Goldman Sachs says that while a sustained climb in oil prices could slow consumption and economic growth it will be a “manageable headwind” for the U.S. economy. “While we forecast consumption growth to slow during the fall and winter, we think higher oil prices are unlikely to cause consumer spending and GDP to decline” The

Share: Palantir stock has shed nearly 9% so far this week. PLTR stock is sitting right on medium-term support from $13.50 to $14. A break of $13.50 would send PLTR hurtling toward $10.25. A recent AIP conference gave Palantir good marks on its move into the LLM space. Palantir (PLTR) stock advanced 1.2%

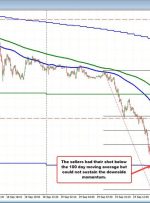

Crude Oil, WTI, Bearish Engulfing – Technical Update: Crude oil prices turned lower over the past 24 hours Bearish Engulfing candlestick pattern now in focus Watch rising trendline, RSI divergence on 4-hour Recommended by Daniel Dubrovsky Get Your Free Oil Forecast Daily Chart WTI crude oil prices might be showing early signs of topping that

Bank of Canada Deputy Gov. Sharon Kozicki is speaking and says: One of the big drivers in August CPI inflation was energy and gasoline prices. They can be pretty volatile It will take a lot of time to sort through the inflation data, given what’s going on underneath Energy prices on their own, if it’s

© Reuters. FILE PHOTO: Signs of Chinese yuan and U.S. dollar are seen at a currency exchange store in Shanghai, China August 8, 2019. REUTERS/Aly Song/File Photo BEIJING (Reuters) -China’s yuan will stabilise after improvements in recent economic data and the bottoming out of domestic prices, state-owned media said on Monday. China’s falling interest rates

Share: USD/CAD struggles to gain any meaningful traction and oscillates in a range on Monday. Bullish Oil prices underpin the Loonie and act as a headwind amid a modest USD slide. The downside seems limited as traders seem reluctant ahead of the FOMC policy meeting. The USD/CAD pair kicks off the new week

GOLD PRICE FORECAST: Gold prices rebound heading into the weekend, challenging cluster resistance stretching from $1,920/$1,930 Despite Friday’s recovery, the fundamental backdrop remains challenging for precious metals Next week, all eyes will be on the FOMC announcement Trade Smarter – Sign up for the DailyFX Newsletter Receive timely and compelling market commentary from the DailyFX

OIL PRICE FORECAST: Most Read: What is OPEC and What is Their Role in Global Markets? Oil prices continued their advance this morning helped by a weaker USD. The surge in US inventories seems to be overshadowed by growing concerns around tighter supply for the remainder of 2023. Tips and Tricks to Trading Oil Prices