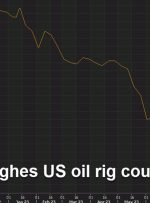

[ad_1] OIL PRICE FORECAST: Most Read: What is OPEC and What is Their Role in Global Markets? Oil prices continued their advance this morning helped by a weaker USD. The surge in US inventories seems to be overshadowed by growing concerns around tighter supply for the remainder of 2023. Tips and Tricks to Trading Oil