Weekly Market Outlook (27-01 December)

[ad_1] UPCOMING EVENTS: Tuesday: Australian Retail Sales, US Consumer Confidence. Wednesday: Australian Monthly CPI, RBNZ Policy Decision, US GPD Q3 2nd Estimate. Thursday: Japan Industrial Production and Retail Sales, China PMIs, Switzerland Retail Sales, Eurozone CPI and Unemployment Rate, Canada GDP, US Core PCE, US Jobless Claims. Friday: Japan Jobs data, China Caixin Manufacturing PMI,

[ad_1]

UPCOMING EVENTS:

- Tuesday:

Australian

Retail Sales, US Consumer Confidence. - Wednesday:

Australian

Monthly CPI, RBNZ Policy Decision, US GPD Q3 2nd Estimate. - Thursday:

Japan

Industrial Production and Retail Sales, China PMIs, Switzerland Retail

Sales, Eurozone CPI and Unemployment Rate, Canada GDP, US Core PCE, US

Jobless Claims. - Friday:

Japan

Jobs data, China Caixin Manufacturing PMI, Switzerland GDP, Canadian

Labour Market report, Canada Manufacturing PMI, US ISM Manufacturing PMI

Tuesday:

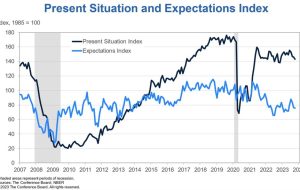

The US Consumer Confidence has been

falling steadily in the past quarter as the labour market started to weaken.

In fact, compared to the University of Michigan Consumer Sentiment, which shows

more how the consumers see their personal finances, the Consumer Confidence

shows how the consumers see the

labour market. The consensus sees the

index falling to 101 in November vs. 102.6 in October.

US Consumer Confidence

Wednesday

The Australian Monthly CPI Y/Y is expected

to fall to 5.2% vs. 5.6% prior. The RBA

hiked the cash rate by 25 bps at the last

meeting following higher than expected CPI

data. The recent hawkish RBA

Meeting Minutes and the comments from RBA’s

Governor Bullock suggest that the

central bank is losing some patience

amid some inflation persistence. A

higher-than-expected release won’t be welcome news for the RBA.

Australia Monthly CPI YoY

The RBNZ is widely expected to keep the

OCR steady at 5.50% as the central bank made

it clear that despite some near

term volatility in the data, inflation is expected to decline to the target

band by the second half of 2024. The economic

data from New Zealand has been showing clear weakness with the PMIs in

contraction and the unemployment

rate rising steadily.

RBNZ

Thursday

The Eurozone CPI Y/Y is expected to tick

lower to 2.8% vs. 2.9% prior,

while the Core CPI Y/Y is seen at 3.9% vs. 4.2% prior. The ECB is firmly in

a “wait and see” mode and this report is unlikely to trigger a rate hike

even if it beats expectations. We will also see the Unemployment Rate, which in

my opinion, is more important at the moment. The consensus sees the

Unemployment Rate to remain unchanged at 6.5%.

Eurozone Core CPI YoY

The US PCE Y/Y is expected to fall to 3.1%

vs. 3.4% prior, while the M/M reading is seen at 0.1% vs. 0.4% prior. The

Core PCE Y/Y, which is the Fed’s preferred measure of inflation, is expected to

fall to 3.5% vs. 3.7% prior, while the M/M measure is seen at 0.2% vs. 0.3%

prior. The market is unlikely to react much to this report given that it

already moved a lot on the more timely CPI

release just two weeks prior. In fact, in my

opinion, the US Jobless Claims released at the same time will be more

important.

US Core PCE YoY

The US Jobless Claims beat expectations

across the board last

week with Continuing Claims falling for

the first time in two months. The data set covered the NFP survey week, but

Jobless Claims are notoriously volatile, so one good report doesn’t make a

trend. This week the consensus sees Initial Claims at 218K vs. 209K prior

and Continuing Claims at 1855K vs. 1840K prior.

US Jobless Claims

Friday

The Canadian Unemployment Rate is expected

to tick higher once again to 5.8% vs. 5.7% prior

with 14K jobs added vs. 17.5K prior. The BoC is expected to keep rates

unchanged, especially after the last week’s CPI

report where all the inflation

measures fell further and the BoC’s Governor

Macklem reaffirmed the central bank “wait and see” approach.

Canada Unemployment Rate

The US ISM Manufacturing PMI is expected

to tick higher to 47.6 vs. 46.7 prior.

If the index prints below 50, it would be the 13th consecutive month

that the US Manufacturing sector remained in contraction. The S&P

Global US Manufacturing PMI released last

Friday missed estimates falling back in contraction. The most important

takeaway from the report though was this line: “As a result of subdued

demand and decreasing backlogs, companies reduced their workforce for the first

time since June 2020, affecting both service providers and goods producers.”

US ISM Manufacturing PMI

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :December ، Market ، Outlook ، Weekly ، Weekly Market Outlook

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0