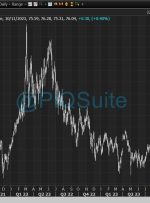

[ad_1] Oil set for third weekly decline as Middle East conflict concerns ebb FULL STORY Oil prices were up slightly on Friday but are set to fall for a third week as concerns of supply disruptions from the Israel-Hamas conflict have ebbed, allowing demand worries to reassert themselves. “The threat of disruptions to supplies from