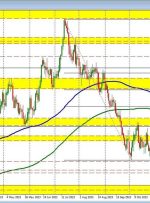

[ad_1] The GBPUSD is back below its 200 day moving average The GBPUSD ran higher yesterday, and in the process extended toward its 100-day moving average near 1.2512. The high price got within 7 pips of that level at 1.2505 before rotating back to the downside. In trading today, lower-than-expected CPI data out of the

[ad_1] OIL PRICE FORECAST: Oil Continues to Advance as Supply Concerns and Potential Rebound in Demand Keep Prices Elevated. Saudi Energy Minister to Provide a Further Update this Week on the Potential for Further Cuts or an Extension into 2024. IG Client Sentiment Shows Traders are 79% Net-Short on WTI at Present. To Learn More

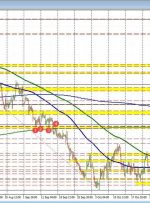

[ad_1] Share: USD/CHF fell to 0.9050, seeing 0.30% losses. The USD is losing interest due to the Fed dovish tone on Wednesday’s decision. Ahead of October’s Nonfarm Payrolls, the US reported weak labor market data. Indicators flash signals of further downside. In Thursday’s session, the USD/CHF saw red, mainly driven by a broad

[ad_1] Share: The USD/CHF rose to a two-week high around 0.9035 near the 20-day SMA. The CHF is one the worst-performing currencies in the session. The US Dollar is trading soft after PCE figures from September. Hawkish bets on the Fed remain low ahead of next week’s meeting. At the end of the week,

[ad_1] Article by IG Chief Market Analyst Chris Beauchamp Nasdaq 100, Nikkei 225, S&P 500 Analysis and Charts Nasdaq 100 holds key support The index rallied off the 14,500 level for the second time in a month, in an echo of September’s price action.Now the bulls need to get the price back above 14,800 on

[ad_1] Share: The USD/CHF reversed its course after jumping to a daily high of 0.9032 and then settling slightly above 0.9000. The USD is struggling to gather momentum on a positive market mood. The US reported strong economic activity figures from September. Rising US Treasury yields may limit the downside for the pair.

[ad_1] Bitcoin (BTC) Prices, Charts, and Analysis: Have global interest rates peaked? Bitcoin is unable to break the 200-day simple moving average. Download our Q4 Bitcoin Forecast for Free Recommended by Nick Cawley Get Your Free Bitcoin Forecast Bitcoin is trapped in a wide $25k – $32k range and is finding it difficult to make