Gold Falters as US Yields and the DXY Advance, $1900 at Risk

[ad_1] XAU/USD PRICE FORECAST: MOST READ: Gold (XAU/USD), Silver (XAG/USD) Forecast: Upside Potential but Technical Hurdles Lie Ahead Gold extended its losses in the European session as US Treasury Yields continued their advance, while the US Dollar holds above the 106.00 handle. The ‘higher for longer narrative’ has gripped markets since last weeks Fed meeting

[ad_1]

XAU/USD PRICE FORECAST:

MOST READ: Gold (XAU/USD), Silver (XAG/USD) Forecast: Upside Potential but Technical Hurdles Lie Ahead

Gold extended its losses in the European session as US Treasury Yields continued their advance, while the US Dollar holds above the 106.00 handle. The ‘higher for longer narrative’ has gripped markets since last weeks Fed meeting with risk assets and USD denominated assets feeling the heat.

Recommended by Zain Vawda

Forex for Beginners

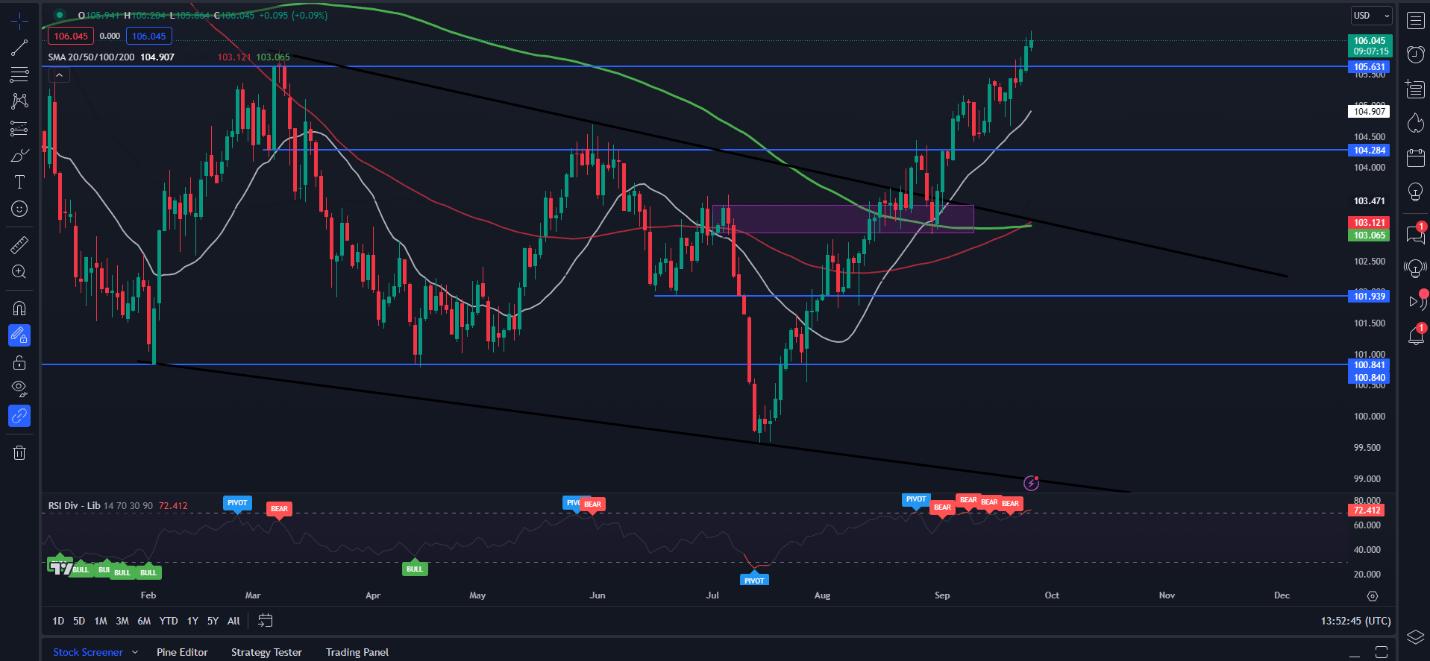

US DOLLAR INDEX (DXY)

The US Dollar has found additional support from a potential Government shutdown coupled with deteriorating economic data globally pointing to a slowdown. The higher rates on offer from holding US Dollars continues to prop up the Greenback as its safe haven appeal grows. Further uncertainty surrounding the Chinese property sector this morning also aiding the Dollars haven appeal.

US data this week continued its positivity as US housing prices continued to rise in July. Later today we also have comments expected from Federal Reserve Policymaker Bowman ahead of more US data later this week. Another reason to be bullish on the USD comes in the form of seasonality with the US Dollar bullish against Western and Eastern European countries as well as emerging market currencies over the past 4 year. This was also corroborated by Economists at Societe Generale as they evaluate the USD outlook for Q4. Will this seasonality trend extend into a 5th year? All signs at present point to it.

Continued US Dollar strength could weigh on Gold prices in Q4 as safe haven appeal continues to favor the US Dollar rather than the non-yielding precious metal. Market uncertainty has been keeping Gold prices partially supported thus far but if the DXY continues its advance Gold could be in store for fresh 2023 lows.

Dollar Index (DXY) Daily Chart

Source: TradingView, Created by Zain Vawda

Looking at the daily chart above, yesterday saw price break above a key area of resistance around the 105.60 handle before piercing through the 106.00 handle. The DXY does remain in overbought territory, but retracements have so far proved short lived. The current macro picture is likely to keep the US Dollar supported moving forward.

The MAs have however crossed on the daily timeframe with the 100-day MA crossing above the 200-day MA in a golden cross pattern. This is a further sign of the upside momentum from a technical perspective and could see the DXY run toward the 107.00 level in the coming days.

Tips and Tricks for Gold? Look no Further and Download your Guide Below.

Recommended by Zain Vawda

How to Trade Gold

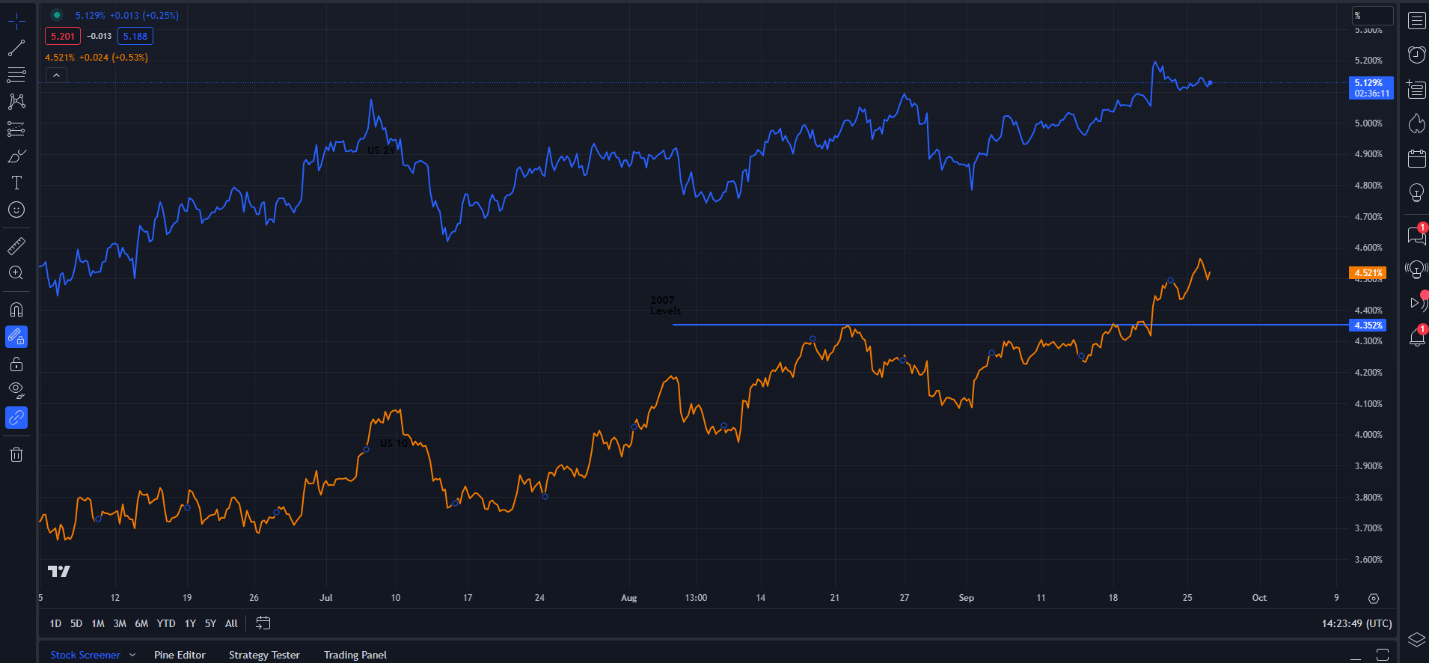

US TRASURY YIELDS HOVER AT 2007 LEVELS

US Treasury yields continue to hold the high ground at 2007 levels adding further pressure on Gold prices. The US 10Y has been trading comfortably above the 2007 levels hitting a high yesterday around the 4.56% mark with the 2Y yield not advancing as much, remaining below recent highs around the 5.12% handle.

US 2Y and US 10Y Chart

Source: TradingView, Created by Zain Vawda

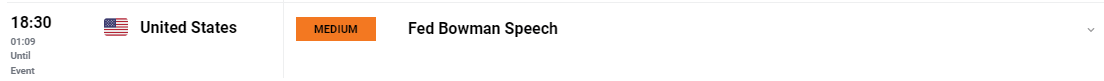

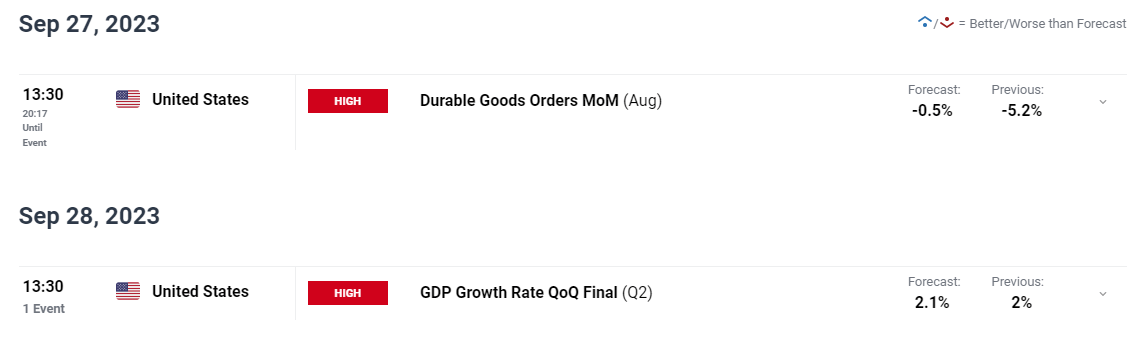

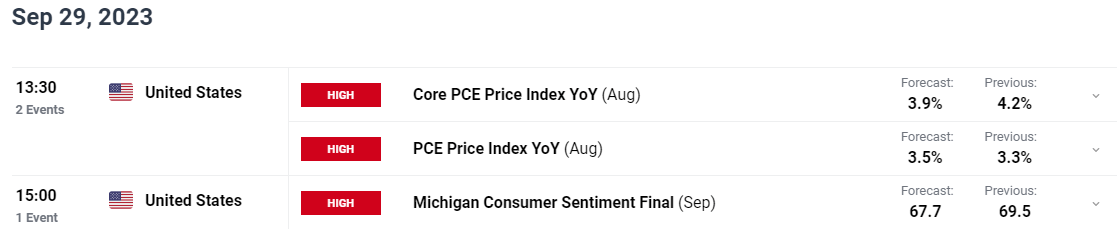

RISK EVENTS AHEAD THIS WEEK

As mentioned earlier we have US Fed policymaker on the docket later today before attention turns to US Durable Goods Orders tomorrow. Final GDP numbers with an expected upward revision will be out Thursday before the biggest risk event of the week on Friday. If anything can arrest the Dollar’s rise of late it could be US PCE data which remains the Feds preferred gauge of inflation. A significant drop here could see some weakness in the DXY but is not something I expect right now. I believe if we are to see any significant change in the PCE data it will likely come from the October print onward as student debt repayments begin and consumers face renewed strain.

For all market-moving economic releases and events, see the DailyFX Calendar

GOLD TECHNICAL OUTLOOK

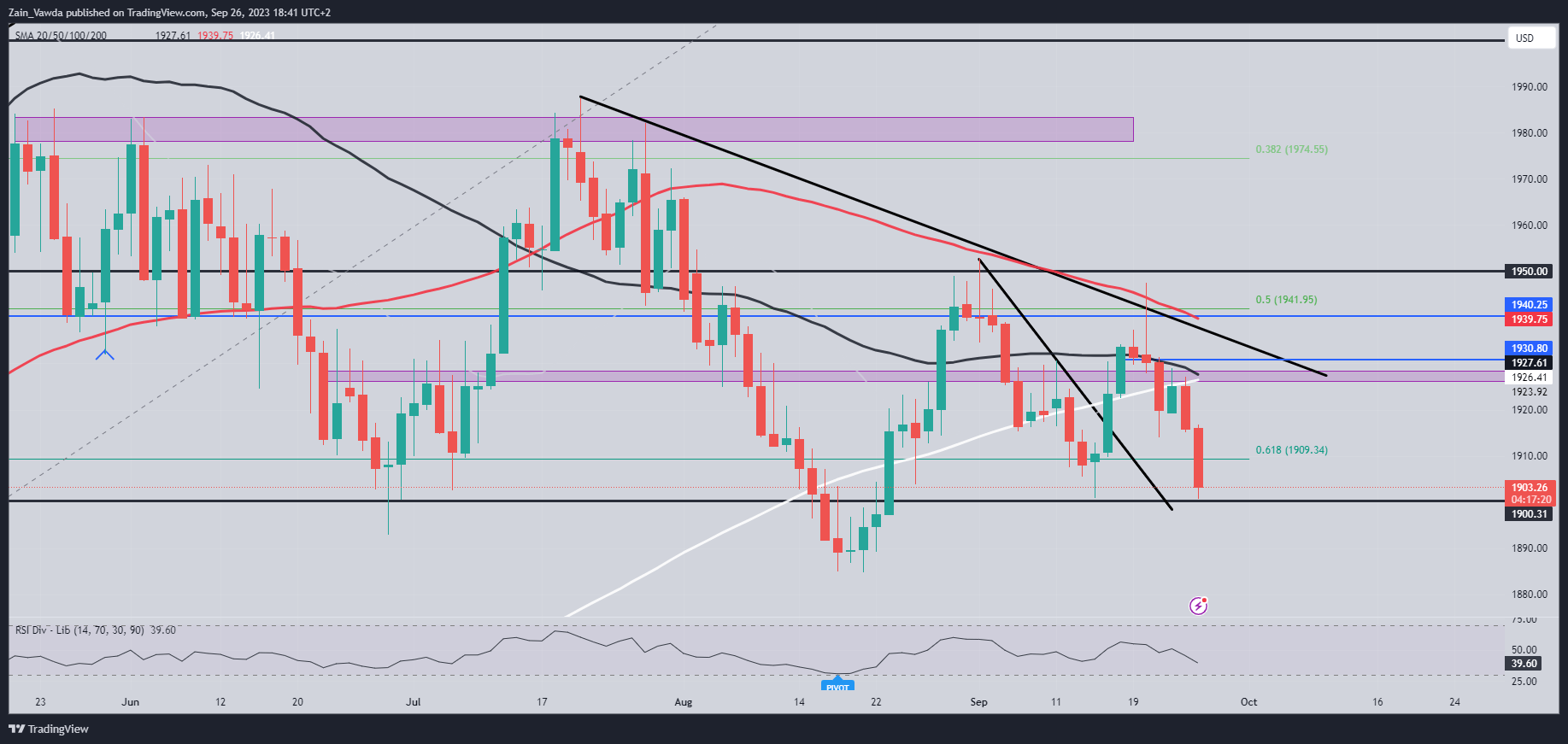

Form a technical perspective, Gold prices have struggled in the early part of the week. Having written my weekly forecast on Gold, I saw the potential for a move higher given last Fridays daily candle close as a bullish inside bar candle. I did however highlight the technical hurdles facing Gold around the $1925-$1930 mark where we have a seen a convergence of the MAs.

At the time of writing, we also have the 50-day MA looking at crossing the 200-day MA in what would be a further sign of the bearish momentum at present. The one apprehension I do have I that Gold seems to be slightly supported, given the rise in US Yields and rise of the DXY I would’ve expected a faster decline in the precious metal.

Looking toward the downside and immediate support is provided by the $1900 handle before the recent lows around $1884 comes into focus. A drop below the $1900 mark could see the precious metal put in some gains before going on to take out the recent lows around $1884 and should be kept in mind.

Gold (XAU/USD) Daily Chart – September 26, 2023

Source: TradingView, Chart Prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment, Retail Traders are Overwhelmingly Long on Gold with 79% of retail traders holding Long positions. Given the Contrarian View to Crowd Sentiment Adopted Here at DailyFX, is this a sign that Gold may continue to fall?

For a more in-depth look at Client Sentiment on Gold and how to use it download your free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 9% | -14% | 3% |

| Weekly | 9% | -30% | -3% |

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰