RBA Rate Decision on Watch, AUD/NZD below key support

[ad_1] Market Recap Recommended by Jun Rong Yeap Get Your Free Equities Forecast Another push higher in Treasury yields kept risk sentiments broadly in check, as the US 10-year yields surged to touch another new high since 2007 at 4.68%. A lesser-than-expected contraction in US manufacturing purchasing managers index (PMI) reading (49 vs 47.8 est),

[ad_1]

Market Recap

Recommended by Jun Rong Yeap

Get Your Free Equities Forecast

Another push higher in Treasury yields kept risk sentiments broadly in check, as the US 10-year yields surged to touch another new high since 2007 at 4.68%. A lesser-than-expected contraction in US manufacturing purchasing managers index (PMI) reading (49 vs 47.8 est), along with a move in manufacturing employment back into expansion (51.2 vs 48.3 est), may be seen as validation for rates to be kept high for longer, despite some progress in easing prices (43.8 vs 48.6 est).

This is further reinforced by comments from several Fed voting members (Michelle Bowman, Michael Barr), with the takeaway being that rates will have to be kept at ‘restrictive level for some time’. The US dollar found its way to a new 11-month high. In return, gold and silver prices head to a near seven-month low. Brent crude prices have also moderated for the third straight day, following a near-term bearish divergence on its daily Relative Strength Index (RSI).

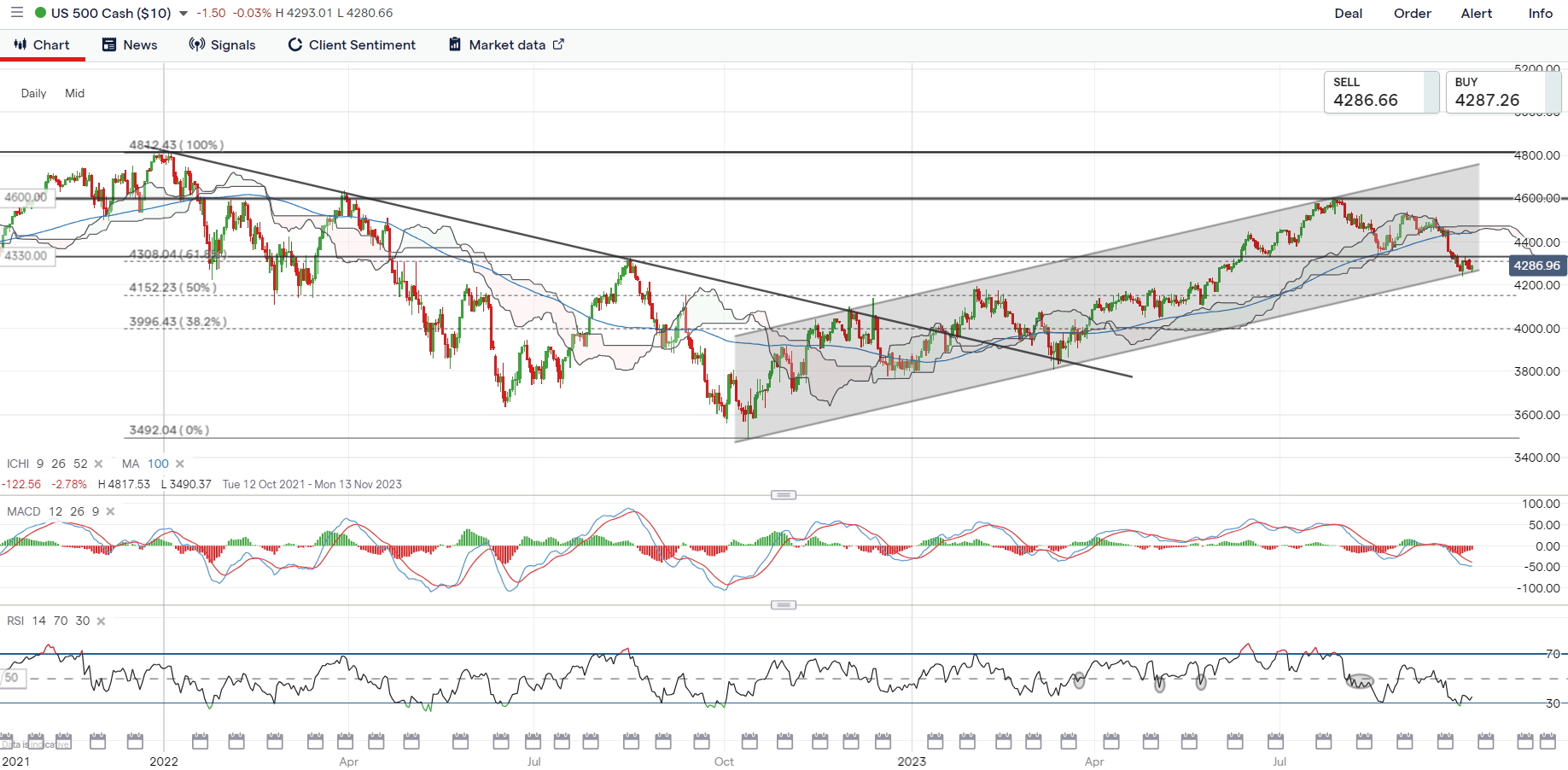

For the S&P 500, the index continues to trade in a tight range, attempting to hold above a lower channel trendline support but lacks the conviction to overcome the 4,330 support-turned-resistance level just yet. This may provide a moment of reckoning ahead, where a breakdown of the lower channel trendline could pave the way for further downside to the 4,000 level, just as the weekly RSI is back at its key 50 mid-point level. Market breadth are edging near its June and October 2022 lows, which may call for some dip buyers, but much indecision is still in place for now.

Source: IG charts

Asia Open

Asian stocks look set for a downbeat open, with Nikkei -1.23%, ASX -1.20% and NZX -0.80% at the time of writing, as rising bond yields and a stronger US dollar did not provide much cues for risk-taking. South Korean and China markets are both closed for holidays.

Ahead, the interest rate decision from the Reserve Bank of Australia (RBA) will be in focus. Broad expectations are for the RBA to keep its cash rate on hold for the fourth straight meeting, but markets are unconvinced that the peak rate has been seen just yet. Cash rate futures suggest that an additional 25 basis-point (bp) hike is still being priced for early next year to put the terminal rate at 4.35% from current 4.1%.

All eyes will be on whether the recent upmove in Australia’s August inflation (5.2% year-on-year vs previous 4.9%) will be sufficient to prompt a more hawkish stance from the central bank, with the RBA likely to keep the option open for “further tightening of monetary policy” – a stance that could be largely unchanged from previous statements.

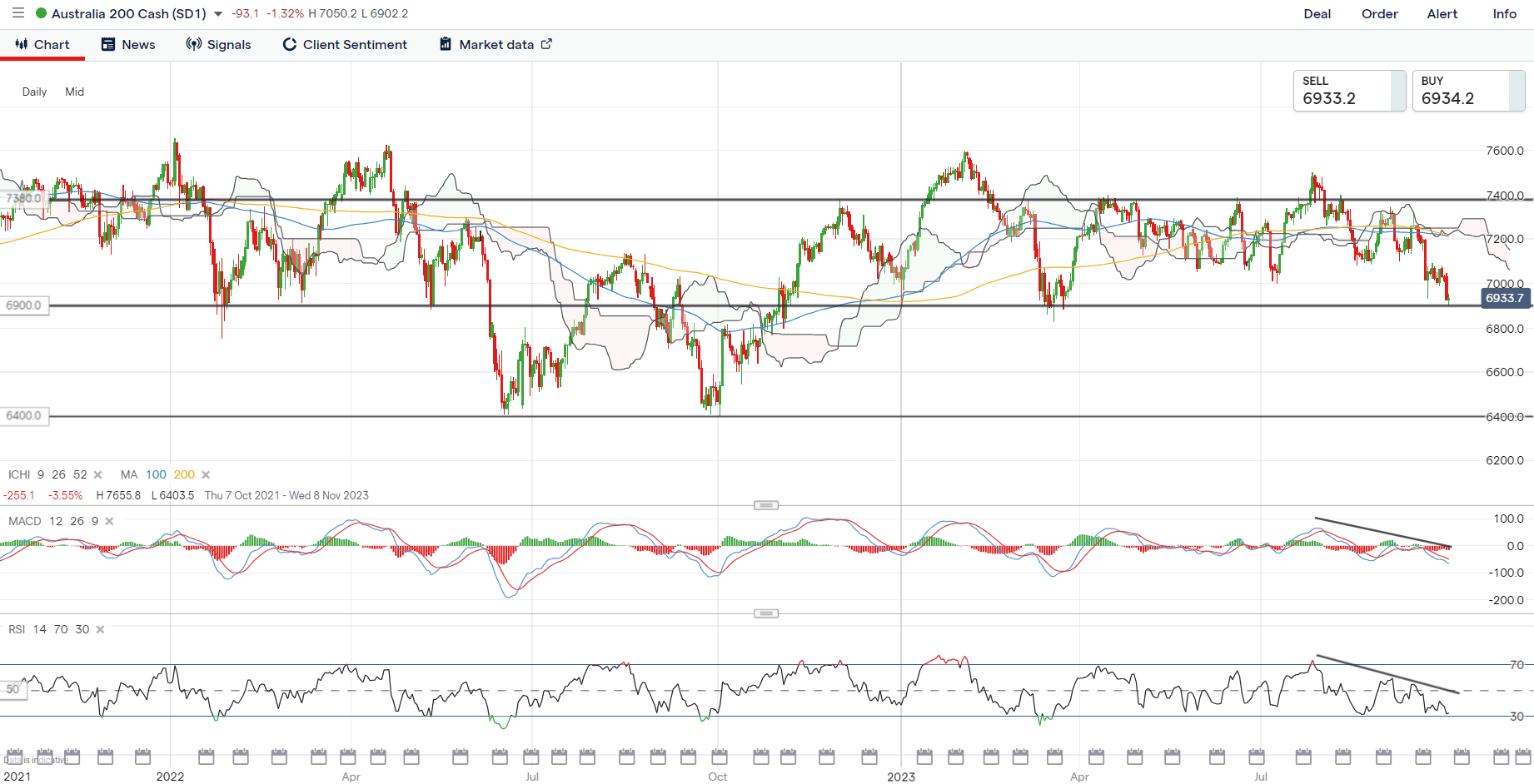

The ASX 200 has registered a new six-month low this week, retracing close to 8% from its July 2023 top. The index is now back to retest a key support level at the 6,900 level, where the lower edge of its long-ranging pattern stands. Failure to defend the 6,900 level could pave the way to retest the 6,730 level, followed by the 6,400 level next. For now, its weekly Moving Average Convergence/Divergence (MACD) is edging into negative territory, with negative momentum broadly in place.

Recommended by Jun Rong Yeap

Traits of Successful Traders

Source: IG charts

On the watchlist: AUD/NZD broke below key support ahead of RBA, RBNZ’s rate decisions

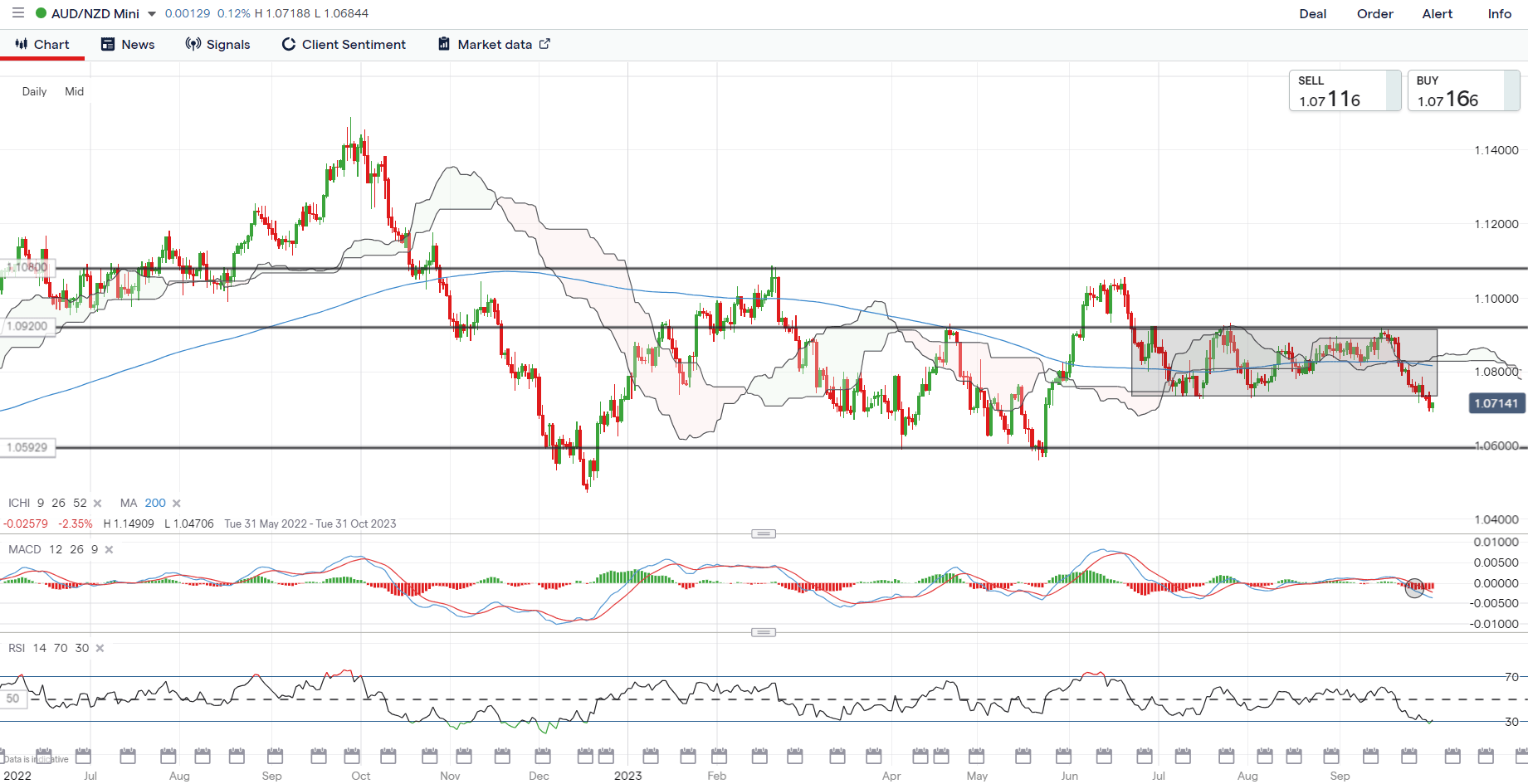

Having largely traded in a range since July this year, the AUD/NZD has broken below its lower consolidation support at the 1.073 level yesterday, which may reflect sellers taking greater control for now. This has brought the pair to a new four-month low, with its daily MACD pushing further into negative territory as a sign of downside momentum.

The RBA and the Reserve Bank of New Zealand (RBNZ) rate decisions will be on watch this week, with neither central banks expected to hike rates but policy guidance will be the key focus. Further downside may leave the 1.059 level on watch as the next level of support, while on the upside, 1.073 will now serve as a support-turned-resistance level for buyers to overcome.

Recommended by Jun Rong Yeap

Get Your Free AUD Forecast

Source: IG charts

Monday: DJIA -0.22%; S&P 500 +0.01%; Nasdaq +0.67%, DAX -0.91%, FTSE -1.28%

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰