EURO FORECAST

- EUR/USD rose modestly after the Federal Reserve announced its July monetary policy decision

- The Fed resumed its tightening campaign after a brief pause last month, raising interest rates by 25 basis points to 5.25%-5.50%, but did not strike a hawkish tone

- Market attention now turns to the ECB, with the bank’s decision and guidance key to the trajectory of the euro

Recommended by Diego Colman

Get Your Free EUR Forecast

Most Read: Fed Hikes Rates After Short Pause, Gold and US Dollar Forge Separate Paths

The U.S. dollar took a turn to the downside on Wednesday following the July FOMC announcement. Although the Fed raised interest rates by 25 basis points to 5.25%-5.50%, it did not adopt an aggressive outlook, with Chairman Powell refraining from definitively signaling further policy firming. The overall tone drove Treasury yields lower, pushing EUR/USD towards the 1.1100 handle.

The euro’s gains, however, could be short-lived if the European Central Bank embraces a conciliatory stance at the end of its next meeting. For context, the institution led by Christine Lagarde is seen lifting borrowing costs by a quarter point on Thursday, but forward-guidance could shift in a dovish direction in the face of the deteriorating health of the economy in the region.

If ECB fails to commit to another rate rise and takes up a data-dependent approach, traders may begin to increase wagers that the hiking cycle is over, pricing out the probability of more tightening in September. This could trigger a sharp downward correction in the euro, causing the common currency to erase part of its 2023 rally.

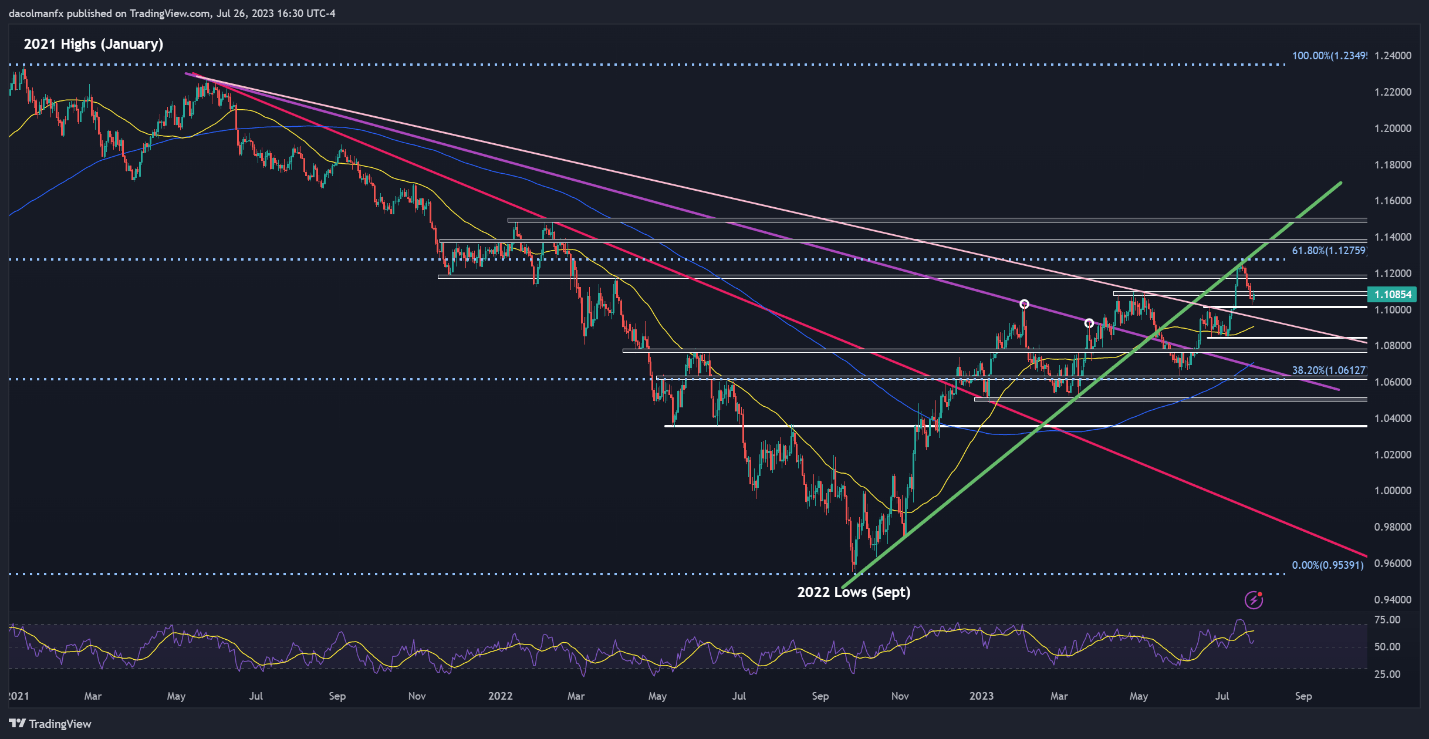

From a technical standpoint, EUR/USD is currently squeezed between resistance at ~1.1100 and support at ~1.1015. These two zones should be watched closely in the coming days to see which way prices resolve after the dust settles following several high-impact events on Thursday and Friday that could produce outsize moves.

In the event of a bullish breakout, buying momentum could accelerate, paving the way for a rally toward 1.1180, followed by 1.1275, the 61,8% Fibonacci retracement of the 2021/2022 selloff. On further strength, the focus shifts to 1.1375. On the flip side, if EUR/USD heads lower and breaches support at 1.1015, we could see a drop toward 1.0950 and 1.0830 thereafter.

| Change in | Longs | Shorts | OI |

| Daily | 6% | 1% | 3% |

| Weekly | 68% | -28% | -4% |

EUR/USD TECHNICAL CHART

EUR/USD Chart Prepared Using TradingView

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0