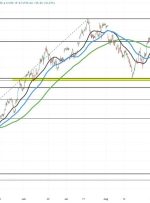

S&P 500, SPX, NASDAQ 100, NDX – OUTLOOK: The S&P 500 index and the Nasdaq 100 index have rebounded from key support. Oversold conditions, light positioning, and positive seasonality raise the bar for a material downside from here ahead of the upcoming earnings season. What are the outlook and the key levels to watch in