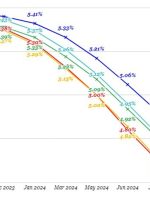

[ad_1] S&P is out with it expectations for the UAW strike and implications. They say Warns that if the UAW strike continues for over a week and expands, it could lead to significant reductions in earnings and liquidity in the US auto sector for 2023. Predicts a slowdown in U.S. auto sector momentum in the