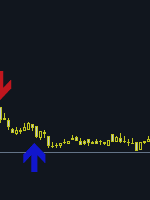

[ad_1] Good evening. Today I traded according to the signals of my indicator. Trading the EURCHF pair on the M1 timeframe. Great result, today I earned $ 28. Buy signal: up arrow. If there are open sell positions, they need to be closed. Sell signal: downward arrow. If there are open buy positions, they need to be closed. There are situations when