Canadian Dollar climbs on Friday after Canadian Retail Sales beat the Street

[ad_1] Share: The Canadian Dollar found its highest bids in nearly six weeks on data beats. Retail Sales in Canada gave a surprise 0.6% jump in September. The Loonie was firmer on Friday as market sentiment spun up to close out the week. The Canadian Dollar (CAD) found some bullish momentum in the latter half

[ad_1]

- The Canadian Dollar found its highest bids in nearly six weeks on data beats.

- Retail Sales in Canada gave a surprise 0.6% jump in September.

- The Loonie was firmer on Friday as market sentiment spun up to close out the week.

The Canadian Dollar (CAD) found some bullish momentum in the latter half of Friday’s trading session, taking the USD/CAD pair down into the 1.3600 region.

A better-than-expected Retail Sales report and a broad market recovery in risk sentiment are bolstering the Loonie against the US Dollar (USD), with the CAD up across the board and the Greenback on the softer side heading into the trading week’s close.

Canadian Dollar price this week

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies this week. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.35% | -1.25% | -0.63% | -1.15% | -0.32% | -1.52% | -0.45% | |

| EUR | 0.35% | -0.91% | -0.28% | -0.79% | 0.04% | -1.16% | -0.10% | |

| GBP | 1.24% | 0.90% | 0.62% | 0.12% | 0.94% | -0.25% | 0.80% | |

| CAD | 0.64% | 0.27% | -0.63% | -0.52% | 0.31% | -0.89% | 0.18% | |

| AUD | 1.13% | 0.79% | -0.11% | 0.51% | 0.82% | -0.37% | 0.69% | |

| JPY | 0.32% | -0.04% | -1.17% | -0.31% | -0.81% | -1.20% | -0.13% | |

| NZD | 1.52% | 1.15% | 0.26% | 0.89% | 0.36% | 1.19% | 1.04% | |

| CHF | 0.46% | 0.11% | -0.81% | -0.17% | -0.70% | 0.16% | -1.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Daily Digest Market Movers: Canadian Dollar finds a rebound, USD/CAD back into 1.3600

- The CAD is back in action, climbing against all of the majors on Friday.

- Retail Sales within Canada surged 0.6% in September, well above Wall Street’s no-change forecast and walking back August’s -0.1% print.

- Core Retail Sales (excluding automobiles, gas station purchases and car parts) still rose 0.2%.

- Retail Sales were still up 0.3% in September by volume.

- 3Q Retail Sales up 0.6%, Retail Sales volume down 0.5% over the same period.

- US Purchasing Managers Index (PMI) in November saw a weakening Manufacturing component, injuring the Greenback.

- US Composite PMI in November held steady at 50.7 as the Manufacturing and Services components were mixed.

- US Manufacturing PMI down from 50.0 to 49.4, missing the forecast of 49.8.

- US Services PMI edged higher from 50.6 to 50.8, beating the expected slip to 50.4.

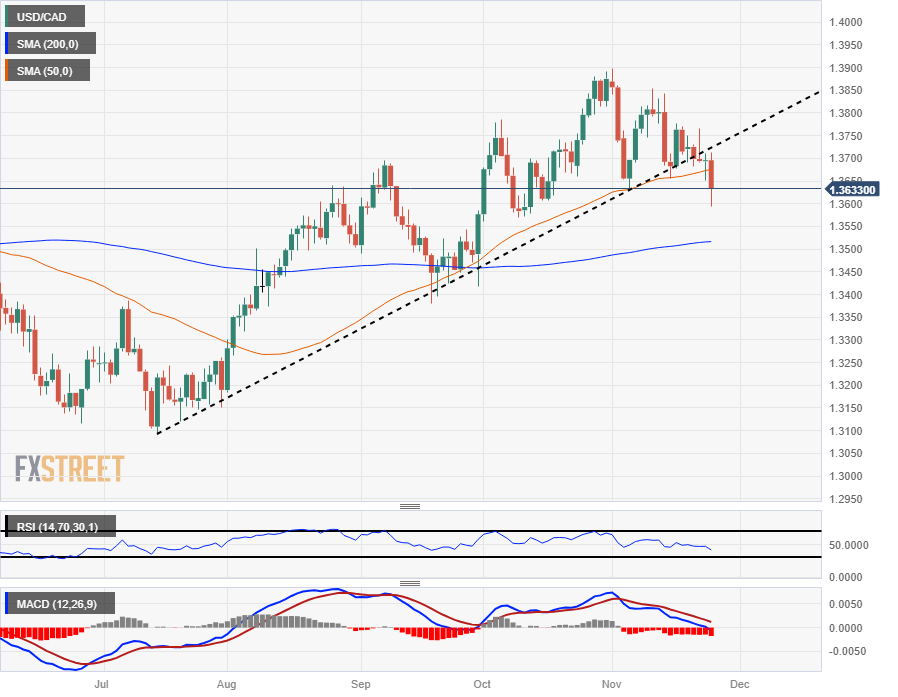

Technical Analysis: Canadian Dollar rebounds in the trading week’s eleventh hour, drags USD/CAD back down to 1.3600

The Loonie’s late break sees the USD/CAD challenging the 1.3600 handle, with the pair aimed straight at the 1.3500 target, just past the 200-day Simple Moving Average (SMA). A late break for the US Dollar saw the USD/CAD briefly retest 1.3650, but overall market sentiment is maintaining control heading into the close. The pair is continuing to test into the downside, around 1.3620.

The pair has decisively broken through the rising trendline from July’s low bids at 1.3100, and technical support from the 50-day SMA has broken through.

Intraday declines in the USD/CAD has hourly candles pulling well away from the near-term mid-ranges, dropping into 1.3600. Any bullish rebounds will be seeing a technical resistance range between the 50- and 200-day SMAs, which are dropping into 1.3680 and 1.3700, respectively.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Beat ، Canadian ، Climbs ، Dollar ، Friday ، retail ، RetailSales ، sales ، seo ، Street ، USDCAD

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰