Weekly Market Outlook (25-29 September)

[ad_1] UPCOMING EVENTS: Monday: German IFO. Tuesday: US Consumer Confidence. Wednesday: BoJ Meeting Minutes, Australia Monthly CPI, US Durable Goods Orders. Thursday: Australia Retail Sales, US Q2 Final GDP, US Jobless Claims. Friday: Japan Tokyo CPI, Japan Unemployment Rate, Japan Retail Sales, UK Q2 Final GDP, Eurozone CPI, Canada GDP, US Core PCE. Tuesday The

[ad_1]

UPCOMING EVENTS:

- Monday: German

IFO. - Tuesday: US

Consumer Confidence. - Wednesday: BoJ

Meeting Minutes, Australia Monthly CPI, US Durable Goods Orders. - Thursday:

Australia Retail Sales, US Q2 Final GDP, US Jobless Claims. - Friday: Japan

Tokyo CPI, Japan Unemployment Rate, Japan Retail Sales, UK Q2 Final GDP,

Eurozone CPI, Canada GDP, US Core PCE.

Tuesday

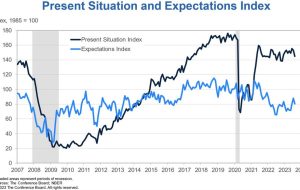

The US Consumer Confidence is expected to

slide further to 105.6 vs. 106.1 prior. The previous

report saw a huge miss and coupled with the

big miss in US Job Openings it hinted to some notable softening in the labour

market. In fact, compared to the University of Michigan Consumer Sentiment

survey, which shows more how the consumers see their personal finances, the

Consumer Confidence shows how the consumers see the labour

market.

US Consumer Confidence

Wednesday

The Australian Monthly CPI is expected to

rise to 5.2% vs. 4.9% prior. This is mainly due to higher energy prices and

it’s something that the RBA

already expects to happen in Q3. Rising energy prices and higher mortgage

payments should lower consumption and weigh on economic growth.

Australia Monthly CPI YoY

Thursday

The US Jobless Claims beat expectations by

a big margin once again last

week. The labour market seems to be

getting into better balance, but it still remains pretty tight. The consensus

for this week sees Initial Claims at 217K vs. 201K prior and Continuing Claims

at 1675K vs. 1662K prior.

US Initial Claims

Friday

The Eurozone CPI Y/Y is expected at 4.5%

vs. 5.2% prior, while the Core CPI Y/Y is seen at 4.8% vs. 5.3% prior. Unless

we see blowout numbers, this report is unlikely to change anything for the ECB,

which is clearly leaning towards keeping rates higher for longer now.

Eurozone Core CPI YoY

The

US PCE Y/Y is expected to rise to 3.5% vs. 3.3% prior, while the M/M reading is

seen at 0.5% vs. 0.2% prior. The Core PCE Y/Y, which is the Fed’s preferred

measure of inflation, is expected at 3.9% vs. 4.2% prior, while the M/M figure

is seen at 0.2% vs. 0.2% prior.

US Core PCE YoY

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Market ، Outlook ، September ، Weekly ، Weekly Market Outlook

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰