Oil tests support as US Dollar strength snaps August rally

[ad_1] Share: Oil (WTI) slides lower and starts flirting with first important support near $88. The US Dollar value keeps increasing as markets price in a possible persistent rate differential between USD and other currencies. Higher Oil prices have negative implications even for Oil producers. Oil prices drop for a second day in a

[ad_1]

- Oil (WTI) slides lower and starts flirting with first important support near $88.

- The US Dollar value keeps increasing as markets price in a possible persistent rate differential between USD and other currencies.

- Higher Oil prices have negative implications even for Oil producers.

Oil prices drop for a second day in a row, with US Western Texas Intermediate (WTI) breaking below the $90 level, on the back of a strengthening US Dollar. Although higher Oil prices should be a good thing for Oil-producing companies, the recent spike has triggered a 5.3% sell-off in an oil producers index. It looks like energy traders are reaching the pain point where demand could start to diminish, which means less income for oil producers.

Meanwhile, the US Dollar (USD) is crushing the markets again. The US Dollar Index (DXY), which tracks the USD against a basket of other main currencies, trades above 106.00, whereas the EUR/USD pair breaks lower to 1.05. It looks like a stronger US Dollar is here to stay as it benefits from the so-called rate differential story, or the fact that the US Federal Reserve (Fed) is expected to keep interest rates at a higher level than other central banks. This strengthens the Dollar as it attracts more foreign capital inflows.This sentiment has triggered a flight to safety across the board as higher interest rates for a longer period could mean a recession and therefore lower demand for Oil.

Crude Oil (WTI) price trades at $88.47 per barrel, and Brent Oil trades at $91.16 per barrel at the time of writing.

Oil news and market movers

- The upcoming weekly Crude stockpile report from the Energy Information Administration (EIA) could see a jump in crude price should the Cushing strategic stockpile print another new low. So far, for the third quarter, stockpile is down 45%.

- Recent reports show Russia is still relying on European demand for Oil. Over half of the exported Russian crude makes its way to Europe despite the price cap breach.

- The CEO of Continental Resources Doug Lawler asked the US government to explore more in domestic crude production. Otherwise, WTI Crude could be heading to $150 if the current pace of drawdowns in stockpiles is maintained throughout the rest of 2023, he said.

- The global decline in equity markets and concerns on the healthiness of the US consumer might trigger a step back in demand for Oil.

- Similar issues from China, where real estate conglomerate Evergrande missed interest payments on its debt..

- The stronger US Dollar backed by the steady-for-longer elevated rate stance of the Fed could act as a cap on demand globally for Oil.

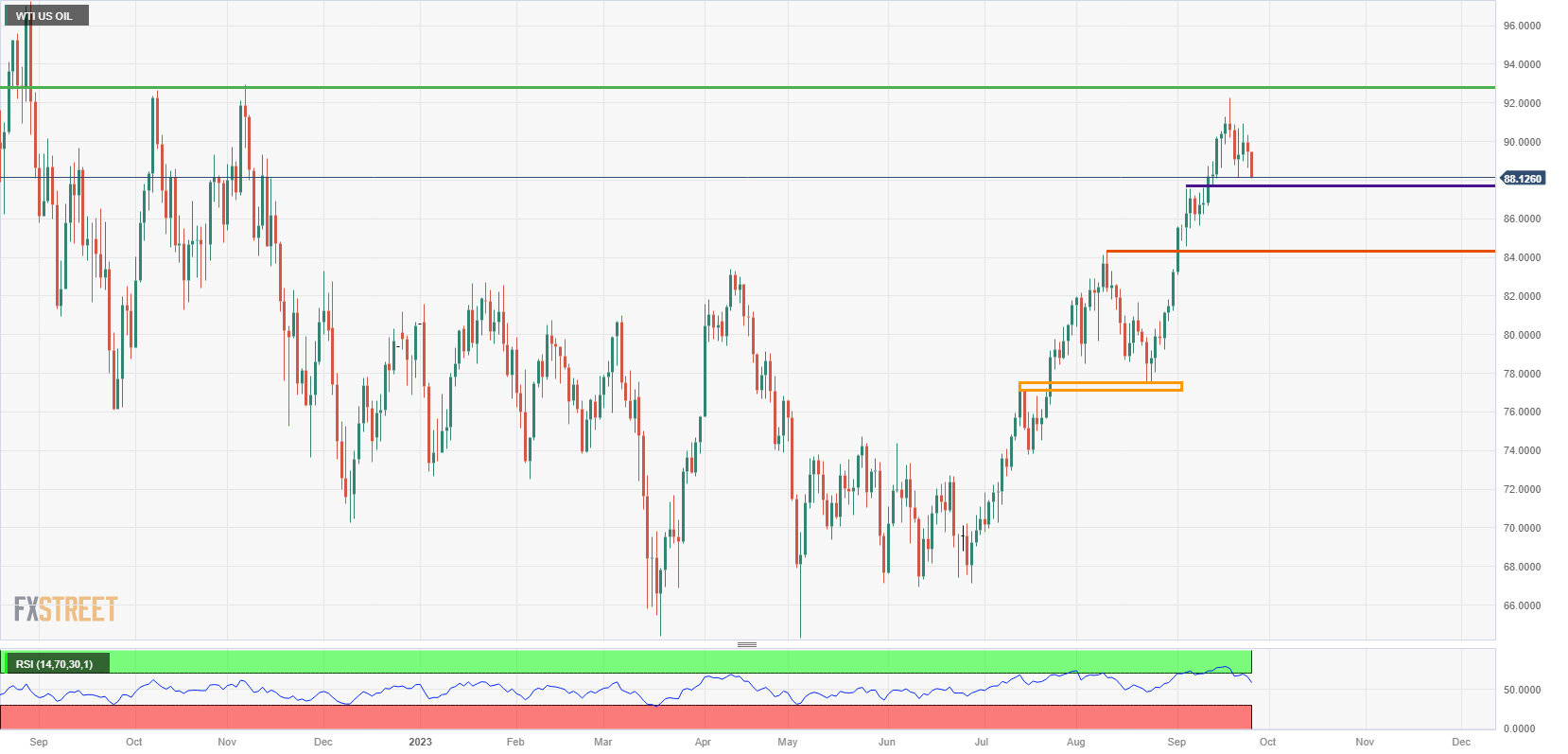

Oil Technical Analysis: small bounce off support

Oil prices are heading into a small correction phase, which is more than granted after the fierce rally since the end of August. The Relative Strength Index (RSI) is still very elevated and any cooldown is more than welcomed from a technical perspective, as crude Oil was trading in an overbought situation. Expect to see pressure built on several lower pivotal levels, which should be able to provide ample support and underpin prices.

On the upside, the double top from October and November of last year at $93.12 remains the level to beat. Although this looks very much in reach, markets have already priced in a lot of possible supply deficits and a bullish outlook. Should $93.12 be taken out, look for $97.11, the high of August 2022.

On the downside, a new floor is formed near $88 with the high of September 5 and 11 underpinning the current price action. Proof of that already exists with the dip of September 13 and September 21, which reversed ahead of $88. Should $88 break , the peak of August 10 needs to be enough to catch the dip near $84.20.

WTI US OIL daily chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :August ، Commodities ، Dollar ، Oil ، Rally ، seo ، Snaps ، strength ، Support ، Tests ، UnitedStates

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰