[ad_1] Share: The DXY sank towards 105.05, its lowest level since mid-September. US government bond yields are retreating, also standing at lows since September. Job creation decelerated in October in the US as well as Hourly Earnings, while the Unemployment Rate increased. The US Dollar (USD) witnessed a significant drop on Friday, with the

[ad_1] Share: JOLTS report will be watched closely by Fed officials ahead of September jobs data. Job openings are forecast to hold steady at around 8.8 million on the last business day of August. US labor market conditions remain out of balance despite Fed rate hikes. The Job Openings and Labor Turnover Survey

[ad_1] Challenger is reporting that they see the labor market starting to cool as the holiday season kicks off. They add: Employers are hiring at a slower clip Retailers have announced 55,755 job cuts through August US retailers will add 410K seasonal positions, which represents the lowest number of jobs added in the 1st quarter

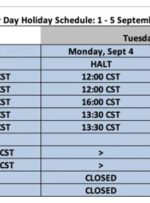

[ad_1] Markets: WTI crude up 43-cents to $85.98 GBP leads, USD lags US/Canada bonds and equities closed There wasn’t much to report in terms of price action in North American trading. The holidays in the US and Canada kept a lid on the market and there wasn’t any news to jar markets. The overall tone

[ad_1] Share: Gold price juggles below the $1,950.00 resistance as the focus shifts to the US Services PMI. US markets will remain closed on Monday on account of Labor Day. Cooling labor market conditions boost the Fed’s hopes of a soft landing. Gold price (XAU/USD) traded back and forth from the past four

[ad_1] High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do

[ad_1] Share: Data released on Friday showed that Nonfarm Payrolls in the US rose by 187,000 in July, falling below the market consensus of 200,000. June’s figures were also revised lower to 185,000, marking the lowest level since December 2020. Analysts at Wells Fargo point out that the slower pace of hiring in

[ad_1] As we noted in our Fundamental Analysis today, data on GDP, the labor market, and inflation are the determining factors for the Fed when planning monetary policy parameters. If the official employment data due on Friday (at 12:30 GMT) also turns out to be strong, Fed officials will have an additional argument in favor

[ad_1] Share: Gold price falls back as Greenback swallows steroids amid US economic resilience. US Q2 GDP, demand for Durable Goods in June remained robust due to higher consumer spending. US recession fears fade significantly amid upbeat labor market conditions. Gold price (XAU/USD) recovers downside blip propelled by softer-than-anticipated United States Q2 Employment Cost index