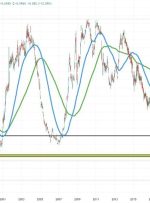

[ad_1] Both the US 10 and 30-year yields are stretching to new highs. The 10-year yield has just reached 4.535%. The low for the day was 4.45%. The new high represents the highest level since October 2007. The 30 year yield just reached 4.653%, which is the highest level since January 2011 As the market