Hawkish Pause to Reignite the Dollar Index (DXY) Rally?

[ad_1] FOMC PREVIEW: READ MORE: Nasdaq 100, S&P 500 Forecast: US Indices Remain Indecisive Ahead of a Massive Week As we approach a busy week for Central Banks the US Federal Reserve (FED) Meeting is set to take place on Wednesday the 20th of September. The resilience of the US economy and the data of

[ad_1]

FOMC PREVIEW:

READ MORE: Nasdaq 100, S&P 500 Forecast: US Indices Remain Indecisive Ahead of a Massive Week

As we approach a busy week for Central Banks the US Federal Reserve (FED) Meeting is set to take place on Wednesday the 20th of September. The resilience of the US economy and the data of late have given market participants more hope of a ‘soft landing’ while at the same time reigniting fear of second round inflationary pressure as demand remains high and energy prices soar.

To Learn More About Forex News Trading, Download the Complimentary Guide Below.

Recommended by Zain Vawda

Introduction to Forex News Trading

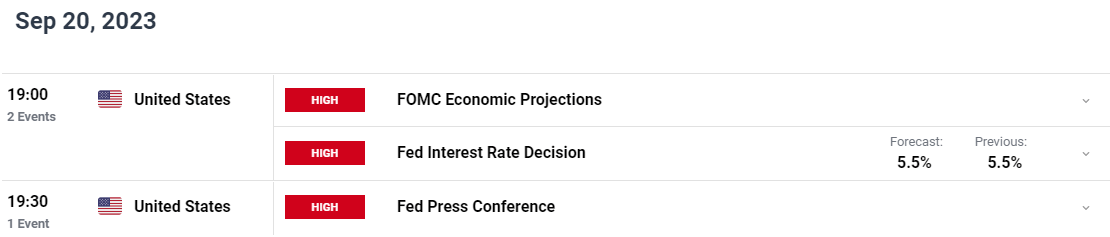

Such is the backdrop heading into Wednesdays meeting that market participants are pricing in a pause from the Fed with all eyes likely to be focused on the Economic Projections moving forward. The surprise jump in the recent inflation print is unlikely to be enough to persuade the FED into another hike right now as they are likely to favor more time to gauge the impact of the recent energy price spike and the ending of the student loan scheme.

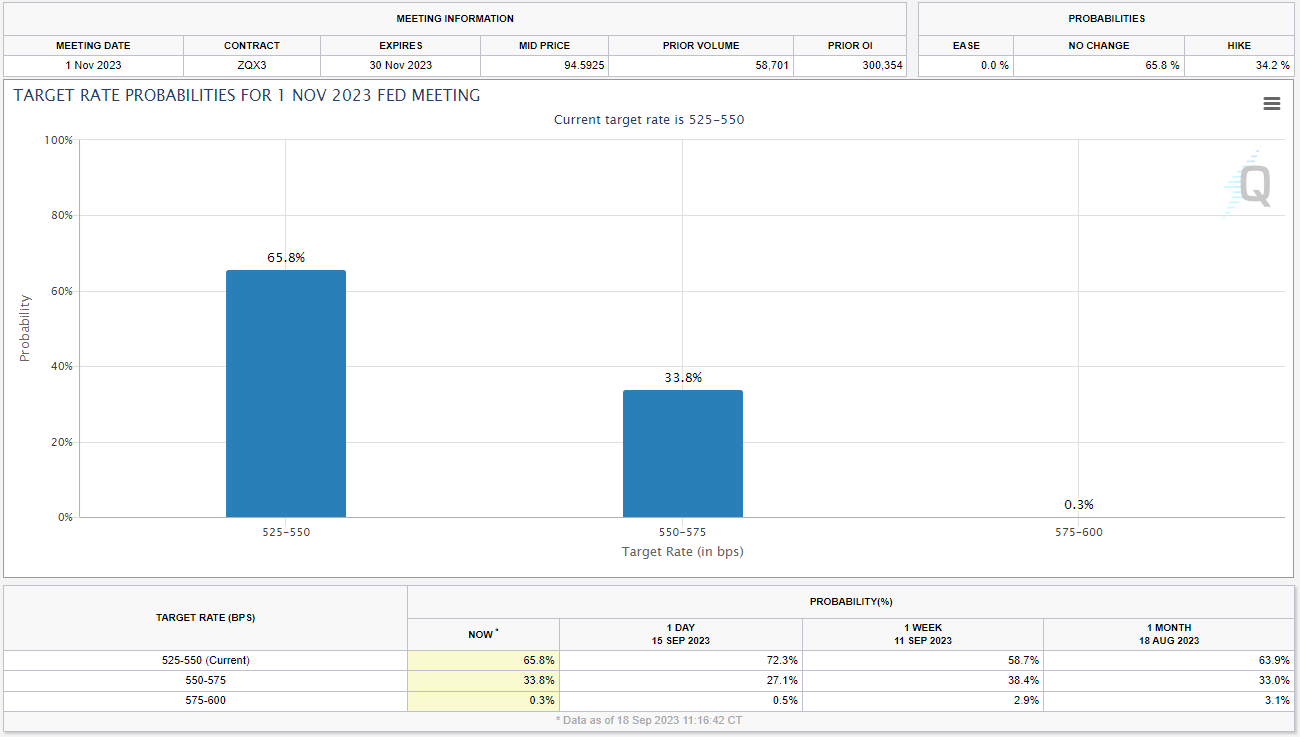

Taking a brief look at the probability of rate hike on Wednesday and markets are almost fully pricing in a hold from the FED (99% probability). The interest, however, lies in the November meeting with the probability of a 25bp hike resting at 33%, down from 38% a week ago.

Source: CME FedWatch Tool

Looking at commentary by Fed Policymakers of late has provided an indication that even known hawks seem open to the idea of a pause in September with the recent meeting minutes also pointing to diverging views on the path moving forward. However, most policymakers have also echoed sentiments around leaving the door open to further hikes should it prove warranted and thus the idea of a ‘hawkish pause’ comes to mind and appears to be the most likely outcome.

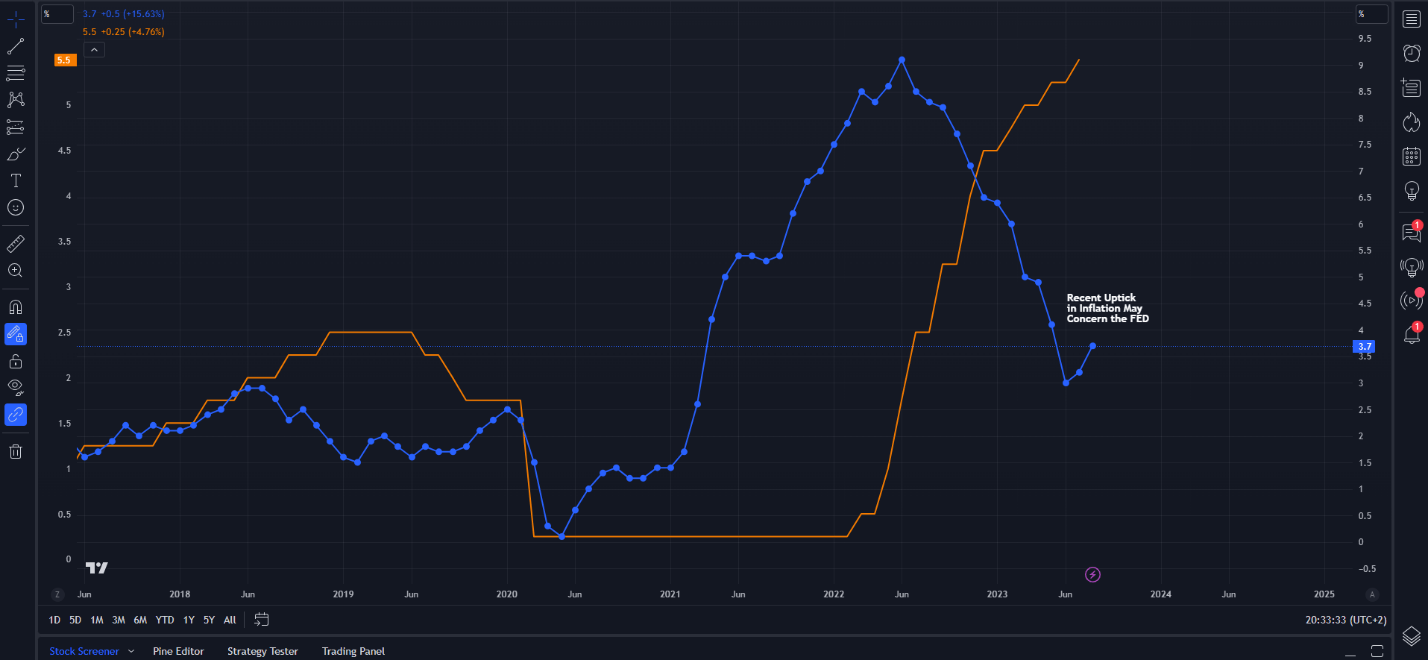

THE INFLATION CONUNDRUM AND ECONOMIC PROJECTIONS

On the inflation front the US has seen notable progress as the inflation rate has more than halved since its peak while the labor market has shown early signs of cooling. There have been positive signs that the current Fed benchmark rate is having the desired effect on the economy as rates are now outpacing inflation. My biggest apprehension heading into this week’s meeting is the recent rise in oil prices and the recent inflation print, which is something that I believe should not be scoffed at. Central Bank Policymakers have been quick to point out that the last bit of inflation may prove the hardest and the US inflation print may be a sign of that. The combination of rising Oil prices and strong demand in the US economy is likely to leave the door open for further hikes as they remain a threat to the fight against inflation as we head into Q4.

US INFLATION VS INTEREST RATE COMPARISON

Source: TradingView, Chart Prepared by Zain Vawda

Given that less than 12 months ago the Fed were prepared to trigger a recession to get inflation under control, it would be foolish for the Fed to be so bold as to rule out any further tightening. I expect a hawkish pause to be followed up by updated economic projections that are indicative of an economy that still remains hot. I do think we will see a lowering of the inflation expectations and labor market data but definitely look set for an increase in GDP projections for 2023 and 2024.

A pause will also give the Fed time to digest more data particularly in light of the recent uptick in inflation while demand and retail sales may come under pressure in Q4 as the loan repayments on student debt resumes. This will have a material impact on consumers ability to spend while at the same time keeping an eye on the developments around household savings. Many analysts have attributed the strong US economy to a build-up in savings and the suspension of student loan repayments which may also be a factor supporting a pause.

Learn from the Best and Take a Look at What Traits Successful Traders Share in the Free Guide Below.

Recommended by Zain Vawda

Traits of Successful Traders

POSSIBBLE SCENARIOS AND IMPACT

Pause in Rate Hikes with Dovish Tilt: A pause seems to be a certainty on Wednesday, but the rhetoric and economic projections will hold the key. A pause with seemingly dovish rhetoric along the lines of data dependency and little to no mention of the upside risks to inflation could point to Dollar weakness and a rally in risk assets. However, this may be short-lived without a definite comment regarding this being an end to the hiking cycle.

Pause in Rate Hikes with Hawkish Tilt: A more hawkish approach to the pause would lean more toward discussions around the recent rise in inflation and upside risks remaining a threat. Any comment reiterating the need to keep the door open for further rate hikes or push back from Fed Chair Powell could be the catalyst the US Dollar needs to continue its advance. This could also in theory weigh on risk assets.

For all market-moving economic releases and events, see theDailyFX Calendar

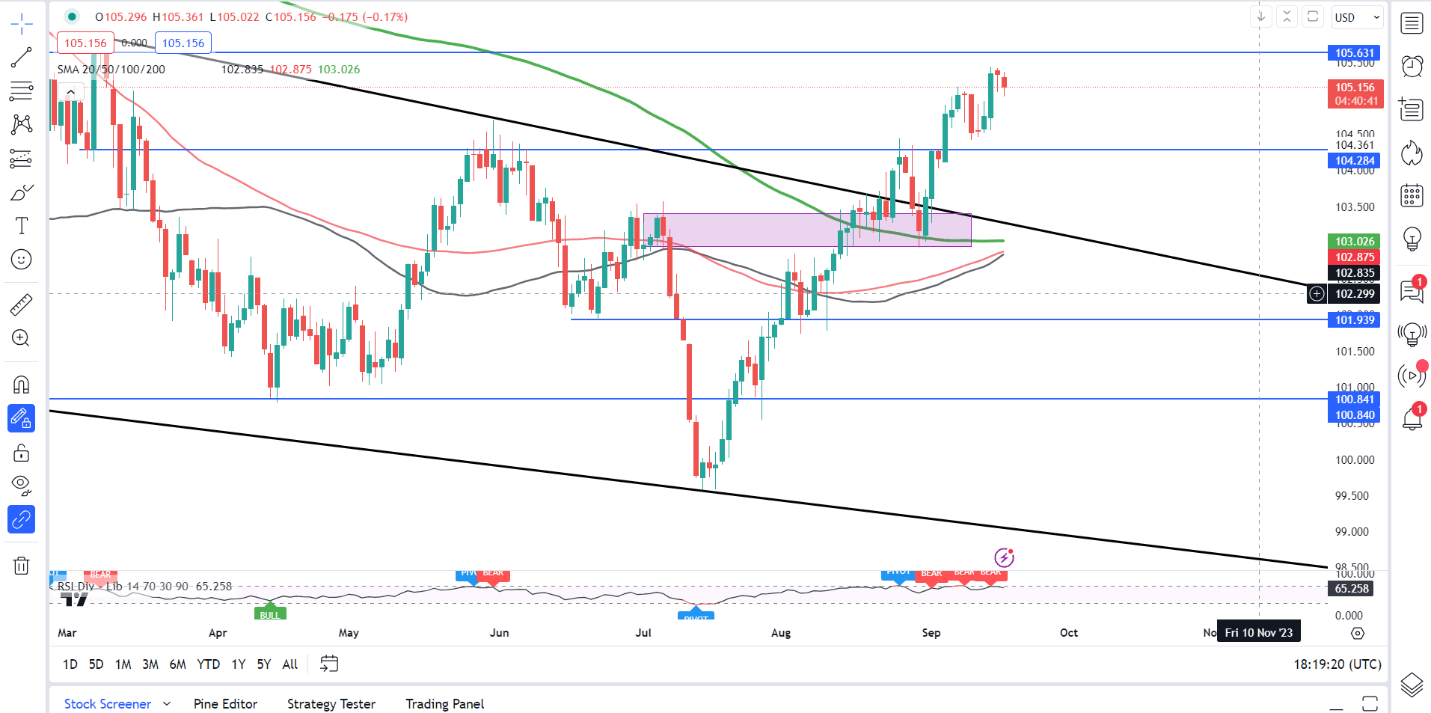

TECHNICAL OUTLOOK (DXY)

The US Dollar Index (DXY) heads into the FOMC meeting following an impressive run of successive weeks of gains and holds the highs ground above the 50, 100 and 200-day MAs. Given the deterioration in both the Euro Area and the UK, the resilience of the US economy has kept the DXY supported. A pause with a dovish tilt on its own may not be enough to deter the USD bulls in the medium term and could just provide an opportunity for potential longs to get involved.

Leaving another rate hike on the table should keep the DXY largely supported in Q4 while the technical outlook appears to be setting up for another upside rally as well. On the daily chart below, we appear to be on the verge of a golden cross as the 50-day MA looks set to cross above the 100-day MA. Should this come to pass, market participants may get another sign shortly thereafter as both the 50 and 100-day MAs eye a cross above the 200-day MA which will add further credence to the idea of a renewed leg to the upside for the Dollar Index (DXY).

Support Areas

- 104.30

- 103.00 (200-day MA)

- 101.93

Resistance Areas

Dollar Index (DXY) Daily Chart

Source: Tradingview, Prepared by Zain Vawda

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰