EUR/USD and EUR/JPY Forecast – Prices, Charts, and Analysis

- Volatility remains low across a range of markets ahead of Jerome Powell’s speech.

- The Japanese Yen remains weak across a range of currencies.

Recommended by Nick Cawley

How to Trade EUR/USD

Volatility across a range of major fx currencies pairs remains extremely low leaving traders waiting for high-impact economic data or events to stoke price action. One such event nears, Jerome Powell’s speech at the Jackson Hole Symposium this Friday at 14:05 GMT.

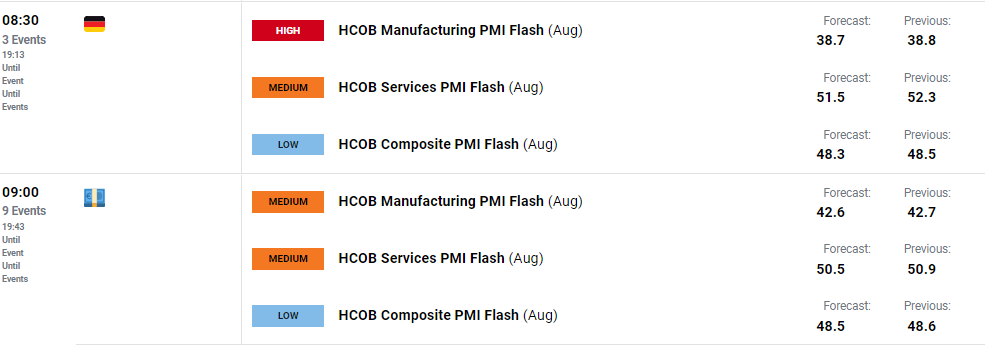

While Powell’s speech will be the main event of the week, tomorrow sees the latest round of Euro Zone PMI numbers, data that gives an up-to-date look at the health of the economy. A reading above 50 shows an economy, or sector, that is expanding, while a reading below 50 indicates contraction.

A look at recent data shows that Euro Zone and German manufacturing is struggling badly, while the service sector is expanding, but only just. Tomorrow’s numbers may well give the single currency a quick shot of short-term volatility if the forecasts are missed or beaten.

DailyFX Calendar

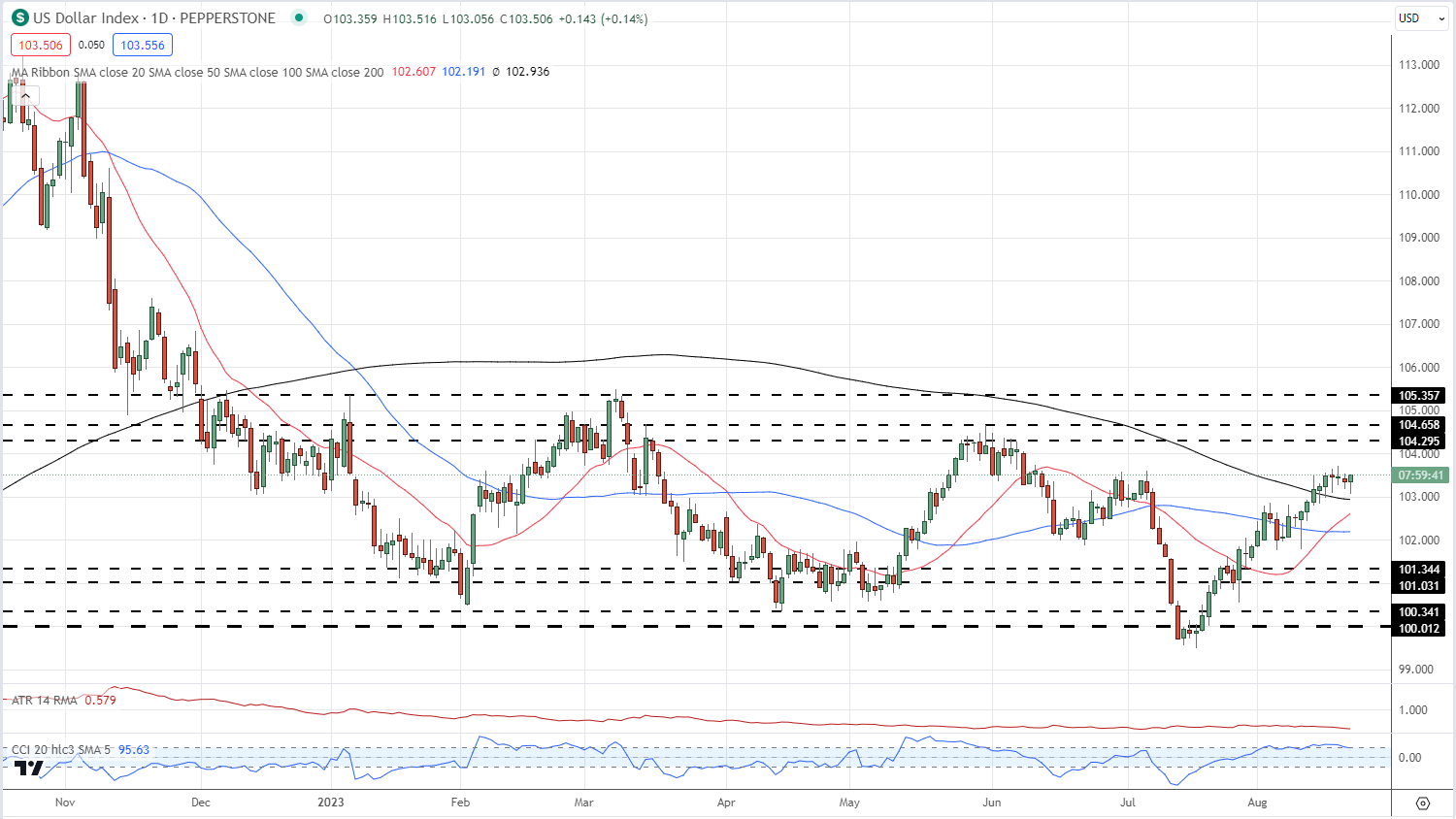

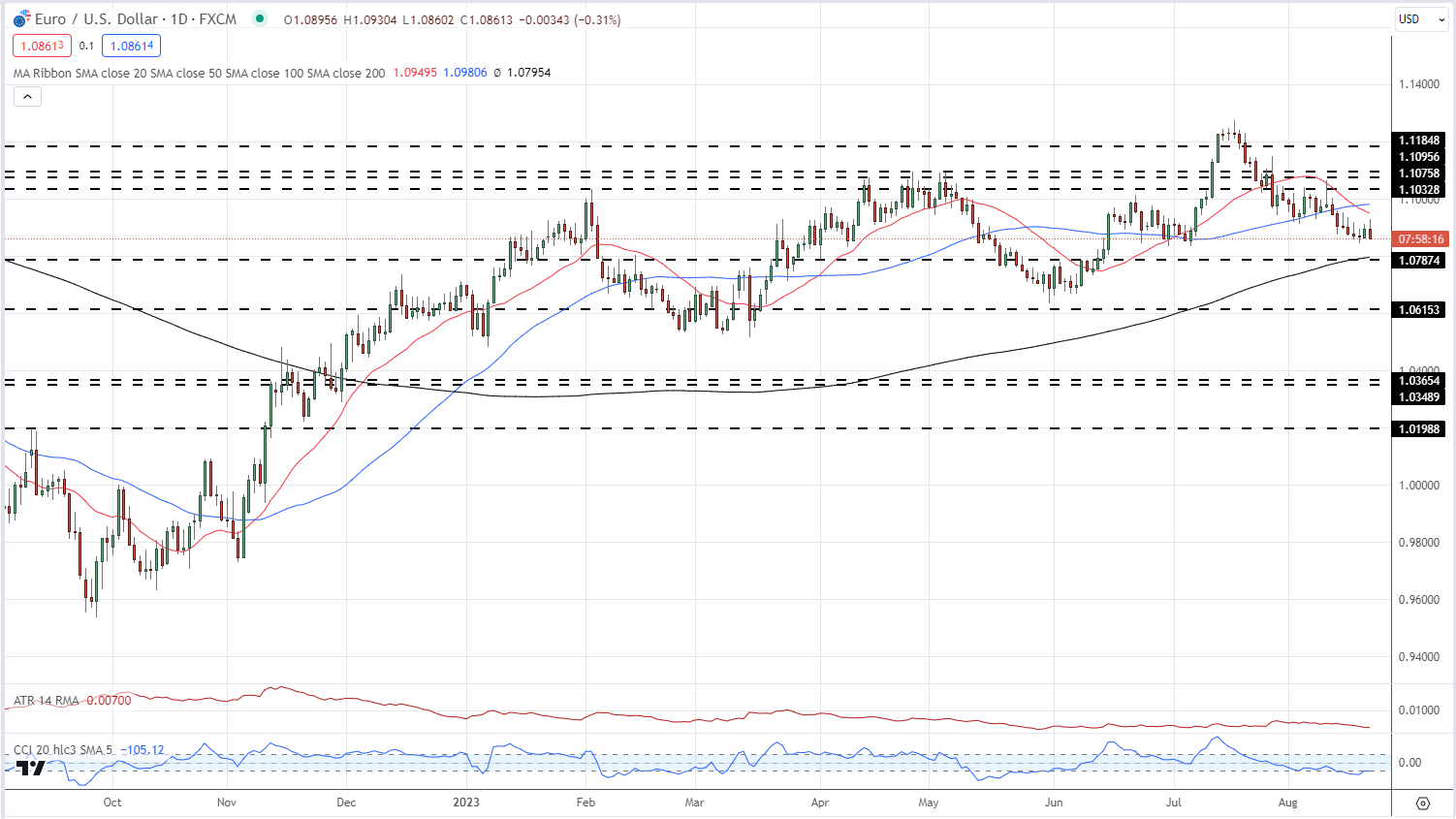

EUR/USD has found a short-term base on either side of 1.0850 although this is being currently tested. The US dollar remains strong due to elevated US Treasury yields with the 10-year benchmark at, or just below, a fresh 16-year high. The US dollar index (DXY) remains above the 200-day simple moving average and may look to re-test the May high at 104.658, especially if chair Powell’s remarks on Friday are hawkish.

US Dollar (DXY) Daily Price Chart – August 22, 2023

If the US dollar breaks higher, the next level of EUR/USD support is between 1.0790 and 1.0795.

EUR/USD Daily Price Chart – August 22, 2023

Chart via TradingView

Learn How IG Client Sentiment Can Help Your Trading

| Change in | Longs | Shorts | OI |

| Daily | 9% | -4% | 4% |

| Weekly | 18% | -11% | 4% |

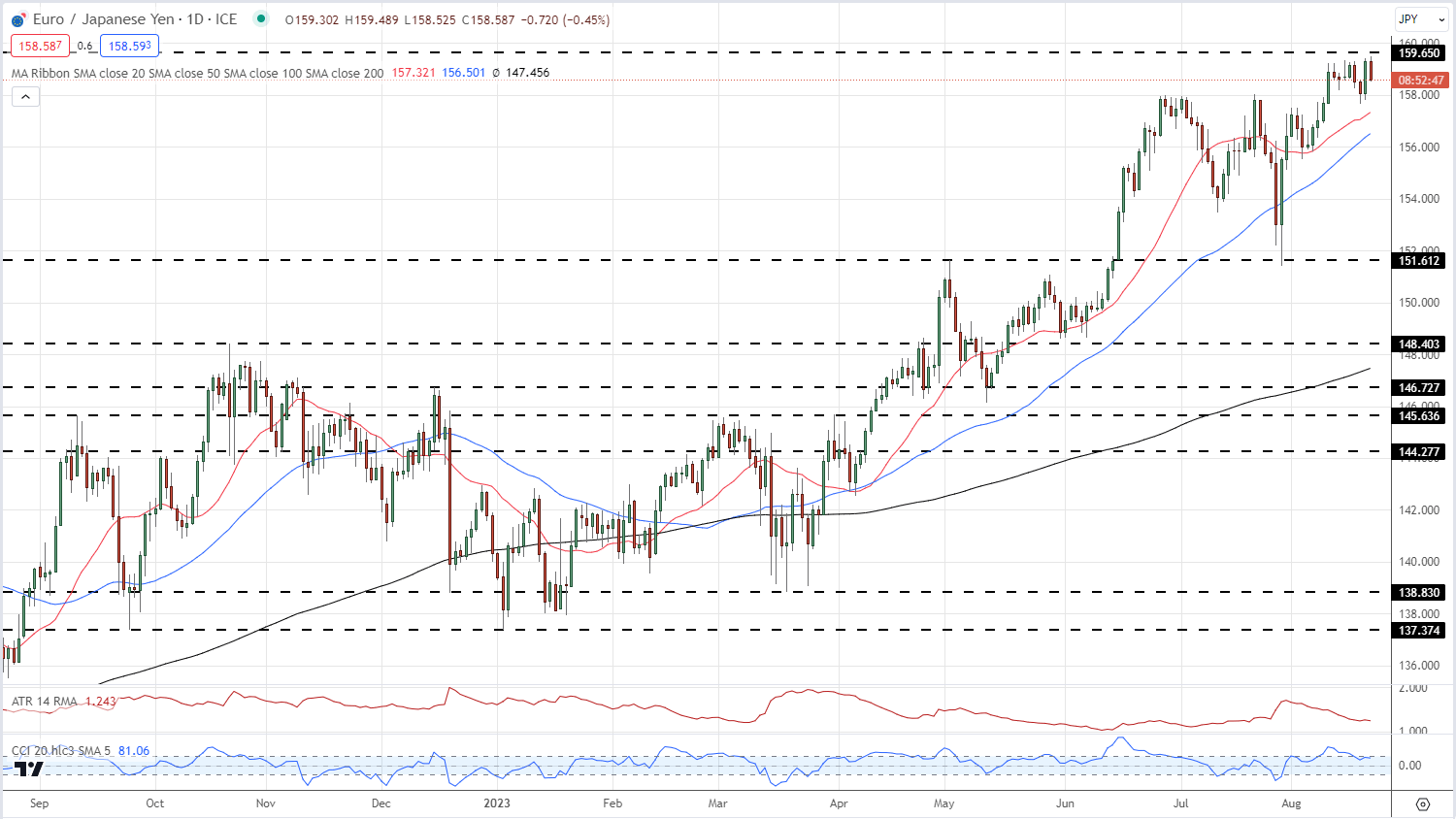

EUR/JPY continues to press higher as the Japanese Yen remains weak. The pair recently traded at a new 15-year high and the chart set-up remains bullish. Care needs to be taken as any official Japanese talk, or suggestion, that the Bank of Japan may intervene to prevent the Yen from weakening further is likely to provoke a sharp reaction lower in the pair.

EUR/JPY Daily Price Chart – August 22, 2023

Recommended by Nick Cawley

The Fundamentals of Trend Trading

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0