USD/JPY ANALYSIS & TALKING POINTS

- Poor Japanese economic data keeps USD/JPY supported.

- US CPI expected lower after PPI miss yesterday.

- 150 retest on the cards.

Supercharge your trading prowess with an in-depth analysis of the Japanese Yen outlook, offering insights from both fundamental and technical viewpoints. Claim your free Q4 trading guide now!

Recommended by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL BACKDROP

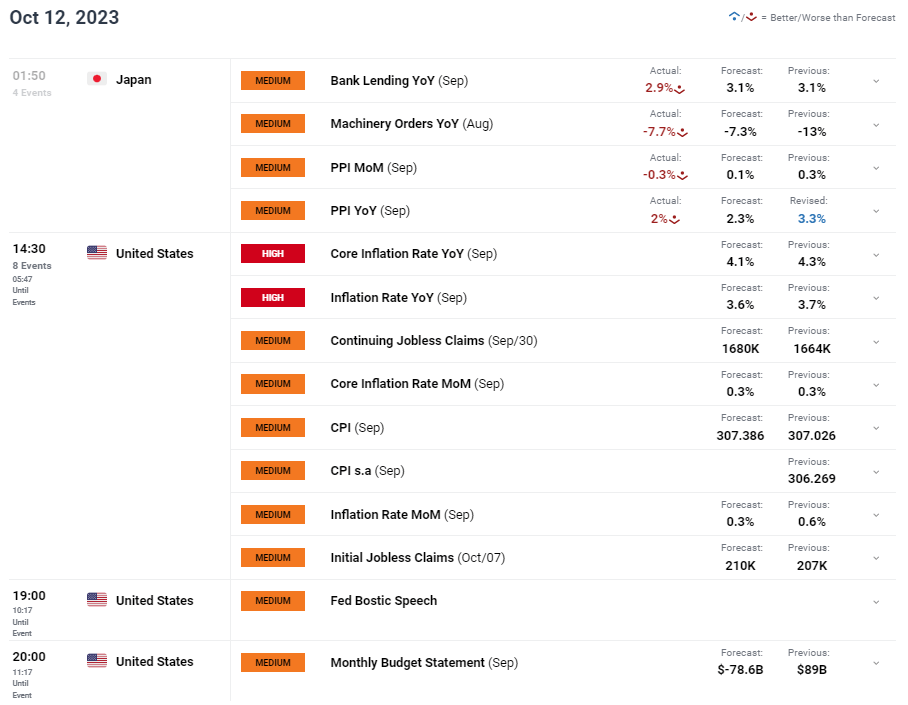

The Japanese Yen is relatively flat today after weak Japanese economic data (see economic calendar below) saw USD/JPY marginally higher post-release. The miss on PPI could see softer inflationary pressures to come going forward as a leading indicator for CPI. That being said, the Bank of Japan (BOJ)‘s Noguchi stated that “we have no choice but to raise inflation forecast for FY 2023” that could prompt a shit away from the ultra-loose monetary policy markets have become so accustomed to with Japan.

Today will be centered around US CPI with forecasts showing a moderation in inflation for both core and headline metrics respectively. Considering recent dovish remarks by Fed officials as well as overtightening risks cited in yesterday’s FOMC minutes, only a significant upside surprise today could sway market pricing from roughly 90% probability for a rate pause in November. Fed speak will continue today and give more insight as to the thought process of these individuals.

LISTEN TO MY RISK EVENT FOR THE WEEK COVERING US CPI

USD/JPY ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/JPY TECHNICAL ANALYSIS

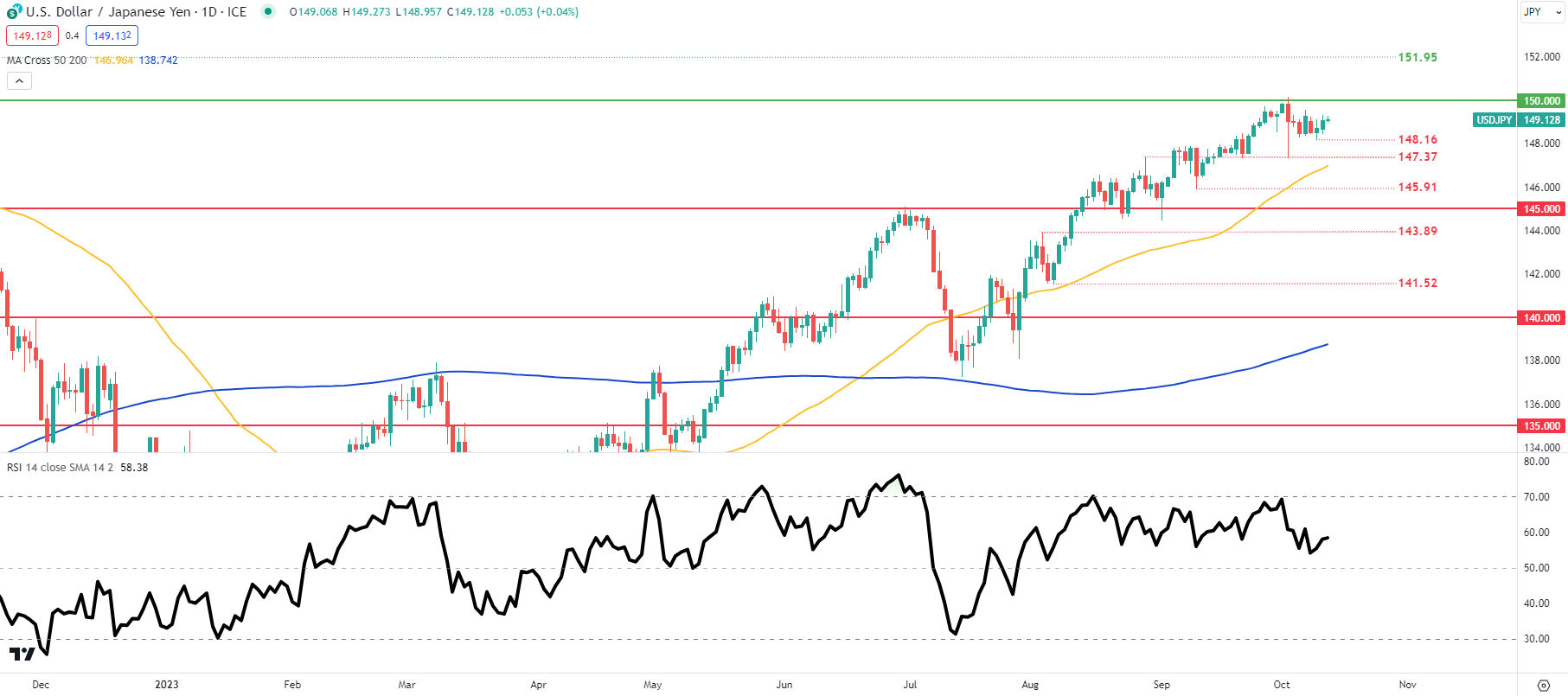

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/JPY price action remains elevated just below the 150.00 psychological handle that has been well respected of recent. Although there is no concrete guidance from Japan about intervention at this point, officials responses and cues could be important moving forward. A weak US CPI later today could find the pair breaking down towards the 148.16 swing support low.

Key resistance levels:

Key support levels:

- 148.16

- 147.37

- 50-day moving average (yellow)

- 145.91

- 145.00

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are currently net SHORT on USD/JPY, with 82% of traders currently holding short positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰