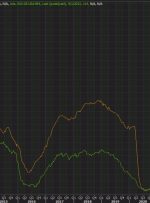

OPEC+ supply restrictions were extended, and U.S. oil and cloth both hit more than nine-and-a-half-month highs. Saudi Arabia and Russia’s strategy to further deplete inventories is being felt across the oil market. The December-December spread for West Texas Intermediate crude, favored by oil hedge funds, rose to its widest level since late 2022. Brent, the