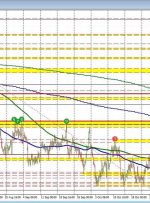

[ad_1] US DOLLAR FORECAST – EUR/USD, GBP/USD, AUD/USD The U.S. dollar extends losses, sinking to its weakest point since early August Meanwhile, EUR/USD, GBP/USD and AUD/USD break out to the topside, clearing key price levels in the process This article focuses on the technical outlook for top forex pairs Trade Smarter – Sign up for