Euro Snapshot Ahead of the FOMC Rate Decision, EUR/USD EUR/JPY

[ad_1] Euro Analysis (EUR/USD, EUR/JPY) Recommended by Richard Snow Get Your Free EUR Forecast FOMC to Hike by 25-bps in July but Where Will Rates Peak? The FOMC concludes its two-day meeting with the monetary policy statement at 19:00 UK time today. A string of encouraging inflation prints have allowed markets to entertain the possibility

[ad_1]

Euro Analysis (EUR/USD, EUR/JPY)

Recommended by Richard Snow

Get Your Free EUR Forecast

FOMC to Hike by 25-bps in July but Where Will Rates Peak?

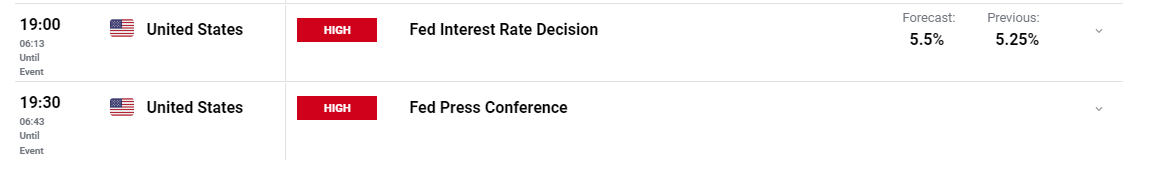

The FOMC concludes its two-day meeting with the monetary policy statement at 19:00 UK time today. A string of encouraging inflation prints have allowed markets to entertain the possibility that the Fed may close out July having hiked rates for the last time. However, if inflation has taught us anything up until now, it’s that widespread price pressures are unpredictable and extremely stubborn.

Given that the unemployment rate remains under 4%, economic growth for the second quarter is forecast to come in at a respectable 1.8% and average wage growth remains strong, the battle against inflation is looking like it’s far from over.

Customize and filter live economic data via our DailyFX economic calendar

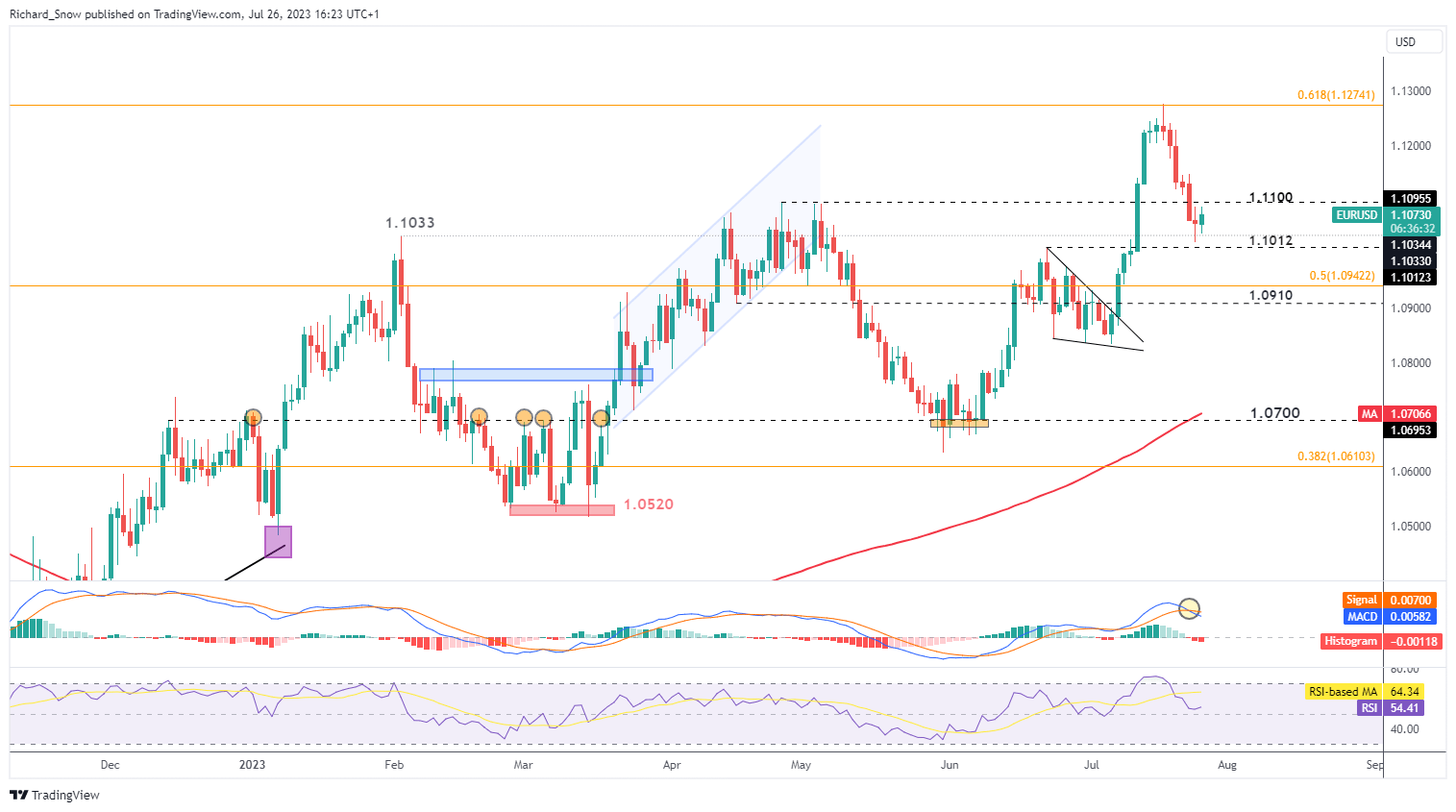

EUR/USD Rises Ahead of the FOMC Statement and Press Conference

Yesterday appeared to mark a halt to the recent EUR/USD selloff as traders positioned themselves ahead of today’s central bank announcement. The extended lower candle wick provided the first rejection of lower prices ahead of the 1.1012 level which has been advanced in today’s trading thus far.

With prices trading above the 200 simple moving average (SMA), the pair has previously rallied on pullbacks, maintaining the longer-term uptrend. With the FOMC today and ECB decision tomorrow, traders can expect a lift in volatility over the two days.

Bulls may view the psychological level of 1.1100 as a tripwire for a bullish continuation from here after the recent selloff provides a more attractive level to re-enter the trend. On the other side, should markets view the Fed message as more hawkish than expected, the EUR/USD selloff could witness an extended selloff, with 1.1012 the immediate level of support followed by 1.0910.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

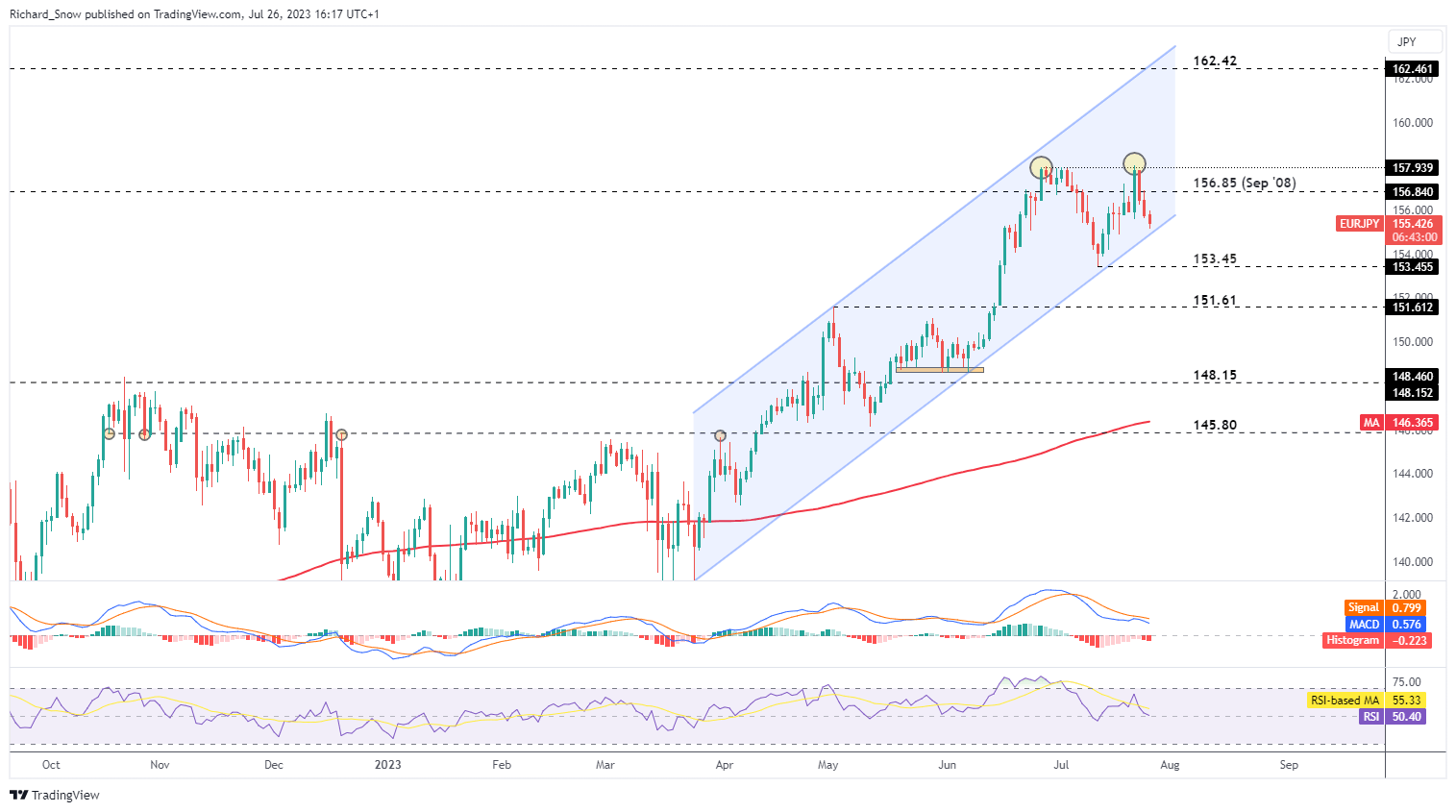

EUR/JPY Hints at Potential Breakdown as the Yen Gains Popularity

Fundamental changes to the Japanese economy appear to be gaining pace. Just last month at a central bank forum hosted by the ECB, new Bank of Japan Governor Ueda hinted that the prerequisites for policy normalization in Japan would require sustained demand driven inflation that rises into 2024, as well as sustained wage growth also above 2%.

With inflation running above the Bank’s target for over a year now and wages growing at a pace not seen since the early nineties, the Bank may soon have to entertain the conversation of tighter monetary policy.

In the lead up to Friday’s BoJ meeting, markets appear to be positioning for more hawkish sentiment from the Bank, with the Yen appreciating across a number of G7 currencies. The EUR/JPY pair recently put in what appears to be a double top formation and prices have fallen since. Today’s drop now brings into focus the channel support and upon a successful break and close on the daily chart, a move towards 153.45 cannot be ruled out heading into the end of the week.

The ECB rate decision and press conference will be crucial in determining short-term direction in the pair. A false breakdown could see EUR/JPY bulls eye a bullish continuation and a move back towards the double top around 157.90 but first, a move above 156.85 would need to be accomplished.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰