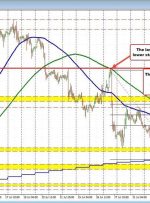

[ad_1] Australian Dollar, AUD/USD, Technical Analysis, Retail Trader Positioning – IGCS Update Australian Dollar on course for worst week since mid-June Retail traders continue to build increasingly bullish exposure AUD/USD breaks under key support, more pain to come? Recommended by Daniel Dubrovsky Get Your Free AUD Forecast The Australian Dollar is on course to drop