate the Stop Distance using Virtual risk % of ADR: Assuming the Average Daily Range (ADR) period of the last 10 days was 100 pips and the Virtual Risk % of ADR selected is 50%, your virtual stop distance is 50 pips

2nd: Determine the amount of risk using the Virtual risk % of balance: Assuming account balance is, for instance, $10,000 and your Virtual Risk % of Balance is set at 1%, the amount you’re willing to risk on the trade is $100

![]()

3rd: Calculate the lot size: To calculate the lot size, you need to know the pip value for 1 standard lot of the pair you trade. For EURUSD, pip value for 1 standard lot is $10. The risk in terms of distance is 50 pips (from step 1). Therefore, the risk in monetary terms for 1 standard lot is 50 pips X $10 = $500. To risk only $100 (from step 2), you’d need to trade 0.2 lots (1 lots X $500/$100).

Setfiles and Strategies

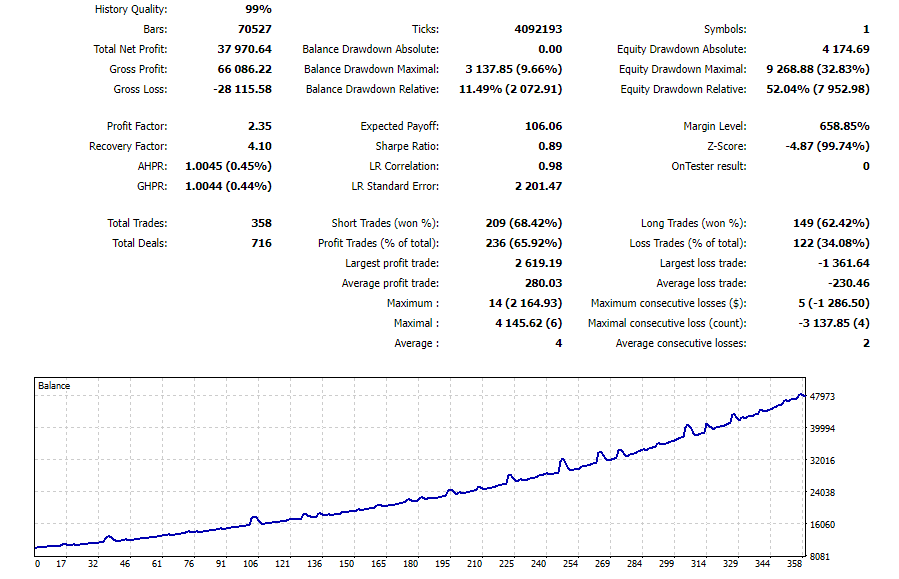

Strategy 1 – Sustainable EURUSD Strategy

- EURUSD 15 min time frame chart.

- Entry signal: TSI variables set to 10 and 14, with HL/LH filter set to YES

- MAs filter: Is active for the cycle first entry (not the top-ups). 2 MAs, 50 and 150 @ the 3 hours time frame, with the angle direction mode.

- Buys, sells and hedging is allowed

- Top-ups are active for both win and lose direction, with a multiple of 2, and the grid distance is 100% ADR size

- Each cycle is set to 1% profit target, hence you need to be patient.

- DDR is not active on this set, and no account management (equity protection) is applied.

- Back testing period: Jan 2021 till Oct 2023 – Turning 10,000 USD to 47,970 USD (Please read the disclaimer below)

Disclaimer: Perform proper back testing this set on your broker data, then demo trade for 2 weeks to 2 months before you apply it on a live account. Author back testing shown above was performed between 2021 till Oct 2023, and doesn’t guarantee any future profits.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰