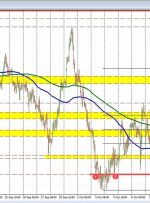

Australian Dollar, AUD/USD, US Dollar, Unemployment, CPI, RBA, China – Talking Points The Australian Dollar crumbled after today’s jobs numbers The RBA meeting has taken on a new light with inflation in its sights The market is eyeing next week’s CPI. Will it drive AUD/USD direction? Recommended by Daniel McCarthy Get Your Free AUD Forecast