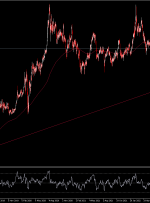

Gold (XAU/USD) Analysis, Prices, and Charts Middle East conflict boosts gold allure. Retail traders remain heavily long of gold. Download our Brand New Q4 Gold Guide for Free Recommended by Nick Cawley Get Your Free Gold Forecast Violence erupted in the Middle East over the weekend after Palestinian Islamist militant group Hamas attacked Israel with