The South African rand has had a tumultuous period throughout Q3 2023 but ultimately trades roughly around the same levels against the USD as it did at the beginning of Q3. Central bank nuances shaped the way while global economic growth concerns did not do the rand any favors. As we head into Q4, these themes will continue their dominance over the ZAR with local factors playing a role as well.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

South African Fundamental Backdrop

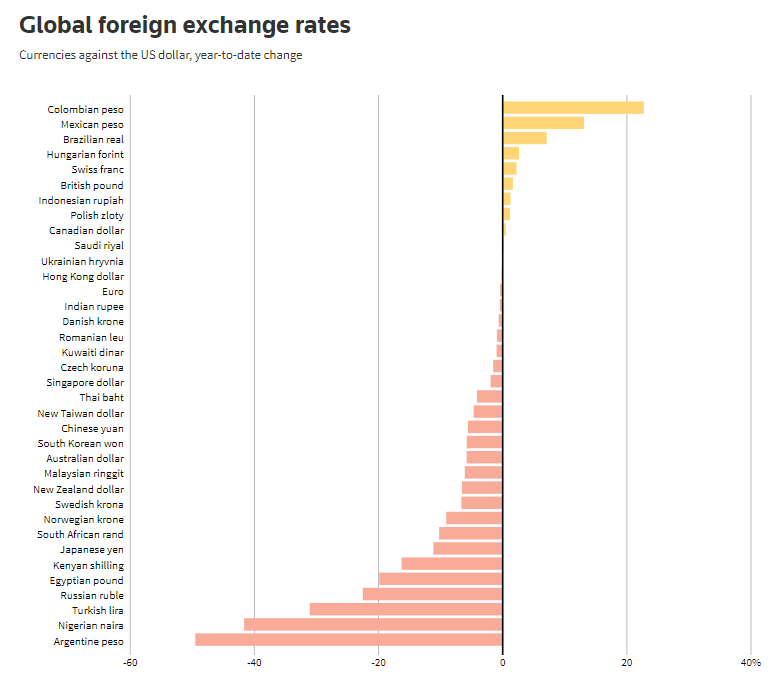

Loadshedding which has been plaguing the South African economy for years has somewhat softened allowing for local business activity to improve. Although there is volatility around electricity production and consistency, if Eskom (power utility) continues to improve albeit slowly, the rand may benefit as well. Year-to-date (see graphic below), the EM currency sits towards the bottom of the table but may turnaround in Q4 depending on fundamental factors.

GLOBAL FX RATES VS USD

Source Thomson Reuters

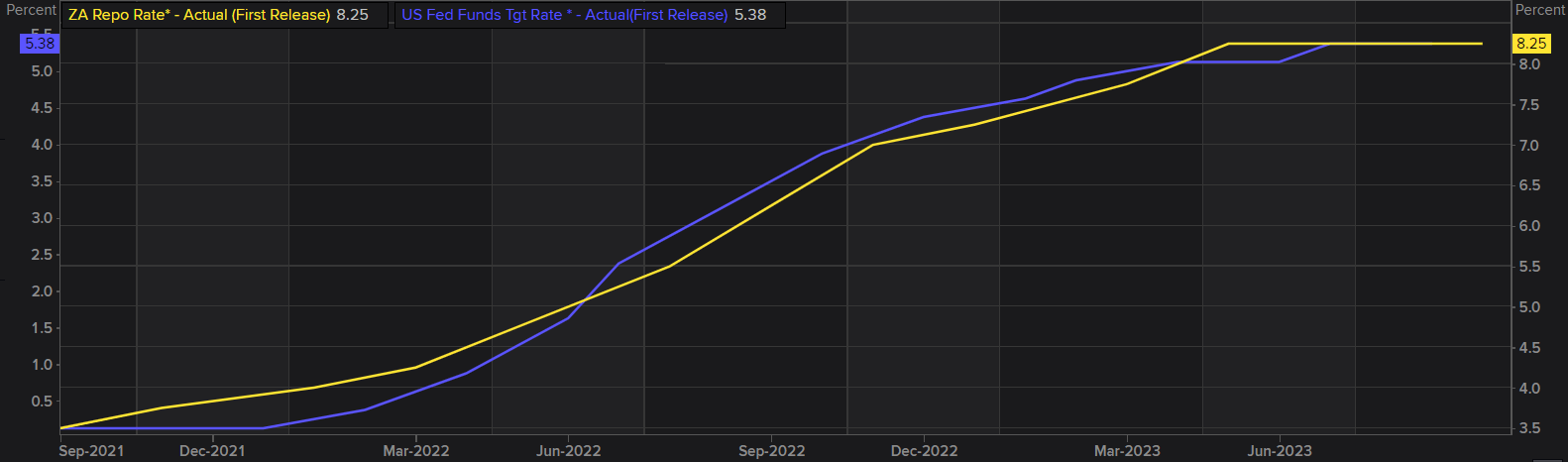

Interest rates have driven most of the price action in Q3 for USD/ZAR and the graphic below shows the difference between the South African Reserve Bank (SARB) and Federal Reserve respectively. It is clear that the SARB is far ahead in terms of outright levels which plays into the carry trade appeal for the ZAR over the USD. Going forward, the SARB has adopted the Fed’s messaging in that should additional hikes be required in future, the SARB will not hesitate to hike rates. Inflation has been on the decline in South African but with crude oil prices rallying of recent, this will be critical in terms of knock-on effects in Q4.

One positive from the recent MPC decision was an upward revision to GDP forecasts for 2023 from 0.4% to 0.7%. While the economy is vulnerable to external shocks that may impact these figures, China will be critical to the nations and the rand’s success. Chinese economic data has been poor and with stimulus measures underway, EM’s like South Africa are hopeful that these actions result in an increase in export commodities as China begins to strengthen – the ZAR is positively correlated to the Chinese economy but it is important to remember correlation does not imply causation.

SOUTH AFRICA VS US POLICY RATE COMAPRISON

Source: Refinitiv

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

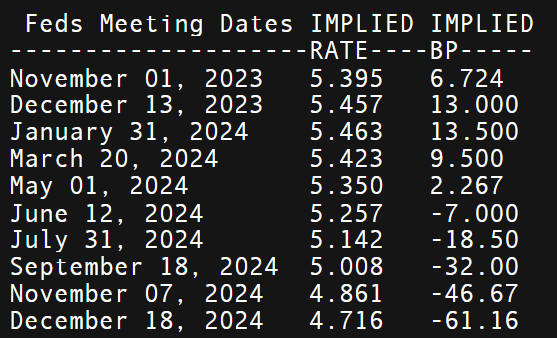

US Dollar in Q4

From a US perspective, we know the US will maintain elevated rates for a longer duration while reducing the extent of rate cuts pre-FOMC. Now total cumulative rate cuts (refer to table below) by December 2024 stands at 60bps from roughly 100bps prior with the option to hike once more this year. The US economy is substantially stronger than the South African economy so another rate hike will not have such a negative impact on the consumer (relatively speaking). The risk for rand bulls is if the Fed hikes again in Q4 where the SARB may not due to the weaker economic state in South Africa. That being said, if things remain as they are currently with both central banks holding rates, the rand may find its footing against the USD with the help of a more optimistic China.

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

Technical Analysis

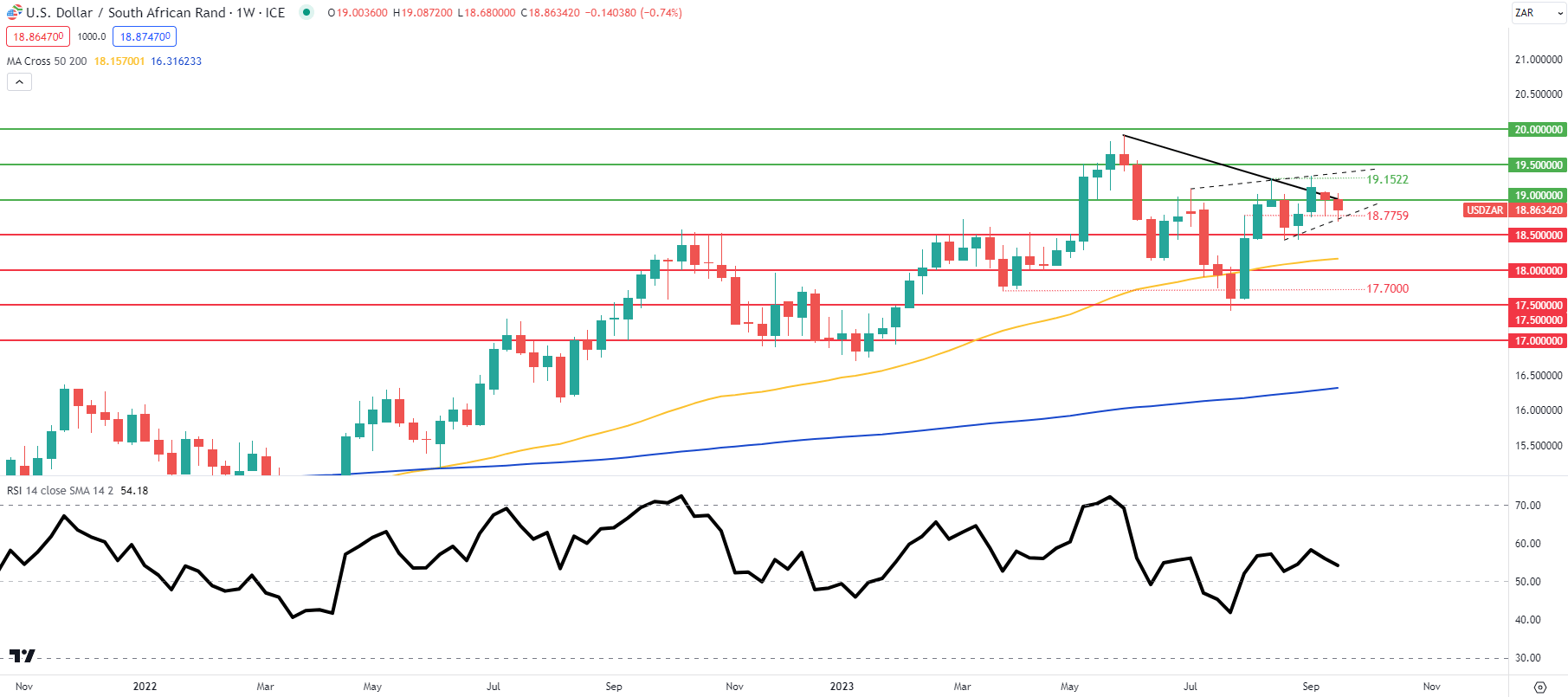

USD/ZAR WEEKLY CHART

Source TradingView, chart prepared by Warren Venketas, Analyst

The weekly USD/ZAR chart above shows prices respective of the medium-term trendline resistance (black). Within this price action, a short-term pattern is emerging in the form of a rising wedge (dashed black line). Wedge support coincides with the 18.7759 swing low and a break below could stoke a push lower in favor of the rand exposing the 18.5000 psychological handle and beyond.

Key resistance levels:

Key support levels:

- 18.7759/Wedge support

- 18.5000

- 50-day moving average (yellow)

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰