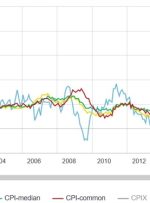

[ad_1] Following a bustling week with significant Central Bank decisions in the limelight, the upcoming week holds the potential for a quieter economic events calendar. The FX market may be influenced by month-end rebalancing. Highlights for Tuesday include Japan’s BoJ Core CPI y/y data and the release of CB Consumer Confidence, New Home Sales, and