PCE, Powell to Set Market Tone, Setups on EUR/USD, USD/JPY

[ad_1] US DOLLAR OUTLOOK – EUR/USD & USD/JPY The broader U.S. dollar was flat on Monday, but volatility could pick up in the coming trading sessions, with several high-impact events on the calendar The focus will be on U.S. PCE data, ISM manufacturing results and Powell’s public appearance later in the week This article explores

[ad_1]

US DOLLAR OUTLOOK – EUR/USD & USD/JPY

- The broader U.S. dollar was flat on Monday, but volatility could pick up in the coming trading sessions, with several high-impact events on the calendar

- The focus will be on U.S. PCE data, ISM manufacturing results and Powell’s public appearance later in the week

- This article explores the technical outlook for EUR/USD and USD/JPY, analyzing price action dynamics and the key levels to monitor in the days ahead

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Gold (XAU/USD) and Silver (XAG/USD) Continue to Rally as Buyers Take Charge

The U.S. dollar, as measured by the DXY index, was largely flat on Monday, oscillating between small gains and losses around the 103.45 mark. Despite this stability, we are likely to see increased volatility later in the week, with high-impact events on the calendar, including the release of PCE data, ISM PMI, and a public speech by Fed Chair Powell.

The consensus view among traders is that the FOMC has concluded its tightening campaign after the last quarter-point hike in July, so the focus has shifted to the easing cycle that is likely to get underway in 2024. To bolster confidence in potential rate cuts, incoming data needs to cooperate by demonstrating a decline in price pressures and a slowdown in economic activity.

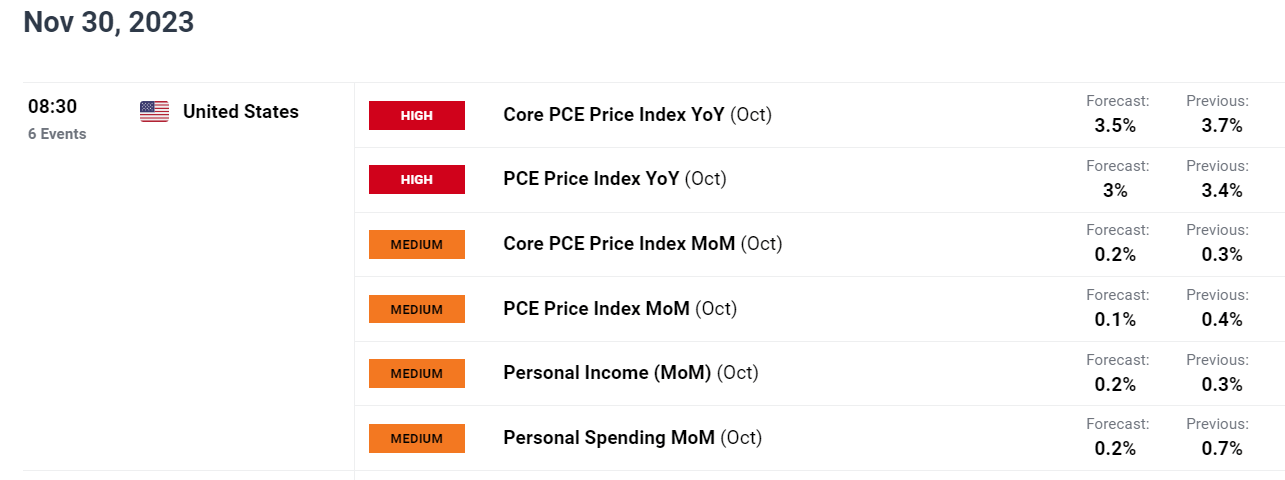

We will be able to better assess the economic outlook on Thursday when BEA releases its latest report on personal income and outlays. In terms of expectations, October’s personal spending is forecast to have risen 0.2% m/m, a significant slowdown from September’s 0.7% jump. Meanwhile, core PCE, the Fed’s favorite inflation gauge, is seen climbing 0.2% m/m, bringing the annual rate to 3.5% from 3.7% previously.

Will the U.S. dollar reverse higher or extend its downward correction? Get all the answers in our Q4 forecast. Request a complimentary copy now!

Recommended by Diego Colman

Get Your Free USD Forecast

US INCOMING DATA

Source: DailyFX Economic Calendar

A day later, the Institute for Supply Management will unveil November manufacturing activity figures. Consensus estimates call for a slight increase in factory output to 47.6 from 46.7 in the prior period. Despite this uptick, the goods-producing sector is expected to remain stuck in a recessionary environment, characteristic of any reading below the 50.0 threshold.

In the grand scheme of things, any data indicating softer inflationary forces and a slowdown in growth might exert downward pressure on the U.S. dollar, potentially prompting a dovish repricing of interest rate estimations. Conversely, higher-than-anticipated core PCE and economic activity could be supportive of the greenback by bolstering Treasury yields and pushing back expectations of rate cuts.

Last but not least, Friday features a noteworthy event with Fed Chair Powell’s fireside chat at Spelman College in Atlanta, Georgia. It’s crucial for traders to focus on his statements regarding the central bank’s forthcoming decisions, recognizing that any hint of hawkishness could fuel a rally in the U.S. currency.

For a comprehensive assessment of the euro’s medium-term outlook, make sure to download our Q4 trading forecast. It is free!

Recommended by Diego Colman

Get Your Free EUR Forecast

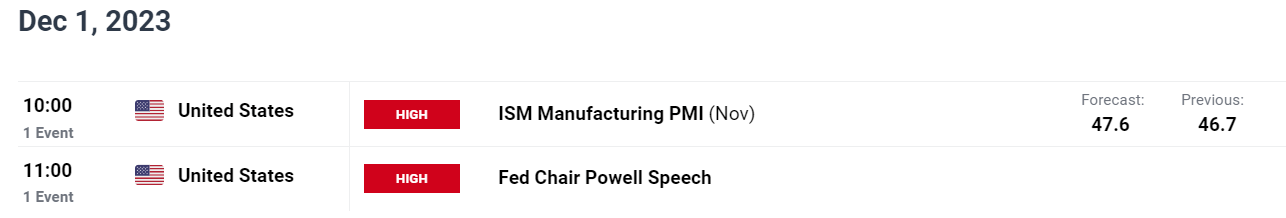

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD has rallied nearly 3.5% this month, coming within striking distance from breaching resistance at 1.0956, which corresponds to the 61.8% Fibonacci retracement of the July/October slump. While bulls may have a hard time pushing prices above this barrier decisively, given the euro’s overbought state, a breakout could pave the way for a rally towards 1.1080, followed by 1.1275, the 2023 peak.

In the event of a downward reversal from current levels, EUR/USD could head towards a key floor at 1.0840. The pair is likely to bottom out in this area on a pullback, but a breakdown could open the door to a retest of the 200-day simple moving average hovering slightly above confluence support around 1.0760. On further weakness, the exchange rate may gravitate towards its 50-day SMA near 1.0665.

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

Interested in learning how retail positioning can shape the short-term trajectory of USD/JPY? Our sentiment guide discusses the role of crowd mentality in FX markets. Get the guide now!

| Change in | Longs | Shorts | OI |

| Daily | 3% | 7% | 6% |

| Weekly | -16% | 14% | 7% |

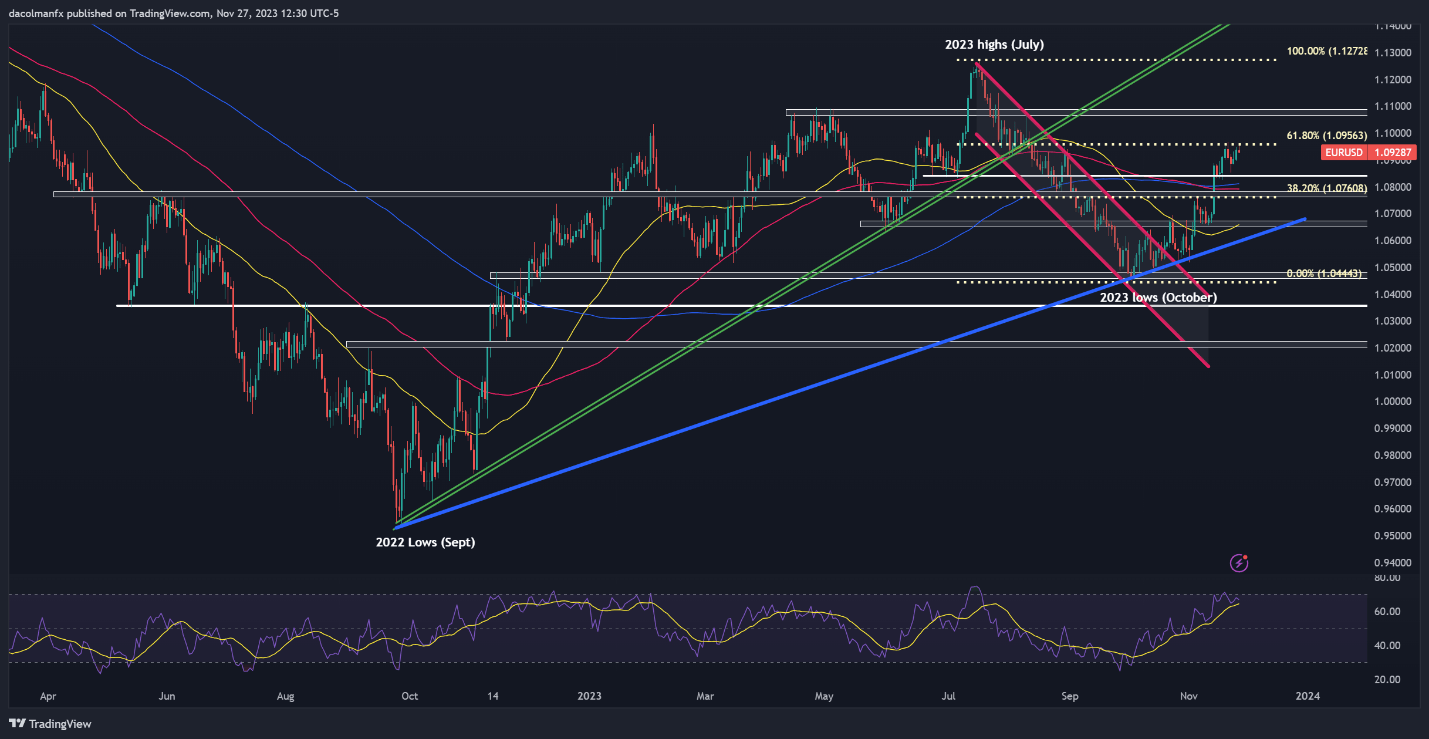

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY charged higher late last week after a pronounced sell-off on Monday, but stalled at resistance near the 50-day simple moving average and has started to retrench, with the pair trading below the 149.00 level at the time of writing. If losses intensify in the coming sessions, initial support is seen near 147.25. Below this zone, the focus shifts to the 100-day SMA, followed by the 146.00 handle.

On the other hand, if USD/JPY resumes its advance, overhead resistance is positioned at 149.70. Upside clearance of this technical ceiling could rekindle bullish momentum, setting the right conditions for a rally towards 150.90. On further strength, buyers could be emboldened to launch an attack on this year’s highs around the psychological 152.00 level.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰