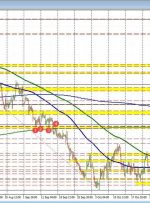

Gold (XAU/USD) and Silver (XAG/USD) Analysis and Charts Gold breaks higher, resistance yields. Silver rallies by 2% and outperforms gold. DailyFX Economic Calendar Most Read: Gold (XAU/USD) Price Setting Up for a Re-Test of Multi-Month Highs The US dollar is moving back to lows last seen in late August and this is giving the precious