S&P 500 and NASDAQ 100

[ad_1] S&P 500 OUTLOOK FROM A HISTORICL AND SEASONALITY PERSPECTIVE: Historical Performance Hints at a Positive Quarter for the S&P 500. Seasonality is Not a Standalone Indicator but Can Provide Valuable Insights When Used in Conjunction with Other Market Indicators. IGCS Shows Retail Traders are Currently Net-Long on the S&P 500 with 58% of Traders

[ad_1]

S&P 500 OUTLOOK FROM A HISTORICL AND SEASONALITY PERSPECTIVE:

- Historical Performance Hints at a Positive Quarter for the S&P 500.

- Seasonality is Not a Standalone Indicator but Can Provide Valuable Insights When Used in Conjunction with Other Market Indicators.

- IGCS Shows Retail Traders are Currently Net-Long on the S&P 500 with 58% of Traders Holding Long Positions.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: GBP/USD, EUR/GBP Forecast: Sterling Brushes Off PMI Data and Eyes Recovery

The financial markets are an intricate labyrinth where various elements intermingle to shape investment outcomes. One such critical component is seasonality, the phenomenon where certain market trends appear to recur at specific times within the year. This concept applies to various asset classes, including equities, bonds, commodities, and currencies. This article explores the significance of seasonality in financial markets and examines the historical performance of U.S equities, specifically the S&P 500 and NASDAQ 100, in the fourth quarter.

Get your hands on the recently released U.S. Equities Q4 outlook today for exclusive insights into the pivotal catalysts that should be on every trader’s radar.

Recommended by Zain Vawda

Get Your Free Equities Forecast

UNDERSTANDING SEASONALITY IN FINANCIAL MARKETS

Seasonality is a statistical pattern where certain time periods are associated with particular market behavior. This could be due to various factors such as tax considerations, the release of economic reports, corporate earnings announcements, and even psychological factors related to investor behavior.

For instance, the “January effect” is a well-known seasonal anomaly where stocks, especially small-cap stocks, tend to increase in value in January more than any other month. This phenomenon is often attributed to tax-loss selling, where investors sell stocks at a loss to offset gains and reduce their tax liability, leading to a subsequent bounce back in the new year when they reinvest.

Seasonality is not a standalone indicator, but it can provide valuable insights when used in conjunction with other market indicators and analysis tools. Understanding seasonality can help investors fine-tune their investment strategies, manage risk, and potentially enhance returns.

U.S EQUITIES: S&P 500 AND NASDAQ 100

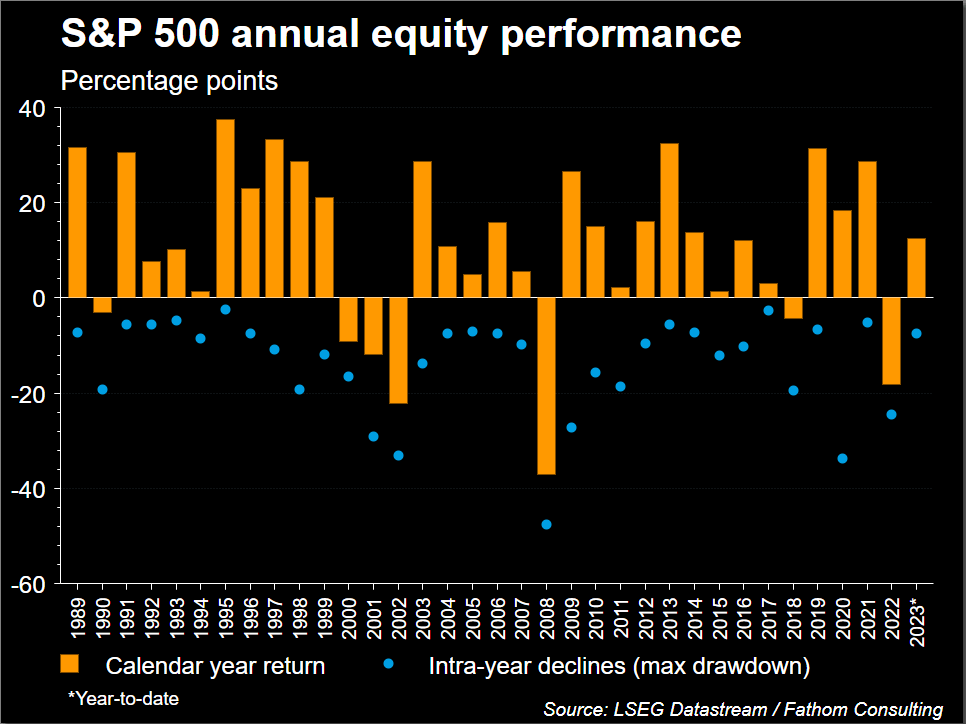

US Equities had been enjoying an excellent first half to 2023 with the SPX up about 19.5% to the end of July. In the two months that followed however, the S&P recorded losses of around 6.5% heading into Q4 with history painting a positive picture.

Looking back at the historical picture and since 1930, there have been 12 prior years where the January-July run had seen gains in excess of 10% followed by a losing period in the months of August and September. In each of those years the fourth quarter posted gains of at least 2% each time with an average quarterly return of 8.4%. The question for bulls is whether we will see history repeat itself even though we are in somewhat uncharted territory.

S&P Historic Annual Performance

Source: Refinitiv, Fathom Consulting

HISTORICAL MARKET DATA REVEALS A FASCINATING TREND ABOUT THESE INDICES IN Q4

The S&P 500 has historically performed well in the fourth quarter. From 1950 to 2021, the S&P 500 has averaged a gain of about 3.9% in the fourth quarter, with positive returns in 73% of those quarters. If we narrow that down even more and look at performance from the year 2000 to 2021, the S&P 500 rose during the fourth quarter in 16 out of these 21 years, indicating a positive return approximately 76% of the time with an average return of 4.3%. It’s essential to break down these returns further, as the average can be skewed by outliers. The median return, which is less influenced by extremes, was approximately 5.1%, indicating that half of the fourth-quarter returns were above this figure and half were below.

Looking for the best trade ideas for Q4? Look no further and download your complimentary guide courtesy of the DailyFX team of Analysts and Strategists.

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

The best fourth quarter during this time frame was in 2020, when the S&P 500 had a return of nearly 11.7%, driven by positive news on the vaccine front and a strong rebound from the COVID-19 induced economic downturn. Conversely, the worst fourth quarter occurred in 2008 during the global financial crisis, when the S&P 500 fell by approximately 22.6%. The standard deviation, a measure of the dispersion or volatility, was around 8.7% for the Q4 returns during this period. This indicates a high level of volatility, which isn’t surprising given the economic events of the past two decades, including the dot-com bubble burst, the global financial crisis, and the COVID-19 pandemic.

The NASDAQ 100 also tends to perform well in the fourth quarter, although its performance can be more volatile due to its heavy tech concentration. From 1985 to 2021, the NASDAQ 100 has averaged a gain of about 4.8% in the fourth quarter, with positive returns seen in 67% of those quarters.

These trends are part of a broader phenomenon known as the “Santa Claus rally,” a surge in stock prices often seen in the final week of December through the first two trading days in January. The rally is typically attributed to increased investor optimism, holiday-induced euphoria, and institutional investors squaring their portfolios before the year ends.

FINAL THOUGHTS AND TECHNICAL ANALYSIS

While seasonality and historical trends provide insightful perspectives, they should not be used in isolation to make investment decisions. Market dynamics are influenced by a myriad of factors, and what worked in the past may not necessarily work in the future. Given that we are in what I consider an unprecedented economic climate.

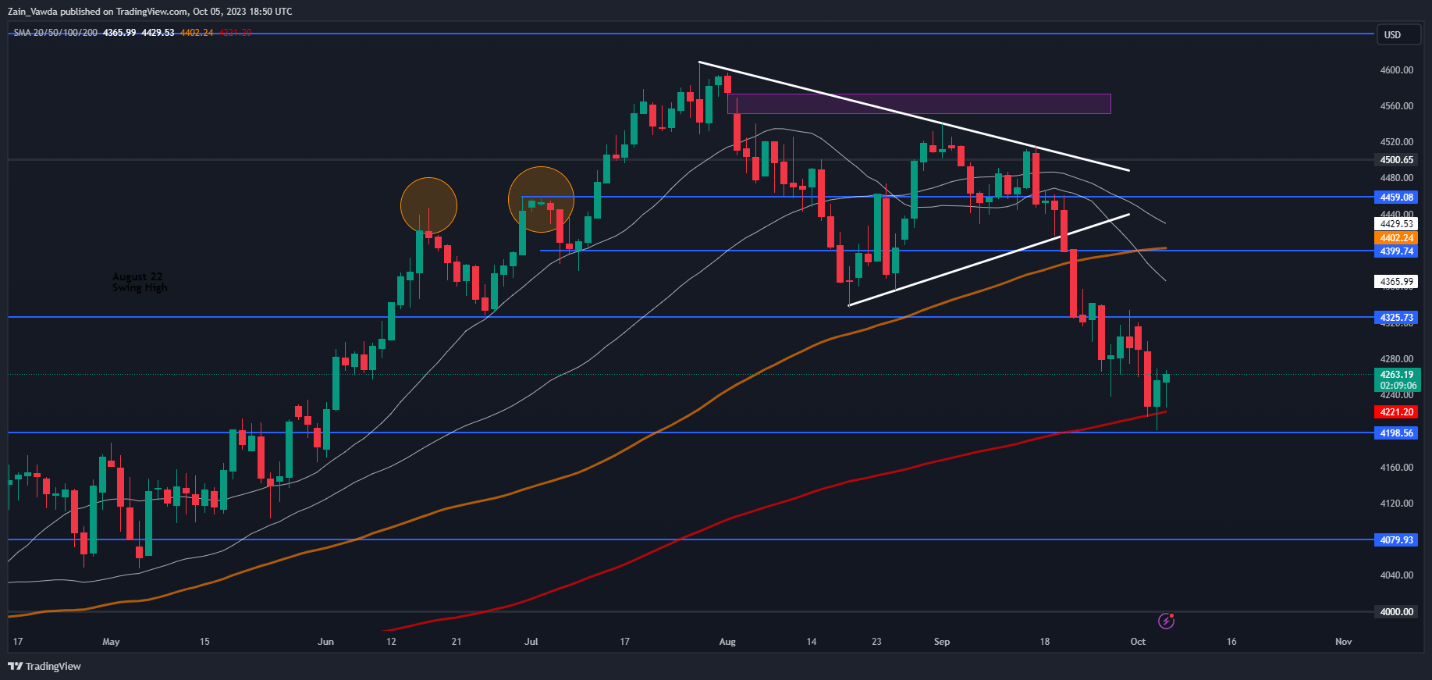

S&P 500 Daily Chart, October 5, 2023

Source: TradingView, prepared by Zain Vawda

Looking at the technical perspective, the SPX has found support of the 200-day MA and retested the level today around 4221. Price has bounced higher on improved overall sentiment and potential profit taking ahead of the US NFP jobs report tomorrow.

The S&P remains extremely bearish and if the recent attempt at a bounce is anything to go by, the current rally could prove short lived particularly if we have a positive and a better-than-expected NFP number. Immediate resistance on the upside rests around the 4325 mark with a daily candle close above leading to a change in structure from bearish to bullish as well. This could be the first sign of a potential sustained bounce to the upside and toward the recent highs.

IG CLIENT SENTIMENT DATA

IGCS shows retail traders are currently Net-Long on the S&P 500, with 58% of traders currently holding LONG positions. Given the contrarian view adopted here at DailyFX, is the SPX destined to fall further?

To Get the Full Breakdown on How to Use IG Client Sentiment, Please Download the Guide Below.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 1% | 2% |

| Weekly | 8% | -2% | 3% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter:@zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Nasdaq

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰