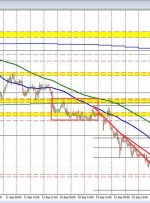

[ad_1] Australian Dollar, AUD/USD, US Dollar, Treasury Yields, ACGB, DXY Index – Talking Points The Australian Dollar steadies as risks swirl for markets The US Dollar has been underpinned by firm Treasury yields Markets appear poised for a busy week. Will AUD/USD recover from the lows? Recommended by Daniel McCarthy Get Your Free AUD Forecast