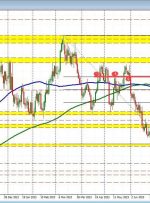

[ad_1] Share: Bullish-engulfing candlestick pattern on the daily chart suggests buyers are in control. The first major resistance at 1.3600, followed by several key levels up to 1.3804. Downside risks include a drop below 1.3489, potentially targeting the 200-DMA at 1.3462 and the 50-DMA at 1.3345. The Canadian Dollar (CAD) losses ground against