Forexlive Americas FX news wrap 22 Sep:Stocks tumble, bond yields soar, USD steady this wk

[ad_1] The NZD and the AUD are ending the day as the strongest of the major currencies. The JPY is the weakest. The latest central bank decision came before the US open, when the Bank of Japan in The rates unchanged but did say that they would consider easy policy exit 1 achievement 2% inflation

[ad_1]

The NZD and the AUD are ending the day as the strongest of the major currencies. The JPY is the weakest. The latest central bank decision came before the US open, when the Bank of Japan in The rates unchanged but did say that they would consider easy policy exit 1 achievement 2% inflation is in sight and that sustainability of wage hikes the most important thing for the inflation outlook.

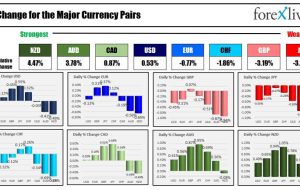

The strongest to weakest of the major currencies

The USD end of the day mixed with gains versus the JPY (+0.55%), GBP (+0.45%), CHF and EUR, and losses vs the NZD (-0.49%), the AUD (-0.41%). The greenback was nearly unchanged versus the CAD.

For the trading week, the dollar index closed the week marginally higher by +0.27%. The DXY is a weighted currency index heavily weighted toward the EUR (57.6%), JPY (13.6%) and GBP (11.9%).

Looking at the major indices versus the US dollar, the green was mixed.

The USD was stronger vs the:

- EUR, +0.16%

- JPY, +0.38%

- GBP, +1.15%

- CHF, +1.07%

The USD was weaker vs. the:

- CAD, -0.33%

- AUD, -0.21%

- NZD, -1.08%

Versus the offshore yuan, the USD rose 0.27% this week.

The Federal Reserve this week kept rates unchanged at 5.5%. However, they did keep the additional tightening expectations for 2023, and raise the expected end-of-year rate for 2024 to 5.1% from 4.6% in June.

In the UK, the Bank of England came into the week with market traders expecting a 25 basis point hike. However, after lower-than-expected inflation data on Wednesday, the odds of a hike decreased to 50/50. The Bank of England did keep rates unchanged by a 5 – 4 vote margin. That helped to weaken the pound vs. the USD this week.

The Swiss National Bank was also expected to raise rates by 25 basis points at their quarterly meeting, but they too kept rates unchanged and that helped to weaken its currency versus the US dollar this week.

In the US debt market this week, yields moved higher for the 3rd consecutive week as traders priced in “higher for longer” for the Fed funds target:

- 2-year yield rose 7.5 basis points to 5.112%

- 5-year yield rose 10.2 basis points to 4.569%

- 10-year yield rose 10.4 basis points to 4.438%

- 30-year yield rose 11.1 basis points to 4.529%

Although the longer end moved up the most, the 2-10-year spread still remains at -67 basis points continuing to signal a recession down the road. The 2 – 10-year spread has been negative since July 2022, reaching a low of -109 basis points in July 2023. Will it ever go positive? If the Fed is higher for longer, the logical way would be for the longer end to go up. The problem is mortgage rates are already up to 7.40%. If the 10-year yield rises another 67 basis points, you are talking about over 8% for mortgage rates all things equal. That would truly send the US economy into a recession which would then lead to lower short-term rates as the Fed is forces to ease.

A recession seems the only way out of the negative yield curve.

In the US stock market this week, the S&P and NASDAQ index had their worst week since March. With the NASDAQ index tumbling by 3.62%. The S&P fell -2.93%.

Crude oil prices this week closed down -0.54% or $-0.48 after extending to the highest level since November 2022 at $92.43.

Spot gold rose $1.37 or 0.07% (call it unchanged). Silver rose $0.52 or 2.276%.

There are some big stories still to be resolved including:

- The auto workers’ strike

- The potential for a government shutdown at the end of the month

Each of these will get resolved at some point. The question is when and at what cost. Economically, the US PCE data will be released next Friday with core PCE expected to rise by 0.2%.

Adam is back next week. Thanks for your support and tolerance this week. Hope you have a great weekend.

Go Ducks beat the Buffs.

Go Tigers beat the Seminoles.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Americas ، Bond ، Forexlive ، News ، SepStocks ، Soar ، Steady ، Tumble ، Usd ، Wrap ، Yields

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰