AUD/USD, NZD/USD Soar on US Dollar’s Slump, Dead Cat Bounce Ahead of US CPI?

[ad_1] AUSTRALIAN DOLLAR OUTLOOK AUD/USD and NZD/USD rally on Monday, bolstered by broad-based U.S. dollar weakness The greenback’s pullback appears to be driven by profit-taking after a strong bullish run since mid-July Looking ahead, the U.S. inflation report for August, to be released on Wednesday, will be the main focus of the currency markets. Trade

[ad_1]

AUSTRALIAN DOLLAR OUTLOOK

- AUD/USD and NZD/USD rally on Monday, bolstered by broad-based U.S. dollar weakness

- The greenback’s pullback appears to be driven by profit-taking after a strong bullish run since mid-July

- Looking ahead, the U.S. inflation report for August, to be released on Wednesday, will be the main focus of the currency markets.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar Forecast – How Will US Inflation Data Impact Yields and USD?

The U.S. dollar, as measured by the DXY index, weakened on Monday, down about 0.5% to 104.53 in early afternoon trading, in a session devoid of major market catalysts, with losses likely driven by profit-taking after eight consecutive weeks of gains and the longest winning streak since 2014.

In this context, AUD/USD climbed nearly 0.93% to 0.6434, registering its best single-day performance since late July. Meanwhile, NZD/USD advanced approximately 0.65% to trade at 0.5921, notching its highest reading in nearly a week.

While both the Aussie and Kiwi are beginning to display tentative signs of recovery against the greenback following a steep slump in recent months, the rebound could be a dead-cat bounce, a short-lived rise in prices before a continuation of the broader downtrend.

One variable that could reignite weakness in antipodean currencies is U.S. data, which has held up remarkably well in 2023. Economic resilience could push the Fed to deliver more hikes or, at the very least, to keep rates higher for longer to ensure that inflation converges sustainably toward the 2.0% target.

Uncover strategies behind consistent trading. Download the “How to AUD/USD” guide for crucial insights and tips!

Recommended by Diego Colman

How to Trade AUD/USD

Related: USD/CAD Dips on Solid Canadian Data but Broader Outlook Tied to US Inflation

Later this week, when the U.S. Bureau of Labor Statistics releases August inflation figures, we will have a clearer picture of the overall trend in consumer prices and clues as to how the U.S. central bank might proceed in the future.

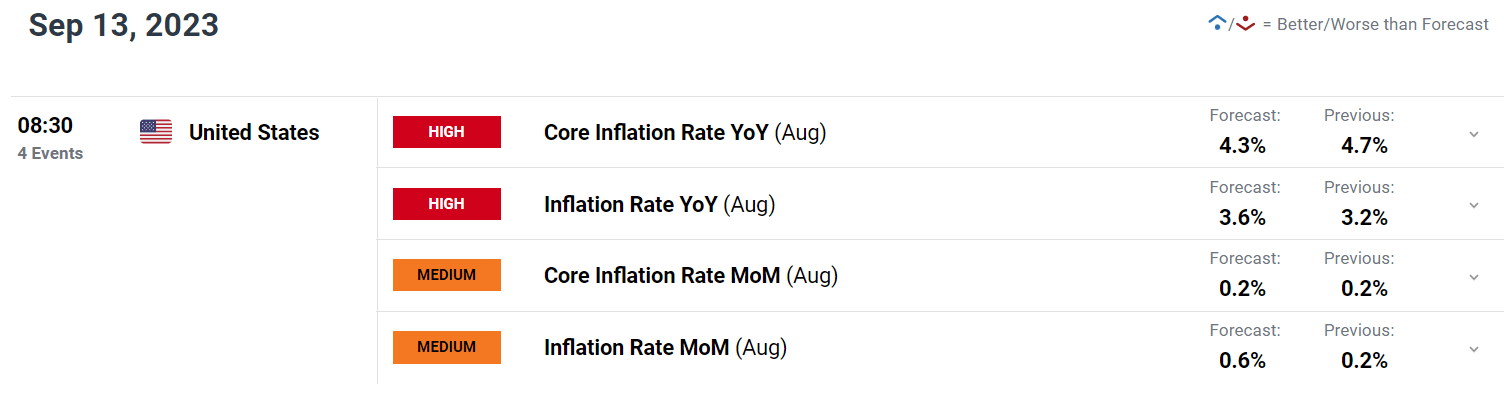

Regarding the upcoming CPI survey, the all-items index is forecast to have risen 0.6% last month, pushing the annual rate to 3.6% from 3.2% previously. The core gauge, for its part, is seen climbing 0.2% on a monthly basis, with the 12-month reading easing to 4.3% from 4.7% prior.

Any upward deviation in the official data from market expectations would be bullish for the U.S. dollar insofar as it would strengthen the case for further policy firming at the November FOMC meeting. In this scenario, both AUD/USD and NZD/USD could sell off.

UPCOMING US DATA AT A GLANCE

Source: DailyFX Economic Calendar

Looking beyond the events of this week, it’s crucial for traders to keep a keen eye on China, which holds a pivotal position as the primary trading partner for both Australia and New Zealand. That said, if the Chinese government opts for comprehensive and substantial support measures to boost the country’s recovery, rather than incremental easing actions, both the Aussie and Kiwi would be better positioned for a more durable rebound.

Download our sentiment guide for valuable insights into how positioning may influence AUD/USD and NZD/USD’s trajectory!

| Change in | Longs | Shorts | OI |

| Daily | -8% | 50% | 2% |

| Weekly | -3% | 34% | 4% |

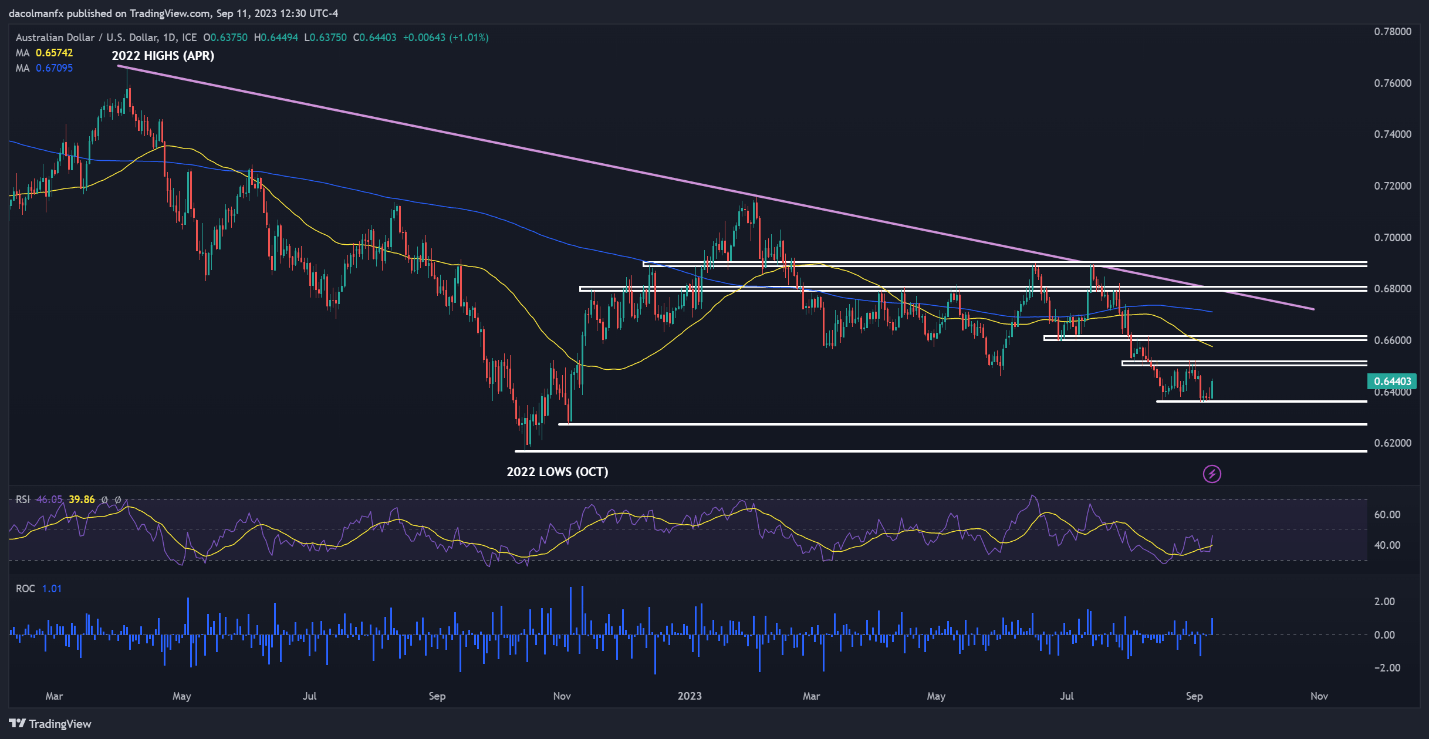

AUD/USD TECHNICAL ANALYSIS

AUD/USD rallied on Monday, bouncing off technical support at 0.6360 and carving out what appears to be a double bottom.

A double bottom is a reversal pattern, composed of two similar troughs separated by a peak in the middle, that often develops in the context of an extended downtrend. Confirmation of this bullish setup happens when the asset completes a “W” shape and successfully breaches the neckline resistance created by the intermediate top within the formation.

In the specific case of AUD/USD, neckline resistance is seen stretching from 0.6500 to 0.6510. Upside clearance of this barrier could attract new buyers into the market, setting the stage for possible move towards the 0.6600 handle.

On the flip side, if sellers resurface and trigger a meaningful pullback, initial support is located around 0.6360, but further losses may be in store on a push below this threshold, with the next downside target at 0.6275, followed by 0.6170.

AUD/USD TECHNICAL CHART

AUD/USD Chart Prepared Using TradingView

Navigate the forex market with confidence and improve your strategies. Download the US Dollar quarterly outlook for a longer-term view of FX trends!

Recommended by Diego Colman

Get Your Free USD Forecast

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰