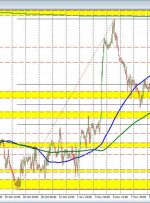

[ad_1] Euro Analysis German manufacturing and services sectors register meagre surprise to the upside EUR/USD rises but pulls back to levels observed ahead of the release Few catalysts this week point to potentially lower volatility as markets speculate on 2024 rate cutting cycle The analysis in this article makes use of chart patterns and key