EUR/USD Stalls at Channel Resistance, AUD/USD Rejected, Fed Minutes a ‘Non-Event’

[ad_1] FED MINUTES The U.S. dollar, as measured by the DXY index, was modestly higher on Wednesday, attempting to end a 5-day losing streak. Against this backdrop, both EUR/USD and AUD/USD traded with a negative bias, unable to sustain their recent upturn in a sign perhaps of market exhaustion. In other developments, the publication of

[ad_1]

FED MINUTES

The U.S. dollar, as measured by the DXY index, was modestly higher on Wednesday, attempting to end a 5-day losing streak. Against this backdrop, both EUR/USD and AUD/USD traded with a negative bias, unable to sustain their recent upturn in a sign perhaps of market exhaustion.

In other developments, the publication of the FOMC minutes did not significantly impact the dynamics of the trading session, even though it echoed a more dovish tone. For context, the record of the last Fed meeting showed that officials agreed to proceed carefully and that risks to the mandate have become two-sided. This choice of language implies a likelihood that the central bank will adopt a more cautious approach, setting a higher threshold for any future interest rate increases. In the grand scheme of this, this could be somewhat bearish for the U.S. dollar in the fourth quarter.

Elevate your trading skills and gain a competitive edge. Get your hands on the U.S. dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Diego Colman

Get Your Free USD Forecast

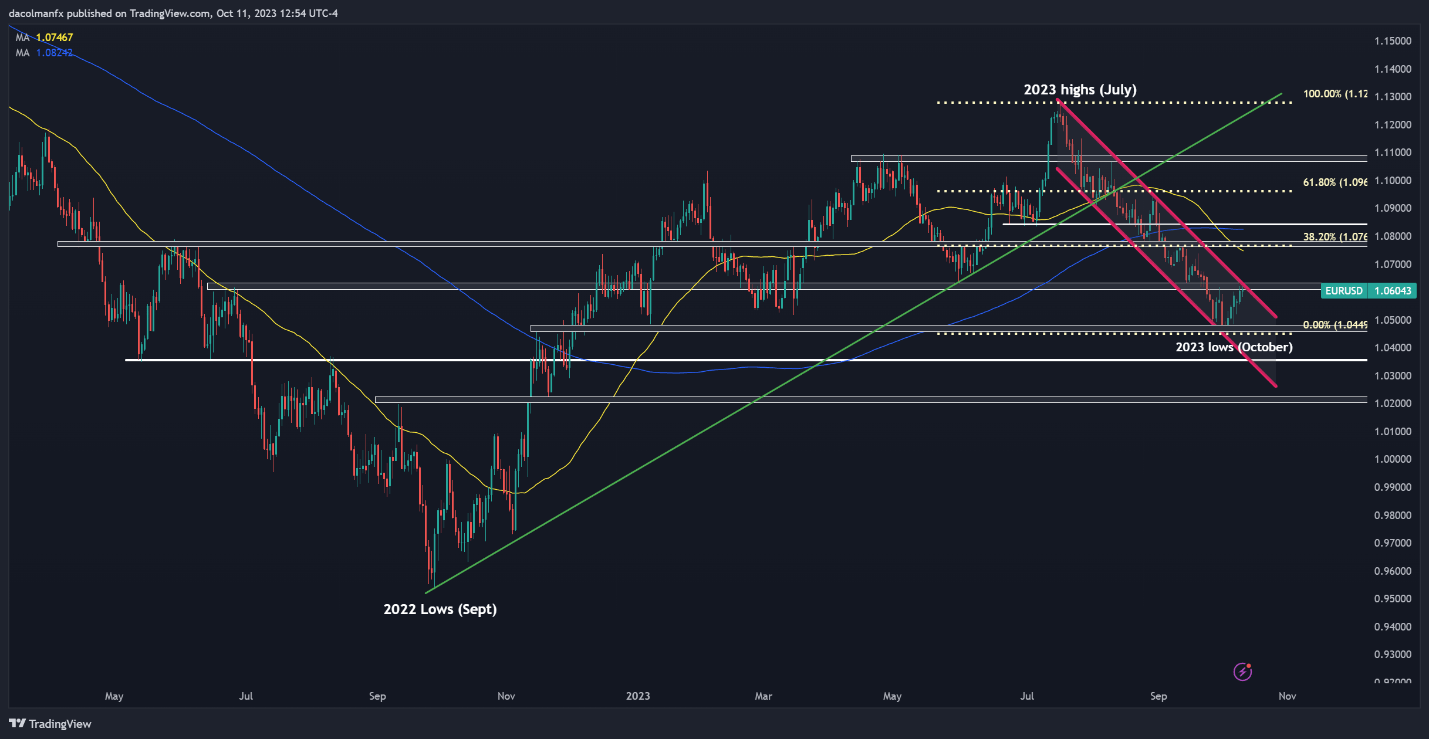

EUR/USD TECHNICAL ANALYSIS

EUR/USD has rebounded in recent days after falling below the 1.0500 level and reaching its weakest point since December 2022 last week. In this context, the pair has recaptured the 1.0600 handle, moving ever closer to the channel resistance at 1.0615. The bulls may struggle to breach this barrier, but a clean breakout could pave the way for a rally towards 1.0765, the 38.2% Fibonacci of the July/October decline.

On the flip side, if market sentiment shifts back in favor of sellers and prices reverse lower from its current position, primary support rests in the 1.0500/1.0465 range. While the pair may establish a foothold in this area during a pullback, a rupture of this foundation could amplify downward momentum, setting the stage for a move towards 1.0365. On further weakness, the focus will be on 1.0225.

Get a holistic view of the euro’s prospects for the months ahead – Secure your Q4 forecast for free and gain an edge in your trading!

Recommended by Diego Colman

Get Your Free EUR Forecast

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

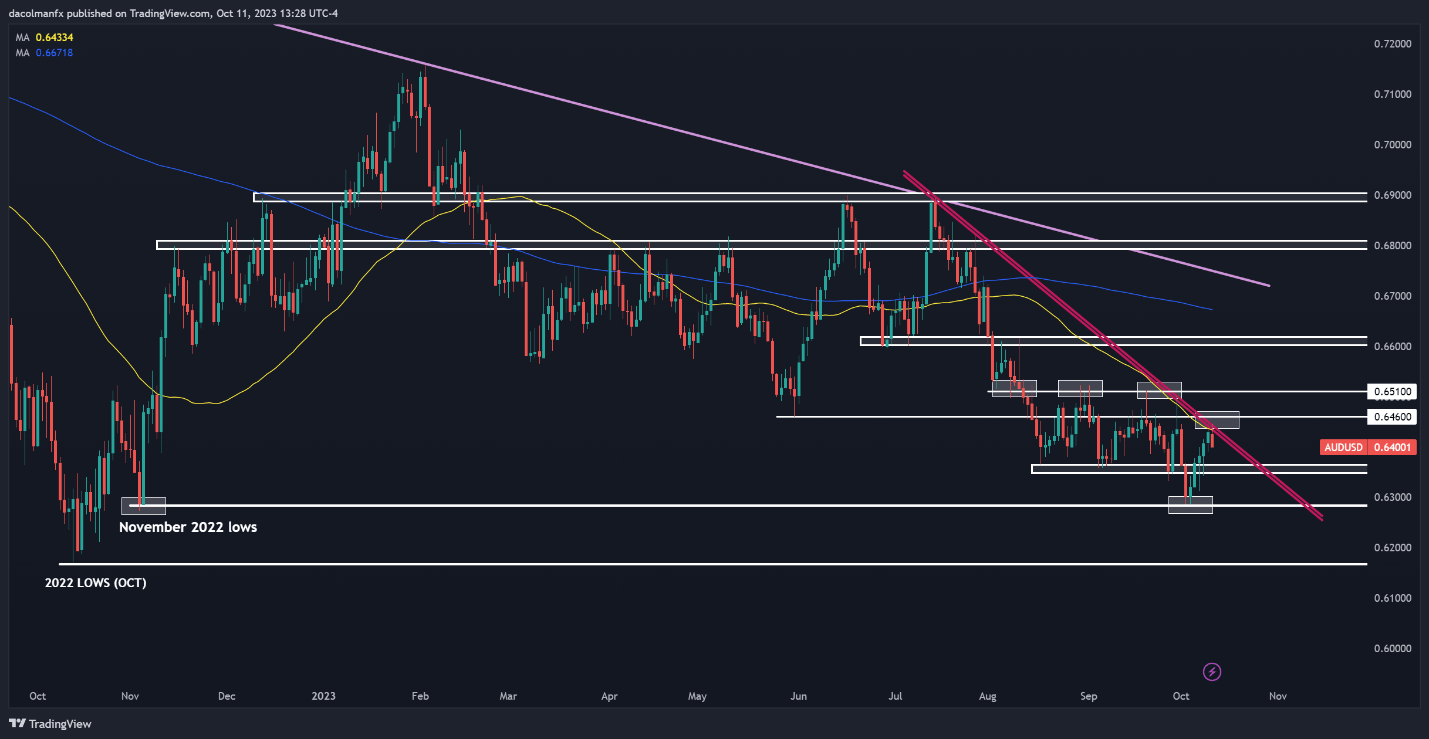

AUD/USD TECHNICAL ANALYSIS

AUD/USD plunged below 0.6300 last Tuesday, touching its lowest level since November 2022. Sentiment, however, improved in the following days, allowing the pair to stabilize and mount a recovery, as seen in the chart below, where prices can be seen touching the 50-day simple moving average above 0.6400 earlier this week.

Despite the rebound observed in the past days, price action remains unfavorable, with the recent rejection from trendline resistance being a key bearish signal. For context, the pair probed a major downtrend line in the overnight session in the vicinity of 0.6445, but was quickly repelled to the downside, allowing sellers to regain the upper hand.

From here, there are two possible scenarios to keep in mind. If AUD/USD extends lower, support is seen at 0.6350. AUD/USD may find stability in this area on a pullback, but in the event of a breakdown, a retest of the 2023 lows is likely. The other possibility involves a rebound from the current levels. Should this scenario play out, we could see a move towards 0.6440/0.6460. Upside clearance of this ceiling could open the door for a rally towards 0.6510.

Seeking clarity on AUD/USD’s outlook? Our Q4 trading forecast provides expert analysis and explores key market catalysts that may impact prices. Request a free copy now!

Recommended by Diego Colman

Get Your Free AUD Forecast

AUD/USD TECHNICAL CHART

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰