Euro Outlook Improves on Bank Tax Clarity: EUR/USD, EUR/JPY, EUR/AUD

Euro (EUR/USD, EUR/JPY, EUR/AUD) Analysis European markets rebound positively to Italian bank tax clarity EUR/USD attempts to claw back yesterday’s losses EUR/JPY gears up for retest of yearly high on improved Euro sentiment EUR/AUD to retest yearly high after yesterday’s drop? The analysis in this article makes use of chart patterns and key support and

Euro (EUR/USD, EUR/JPY, EUR/AUD) Analysis

- European markets rebound positively to Italian bank tax clarity

- EUR/USD attempts to claw back yesterday’s losses

- EUR/JPY gears up for retest of yearly high on improved Euro sentiment

- EUR/AUD to retest yearly high after yesterday’s drop?

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free EUR Forecast

European Markets Respond Positively to Italian Bank Tax Clarity

European assets began trading on the front foot this morning after the announcement of a surprising Italian bank tax sent markets lower yesterday. The tax had been brought up before but had since gone off the boil, so while markets saw it as a shock, it’s not something that came completely out of nowhere.

Nevertheless, the lack of clarity around the magnitude of the tax had markets concerned, sending Italian and European banking stocks sharply lower. The mood has eased this morning after receiving clarity that the tax will not exceed 0.1% of bank assets.

Scheduled risk events remain light this week, particularly on a European level, with everyone now focused on US inflation data on Thursday and PPI on Friday.

Customize and filter live economic data via our DailyFX economic calendar

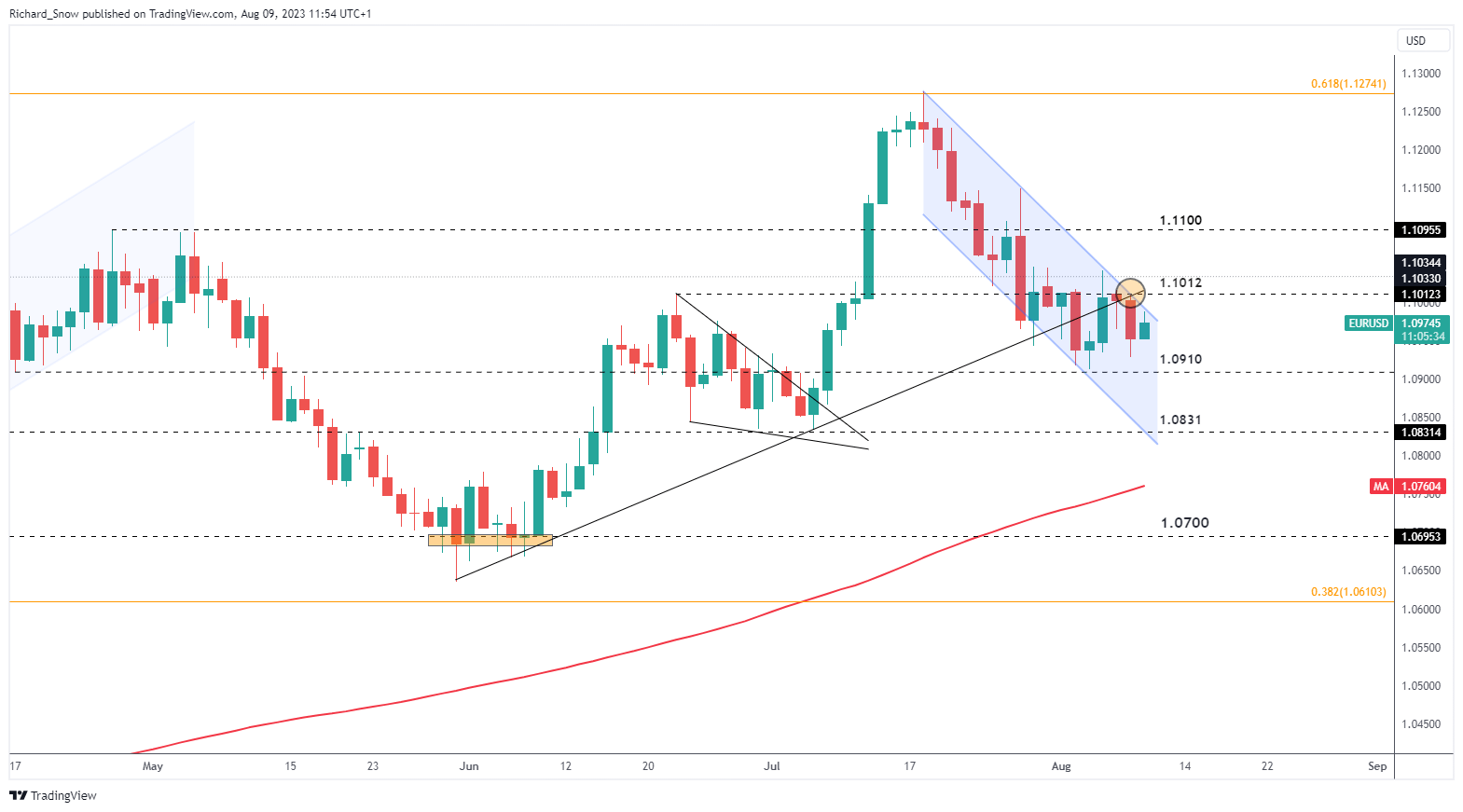

EUR/USD Attempts to Claw Back Yesterday’s Losses

The EUR/USD pair trades up this morning, yet to fully retrace yesterday’s losses. The pair has hinted at a bearish breakdown ever since providing a daily close below trendline support on the 2nd of August. As is often the case, a prudent approach to assessing breakouts leans on a retest of the trendline and bounce lower before contemplating further downside plays.

Yesterday’s price action revealed a bounce lower off confluence resistance at the intersection of the 1.1012 prior high, the underside of trendline resistance (prior support) and a tag of channel resistance. Hence, despite today’s lift in prices there could be further euro weakness to come. Support comes in at 1.0910 followed by 1.0831. A rise above 1.1012 places the bearish outlook in doubt while a move above 1.1100 suggests a reexamination of the bearish view.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

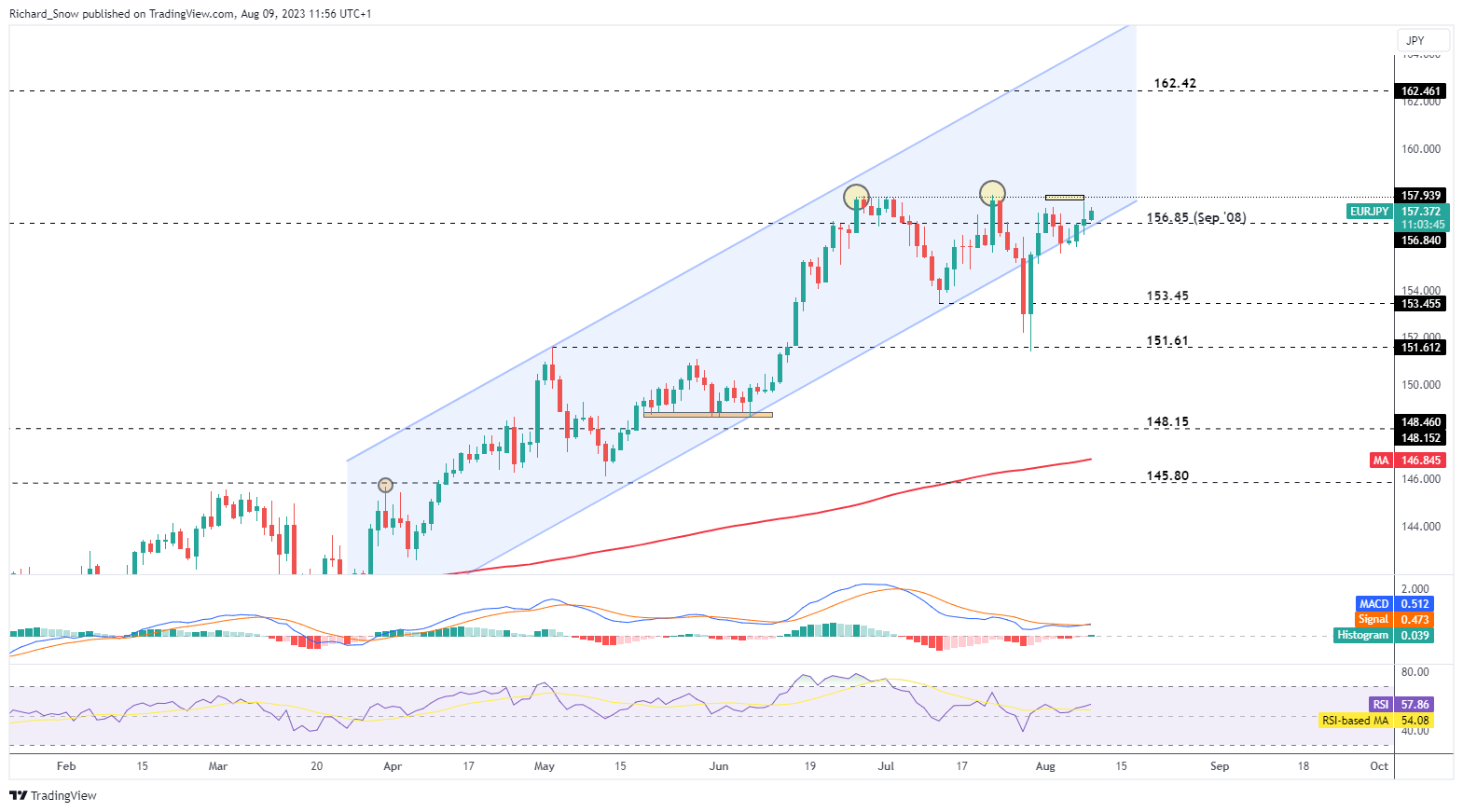

EUR/JPY Gears up for Retest of Yearly High on Improved Euro Sentiment

EUR/JPY heads higher on the back of the broader lift in European assets and the inability for the Japanese yen to extend gains after the July central bank meeting. The yen has more than surrendered recent gains after Japanese officials clarified that the tweak to yield curve control was put initiated in order to maintain current loose monetary policy in a sustainable fashion, rather than a step towards normalization.

The pair now trades back within the larger ascending channel with 157.94 well in sight once again. This level has proven difficult to break above, having been approached multiples times since June without a break and hold above it. It is difficult to find bullish drivers in the euro now that a small section of the ECB has even expressed doubts over one more 25 bps in September – with one last hike into year-end remaining the consensus. Core inflation however, could downside risks for the euro but has struggled to effect bullish moves in the currency recently as inflation has shown progress at a time when GBP saw a slight lift in Q2.

Immediate support rests at 156.85, followed by the 153.45 level. Upside resistance holds steady at 157.94.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Building Confidence in Trading

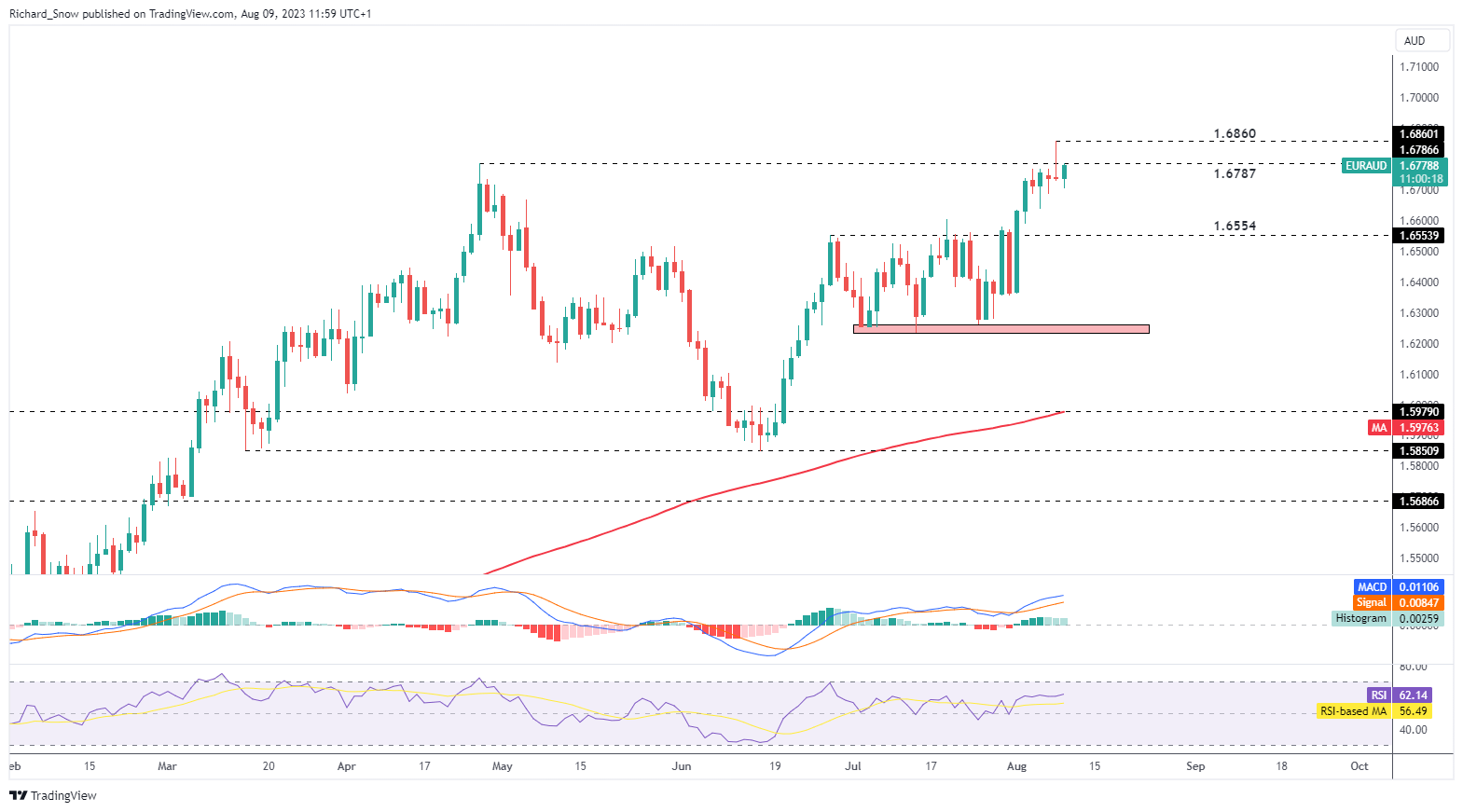

EUR/AUD to Retest Yearly High after Yesterday’s Drop?

EUR/AUD posted a significant rise (around 3% or 480 pips) after the Reserve Bank of Australia (RBA) voted to hold rates for a second time. The pair remains linked to the ongoing misfortunes of the Chinese economy which initially had the pair trading higher yesterday before the pulling back to end flat.

China has received an unfortunate ‘one-two’ combination, backing up poor trade data on Tuesday with confirmation of deflating consumer prices in the early hours of this morning. Other advanced economies, even Japan, are experiencing rising prices – opening the door for Chinese authorities to provide substantial support instead of smaller targeted pockets of stimulus. Stubborn Australian inflation remains a potential downside risk for the pair, however the nations proximity to China may be too strong of an influence ahead of the next meeting. Look out for RBA minutes next week.

A worsening Chinese outlook does not bode well for the Aussie dollar, meaning upside continuation remains in sight provided prices do not drop below 1.6554. Immediate resistance appears at 1.6787 with the yearly high of 1.6860 thereafter.

EUR/AUD Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰