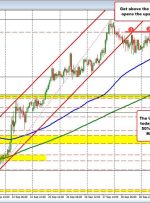

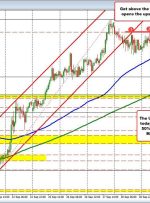

[ad_1] Gold, Retail Trader Positioning, Technical Analysis – IGCS Update Gold prices fell the most last week since June 2021 And now, 85% of retail traders (IGCS) are net-long Overall, things are not looking great for XAU/USD Recommended by Daniel Dubrovsky Get Your Free Gold Forecast Gold prices sank about 4 percent last week. To