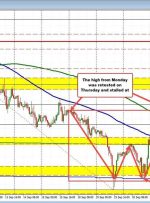

[ad_1] Canadian Dollar, USD/CAD, Technical Analysis, Retail Trader Positioning – IGCS Update Canadian Dollar heading for worst 2-weeks since mid-February Meanwhile, retail traders continue to increase downside exposure USD/CAD achieves key bullish breakout, but momentum fading Recommended by Daniel Dubrovsky Get Your Free USD Forecast The Canadian Dollar is heading towards its worst 2-week period