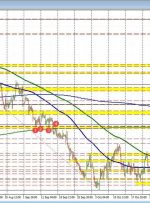

[ad_1] The GBPUSD is back below its 200 day moving average The GBPUSD ran higher yesterday, and in the process extended toward its 100-day moving average near 1.2512. The high price got within 7 pips of that level at 1.2505 before rotating back to the downside. In trading today, lower-than-expected CPI data out of the