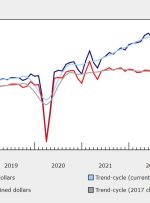

[ad_1] Canada retail sales Friday’s Canadian retail sales report for September far-surpassed expectations at +0.6% compared to a flat reading expected. In addition, the advance reading for October was +0.8% in a sign of even-more strength. CIBC highlights a contrast in consumer spending patterns in the report. While auto sales surged, there was a noticeable