[ad_1] Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making

[ad_1] Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making

[ad_1] Prior month manufacturing PMI 47.9. Services PMI 50.5 Manufacturing PMI 48.9 versus 48.0 estimate Services PMI 50.2 versus 50.6 estimate Composite PMI 50.1 versus 50.2 last month Mixed report vs expectations. Manufacturing remains below the 50 level indicative of contraction. Services remain just above the 50.0 level as it clings to growth. The services

[ad_1] ISM manufacturing Prior report 46.4 Prices paid 48.4 vs 43.9 expected. Last month 42.6 Employment 48.5 vs 44.2 expected. Last month 44.4 New orders 46.8 vs 47.3 prior Manufacturing has been in a recession for some time but there are some green shoots. I suspect this survey is going to be a mess for

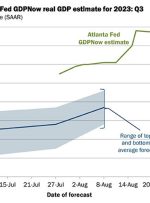

[ad_1] The Atlanta Fed left its GDP tracker for Q3 unchanged today: After this morning’s releases from the US Census Bureau, the US Bureau of Labor Statistics, and the Institute for Supply Management, an increase in the nowcast of third-quarter real gross private domestic investment growth from 11.8 percent to 12.3 percent was offset by

[ad_1] That’s an extremely poor reading as Swiss manufacturing activity slumped heavily to start Q3. The reading is the lowest since April 2009 as production fell sharply alongside purchasing volume. That comes despite a fall in purchase prices and shorter delivery times. That’s not a good sign at all. [ad_2] لینک منبع : هوشمند نیوز