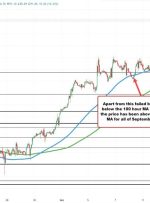

[ad_1] Share: WTI is strung up near $89.00/bbl after slipping off of recent highs. US crude barrels briefly saw $92.00 in the midweek on continuing supply concerns. Price pressures have eased heading into the weekend, but prices are set to continue rising. West Texas Intermediary (WT) US crude oil is struggling to hold